Last year was Manchester United's (MANU) worst season in more than 50 years...

Last year was Manchester United's (MANU) worst season in more than 50 years...

The professional soccer club lost 21 total games in 2023... a record they haven't blown past since 1972. It was also their fourth-worst season in history.

And with only a few games to go in this year's premier league, the club is on the verge of not qualifying for the Champions League.

Over the past couple of years, many fans have blamed ownership for the dip in performance. The Glazer family, which owned 69% of the club until recently, has been in the hot seat ever since the train came off the tracks.

Investors aren't happy, either.

If there's one thing keeping broadcast television alive, it's sports. So Manchester United's poor performance means a direct hit to broadcasting dollars... adding fuel to the fire of an already struggling sports club.

Fans and investors alike have been begging for change. At the end of last year, they finally got it... Yet as we'll explain, the market has no faith in this team's ability to turn itself around.

With interest rates so high for the past two years, very few companies were buying or selling...

With interest rates so high for the past two years, very few companies were buying or selling...

But there was one exception... sports.

While global merger and acquisition (M&A) value fell 16% in 2023, sports M&A value rose 27%.

And Manchester United became one of the very last sports M&A deals of the year... when British billionaire Jim Ratcliffe agreed to buy 25% of the team on December 26.

Ratcliff is the CEO of chemical company Ineos. He paid $1.5 billion for the stake in his childhood favorite soccer club. The Glazers still own 44%.

It's still early in Ratcliffe's ownership stake... and it remains to be seen if he can turn the club's game-time performance around.

That said, Manchester United's financial performance is already rebounding...

That said, Manchester United's financial performance is already rebounding...

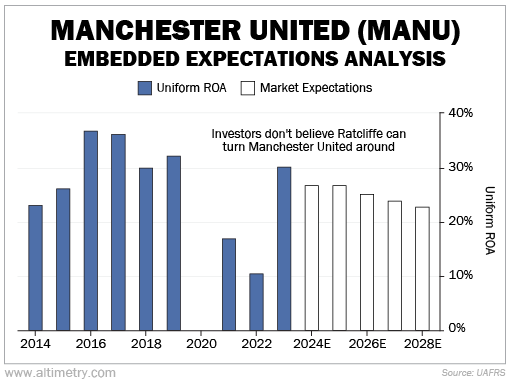

The club's pre-pandemic Uniform return on assets ("ROA") was 30% or higher for four straight years. That number dropped to zero in 2020... and remained below 20% for the next two years.

By 2023, Uniform ROA was already back at 30%. Yet despite that improvement, the market doesn't expect much from Manchester United...

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use Manchester United's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Investors currently expect Manchester United's Uniform ROA to fall to 23% by 2028. That would be the lowest level for the club since 2010, excluding the pandemic years.

Take a look...

Investors don't think Manchester United can remain the powerhouse it has been for nearly a decade...

Investors don't think Manchester United can remain the powerhouse it has been for nearly a decade...

They're acting as though returns will fade... even as the club puts COVID-19 behind it.

Sports are the glue holding the struggling broadcast industry together. There's little reason to worry that a franchise as popular as Manchester United won't bounce back, and fast.

Jim Ratcliffe seems to get this... Investors would be wise to catch on soon.

Regards,

Joel Litman

April 24, 2024