Some Republicans seem to have sticker shock...

Some Republicans seem to have sticker shock...

President Donald Trump is an ardent supporter of lowering tax rates, pretty much across the board. Corporate taxes, income taxes, and estate taxes all fell under Trump's 2017 plan.

His first few weeks back in office have made it clear... he isn't bending on his tax vision this time around, either.

The president wants to extend many of the 2017 tax cuts set to expire at the end of 2025, or even make them permanent. All told, we're looking at a potential $5.5 trillion in tax cuts.

Government officials – particularly some fiscally conservative Republicans – are nervous that those cuts will raise the federal deficit.

But as it turns out, within a few years, tax cuts should increase tax revenue. They could even help trim the deficit...

Many folks believe the government needs to reduce federal spending to offset Trump's tax cuts...

Many folks believe the government needs to reduce federal spending to offset Trump's tax cuts...

And they're struggling to find enough places to slash. Several House Republicans are wary about signing off on such a plan.

If the past few years are any proof, though, we could still cut taxes without hurting tax revenue.

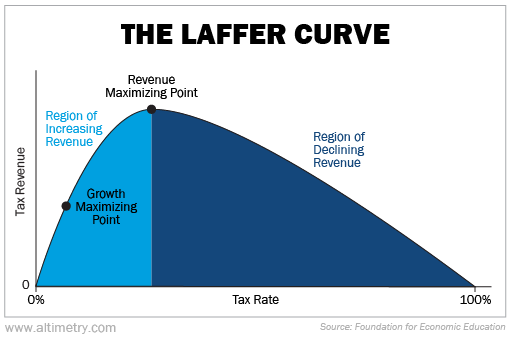

We can see this through a theory called the "Laffer curve."

The Laffer curve tracks the relationship between tax rates and tax revenue. It shows that when tax rates drop from punitive levels (the region of declining revenue in the chart below), individuals and businesses have more capital to spend, invest, and grow.

Over time, this generates more taxable income... leading to higher government revenue despite the lower tax rates.

There are many versions of the curve. But it looks something like this...

There's no exact right tax rate that every nation should strive for. But as you can see, lower tax rates don't always lead to lower tax revenue.

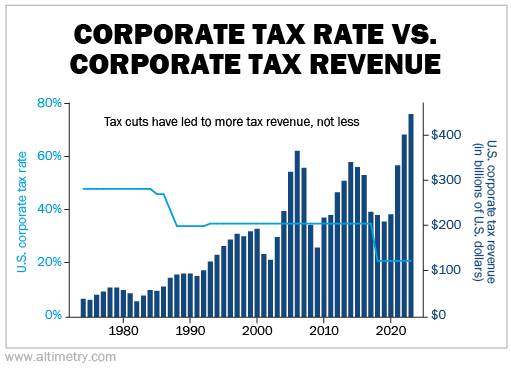

This theory has held true for roughly 50 years in the U.S...

This theory has held true for roughly 50 years in the U.S...

We've cut corporate taxes several times since the 1970s. And each time, tax revenue has surged within a few years.

Check it out...

As you can see, corporate tax cuts have boosted tax collections in the long run. And that, in turn, should help manage the deficit.

Trump's approach could unlock similar growth... if it's executed well.

Trump's approach could unlock similar growth... if it's executed well.

His proposed tax reforms could help boost corporate earnings, which should help keep the job market strong.

Our government is dealing with a historic deficit. It's natural to worry that taking $5.5 trillion in future revenue away will only make things worse.

But while it may seem counterintuitive, Republicans shouldn't prioritize balancing the budget today if it means slowing down the next round of tax cuts. This is a slow-moving situation. Tax cuts should help keep the economy strong.

In any case, investors should be prepared to play the long game. Tax cuts like these tend to drive corporate profits – and therefore tax revenue – much higher within a few years.

Regards,

Joel Litman

February 7, 2025

Some Republicans seem to have sticker shock...

Some Republicans seem to have sticker shock...