The U.S. accounting system has pulled off the biggest mass deception in American financial history.

In Altimetry's High Alpha, we provide the foundation you need to protect yourself from these falsehoods... and position yourself for solid gains from small- and midcap stocks.

Better yet, High Alpha gives you the best opportunity to push back against this as-reported accounting "con job" – and take extreme advantage of it.

We uncover deceptions across the market, bringing you the TRUE earnings story. Our goal is to uncover hundreds (or even thousands) of mispriced stocks with enormous potential.

For more than a decade, we've used our patented forensic analysis system to spot distortions in companies' earnings statements for institutional investors.

And with High Alpha, we bring this state-of-the-art research to individuals...

We make 130 different adjustments to thousands of records a day… allowing us to uncover the TRUTH behind financial reports. Then, we identify mispriced opportunities from the entire universe of 32,000 stocks using our forensic accounting system.

And we employ more than 100 accountants and analysts in Boston, Chicago, Hong Kong, and the Philippines to make it all happen.

The process continues as we filter through hundreds of companies we believe have major discrepancies in their records.

We do deep fundamental analysis... boiling this list down to a few dozen stocks with the best potential to skyrocket. We even listen in on earnings calls using our Earnings Call Forensics system to check for any signs of deception from management. This is how we settle on our top stock recommendation for subscribers each month.

Our research typically leads us to shares of a completely misunderstood small- or midcap stock... with tremendous potential no one else is seeing yet.

Is there a little more risk involved when you’re dealing with smaller companies?

Of course.

But the rewards can be far greater than anything you’ll ever see from large caps.

Here’s an example of what I mean...

We pinpointed a company called Sonos (SONO) in May 2021.

If you just paid attention to the public earnings statements, you'd think the home stereo company was barely making money.

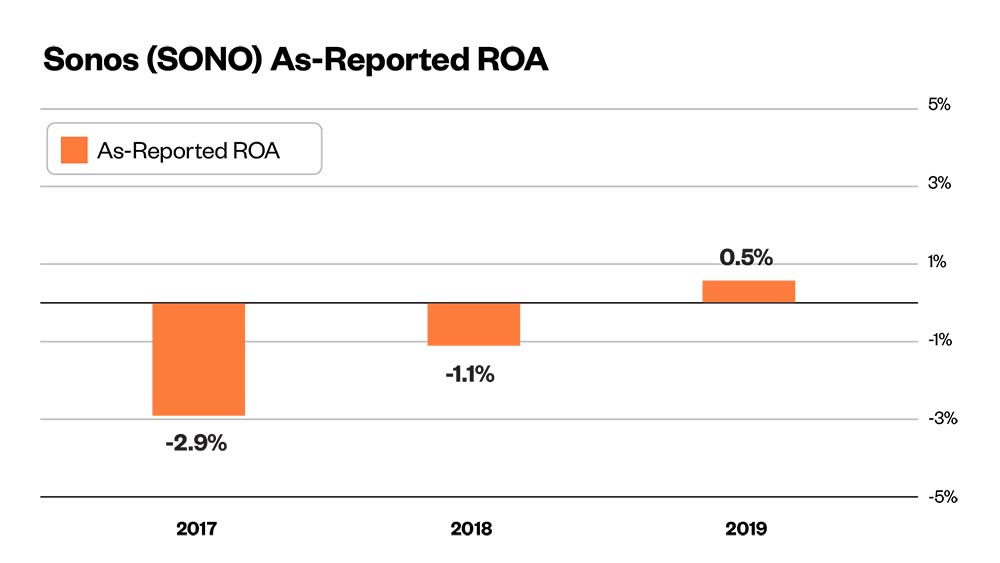

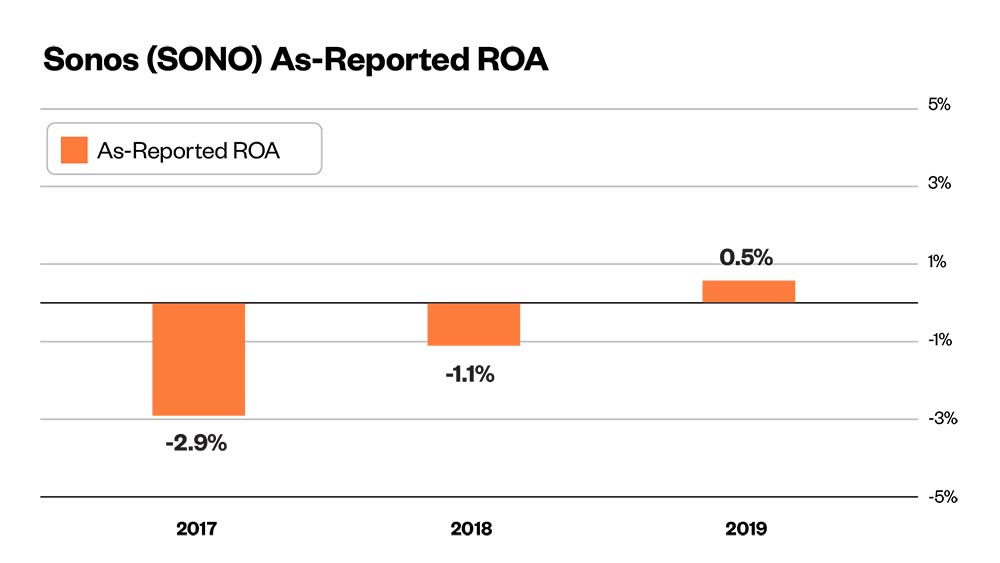

Not to get "in the weeds” with a bunch of technical language... But the company was capping out at a 0.5% return on assets ("ROA"). According to Wall Street, the business was bleeding most of its cash.

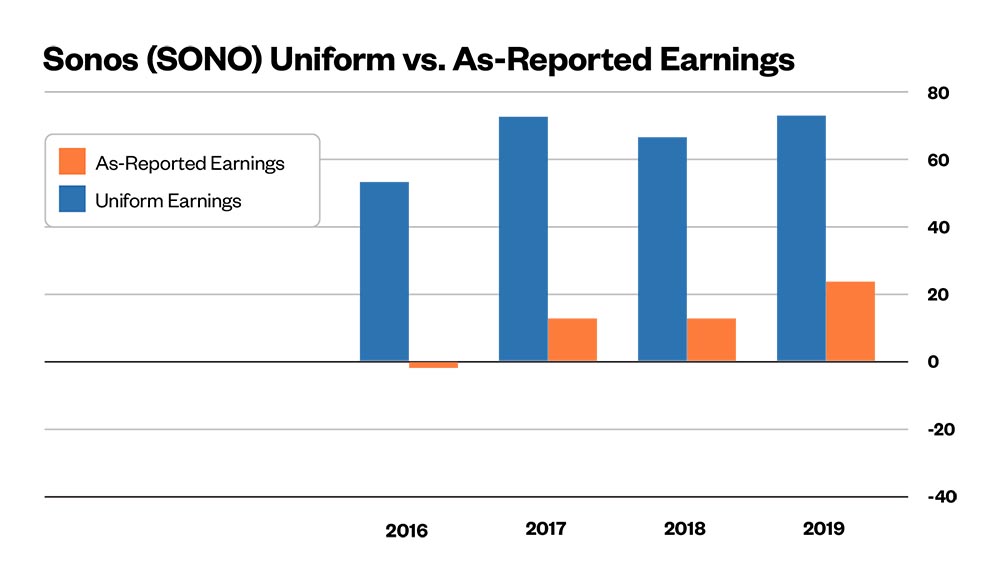

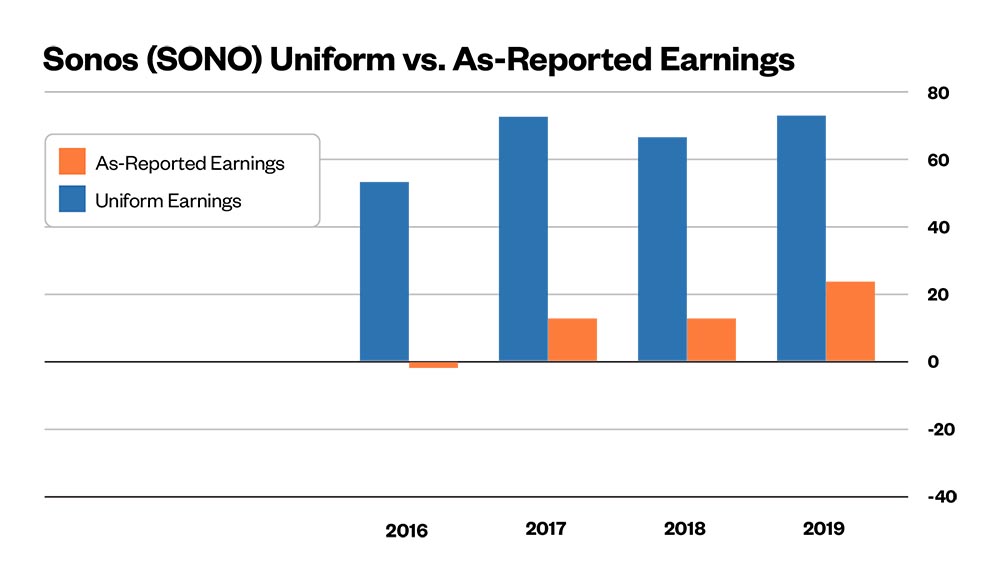

But if you had access to our forensic analysis, you could have seen the TRUE numbers for Sonos...

In reality, Sonos had way more cash than the “official” accounting reported.

Readers who saw the TRUE numbers and followed our advice had the chance to take home a 211% combined gain in just over a year.

And that's only the beginning...

We have a long history of providing our institutional followers with the chance to make some of the best gains on the market using this exact strategy.

I'm talking about recommendations that could have shown you incredible gains (assuming you held on to them long enough).

Some of our winners were as high as...

- 830% on Middleby (MIDD)

- 3,625% on Advanced Micro Devices (AMD)

- 1,566% on Skechers (SKX)

- 13,944% on Jazz Pharmaceuticals (JAZZ)

- 8,548% on Lululemon Athletica (LULU)

- 4,549% on Salesforce (CRM)

And dozens more...

Now, these are just a few of the highest gains we’ve shown our followers... including some of my institutional clients.

And of course, all investments carry risk. Just because we've done well in the past with my work at Valens Research doesn't guarantee that all of our picks will be this successful. You should never invest more than you're willing to lose.

But our numbers don't lie.

They explain why our institutional clients will pay more than $100,000 a year for this kind of information.

Today, you have the opportunity to take advantage of the very same world-class research… for the chance to see the kinds of incredible gains that occur when we apply our forensic approach to smaller companies.