The idea for Microcap Confidential stemmed from a program we worked on for the SEC that involved fraud whistleblowing.

The goal was to expose mismanaged companies – and their TRUE earnings.

Using our process, we exposed 57 different stocks to avoid. Fifty fell in price... with many that crashed, went bankrupt, or fell to near $0 a share within months after our analysis.

Mind you, these discoveries were all made during the height of the bull market...

EXPOSED RESULT

-

- Blaze Energy: fell 100%

- Ubiquity: fell 95%

- Mattress Firm: fell 100%

- Purebase: fell 94%

- Restorgenex: fell 100%

- ForceField Energy: fell 100%

- LifeLogger Technologies: fell 97%

- Hydrocarb Energy: fell 99%

- Net Element: fell 93%

- Joe's Jeans: fell 100%

- Changing Technologies: fell 99%

- Ultimate Rack: fell 99%

- Texas South Energy: fell 92%

- Progressive Green Solutions: fell 94%

- MRI Interventions: fell 95%

- Telupay: fell 99%

- Cambrian Minerals: fell 97%

- Nudg Media: fell 100%

- MediGreen: fell 99%

- Plandai Biotechnology: fell 92%

- Heritage Financial: fell 100%

Our analysis has been so accurate that the FBI, law firms, and some of the biggest hedge funds in the world have called us in to help.

These days, Microcap Confidential readers also have access to our quarterly Do Not Buy List.

This report contains the names of dozens of "ticking time bombs"... companies that should be avoided at all costs.

But along the way, we weren't only able to see which stocks were likely to fall...

We also found stocks that were doing far BETTER than the public believed... and were on the verge of rising 100% or more.

Of course, the market is huge. A lot of the most reliable growth companies only really go up by a couple points at a time.

So we pared it down to the group with the biggest potential gains...

And placed our focus squarely on microcap stocks.

These tiny, overlooked companies can be a breeding ground for deception… But if you know what you're looking at, they can offer massive upside potential.

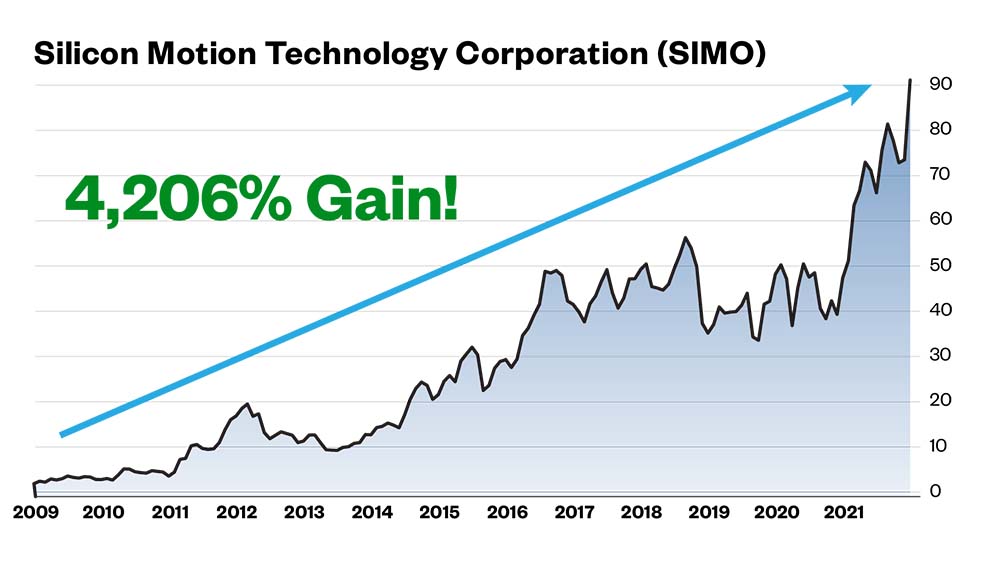

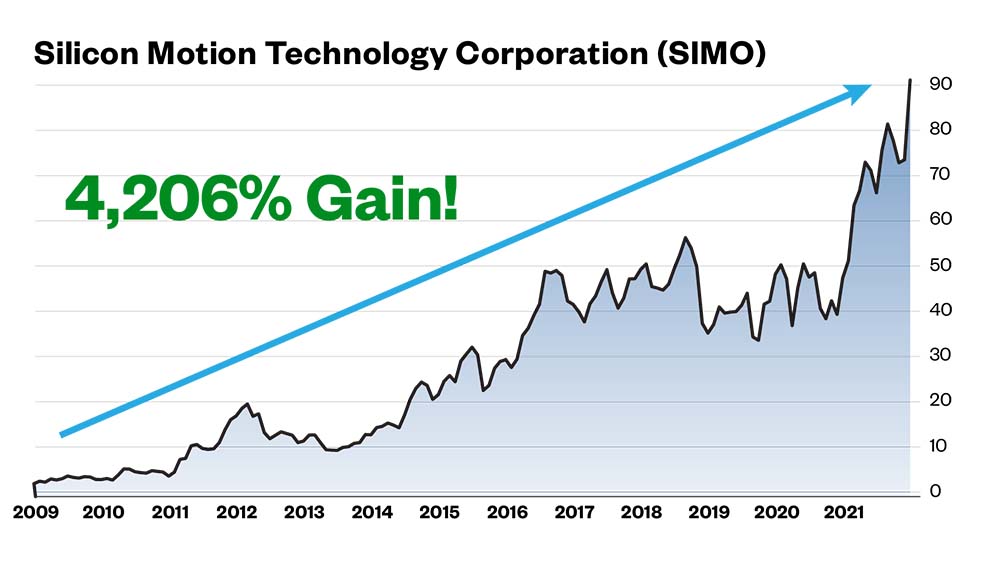

Let me show you a perfect example with a company called Silicon Motion Technology (SIMO).

Most people couldn't care less about an accounting mistake, especially for such a small and little-known company.

But this is exactly what we’re looking for. My team discovered Silicon had miscategorized almost $10 million in income.

Now, Silicon didn't do it on purpose. The mistake didn't even move the numbers in its favor.

This was just an example of bad bookkeeping.

In fact, because of this distortion, Silicon looked like a struggling business... rather than a company on the verge of success.

If you'd known this information... bought the stock back in 2009... and held it through 2021... you could have made as much as a 4,206% gain.

That’s a return of 43 times your money...

But the only way we discovered an opportunity like this was by taking a deep dive into the shoddy accounting of a microcap stock.

Which is exactly why we launched Microcap Confidential.

To date, we’ve shown our readers the chance at gains like...

- 116% on Biolife Solutions (BLFS)…

- 215% on Movado (MOV)…

- 859% on eXp World (EXPI)…

Plus dozens of other opportunities for double- and triple-digit returns.