There is a tremendous value in understanding a company's true financial status. Unfortunately, performance metrics like price-to-earnings (P/E) ratios and discounted cash flow – and thus all derived analysis built on as-reported financials – are terribly distorted and, in some cases, useless.

How could this be?

There are problems with as-reported financial statements under GAAP and IFRS.

Important elements of as-reported corporate financial statements have become unreliable. The problem stems from significant inconsistencies in the rules and application of those rules in as-reported financial statements today.

Earnings can be reported to go up when in fact a firm's performance has faltered. P/E ratios show stocks to be expensive that are in actuality cheap. Margins, assets, capital expenditures, debts, and virtually all key financial performance indicators can be a far cry from an accurate representation of corporate activity.

A simple example is the FIFO/LIFO accounting policy that management teams choose for reporting cost of goods sold and inventory levels.

It is perfectly acceptable for one company to use the Last-In-First-Out (LIFO) method for reporting cost of goods sold. Meanwhile, a peer company could choose the First-In-First-Out (FIFO) method.

Both companies have elected a perfectly legal and acceptable accounting method under Generally Acceptable Accounting Principles. However, each of these firms now has incomparable profits, costs, and balance sheets. Many other key financial performance indicators will also be victim to this simple change.

We have identified more than 130 similar inconsistencies.

Are CEOs and CFOs lying about their results?

In most cases, no. The CEO and CFO have received much of the blame for the erosion in financial statement quality. Think Enron, MCI, and Global Crossing.

However, the global financial reporting problem rests squarely with the rule-making process of the governing accounting bodies over time. In particular, with GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

The financial reporting authorities have established a set of standards that have been argued, debated, and then established over decades and decades.

Unfortunately, the result is a set of accounting rules with inconsistent policies that reflect a mixture of differing objectives for the financial statements.

So how do we use this to our advantage?

These accounting problems mean valuing a company on available information can be misleading.

In other words, Wall Street is getting it wrong! The data they are using, the screeners they are using, the models, etc. are all wrong.

In order to see the true picture, we disassemble the financial statements of more than 8,000 publicly traded companies around the world and then reassemble them using globally consistent standards that repair the problems cited above.

We have a team of more than 90 accountants and analysts who make more than 130 adjustments to create the true picture of a company's financials.

Then we sift through the results looking for great companies that are widely mispriced.

Here's an example: Netflix (Nasdaq: NFLX)...

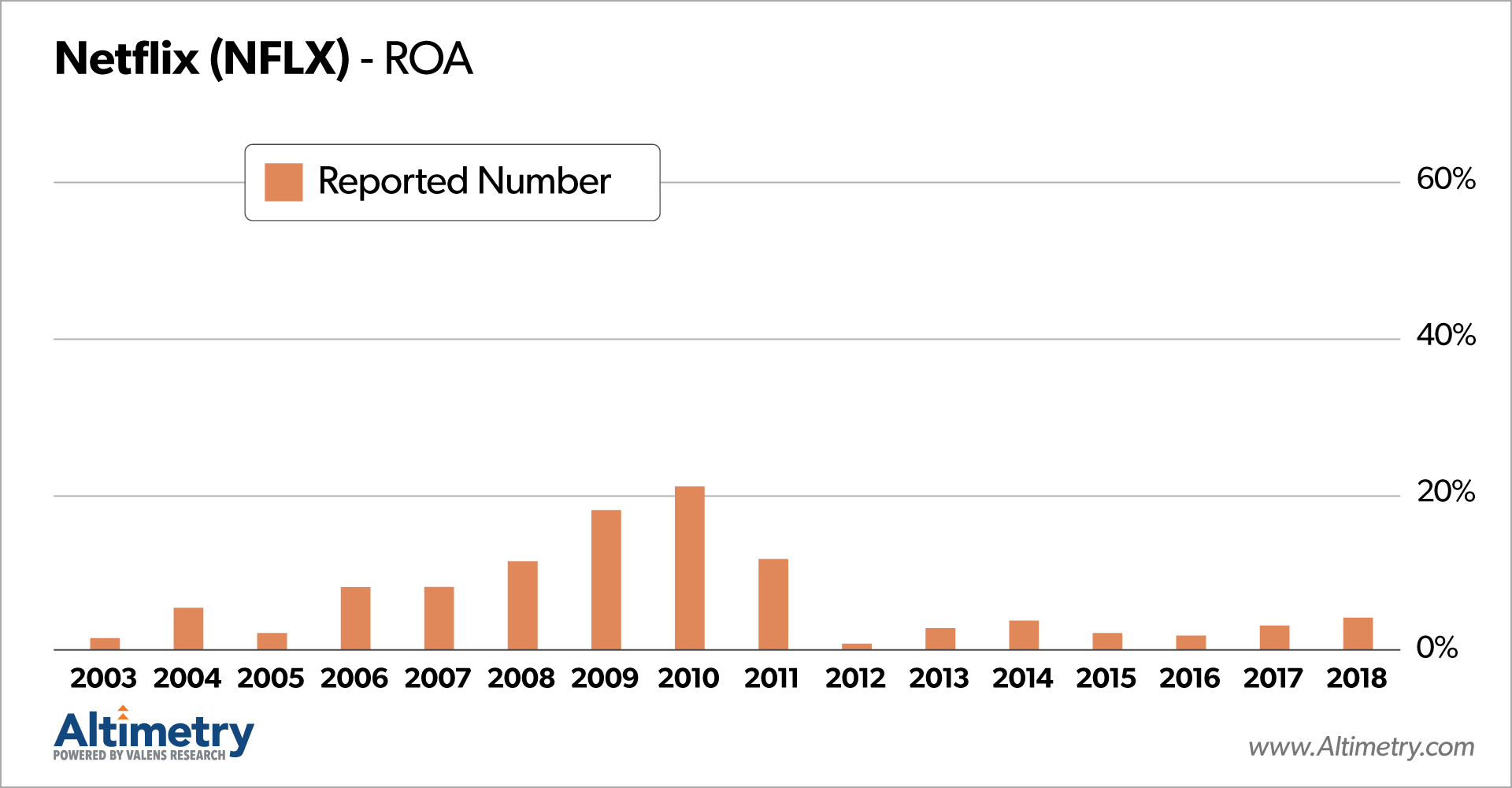

The orange bars are the publicly reported RETURN ON ASSETS... In other words, the cash return that Netflix makes based on each dollar it invests into its business. This is a pretty simple measurement of its earnings.

This is what the world believes to be true about Netflix.

Even in the early years, Netflix's return on assets was only about 1.8%. Not very impressive.

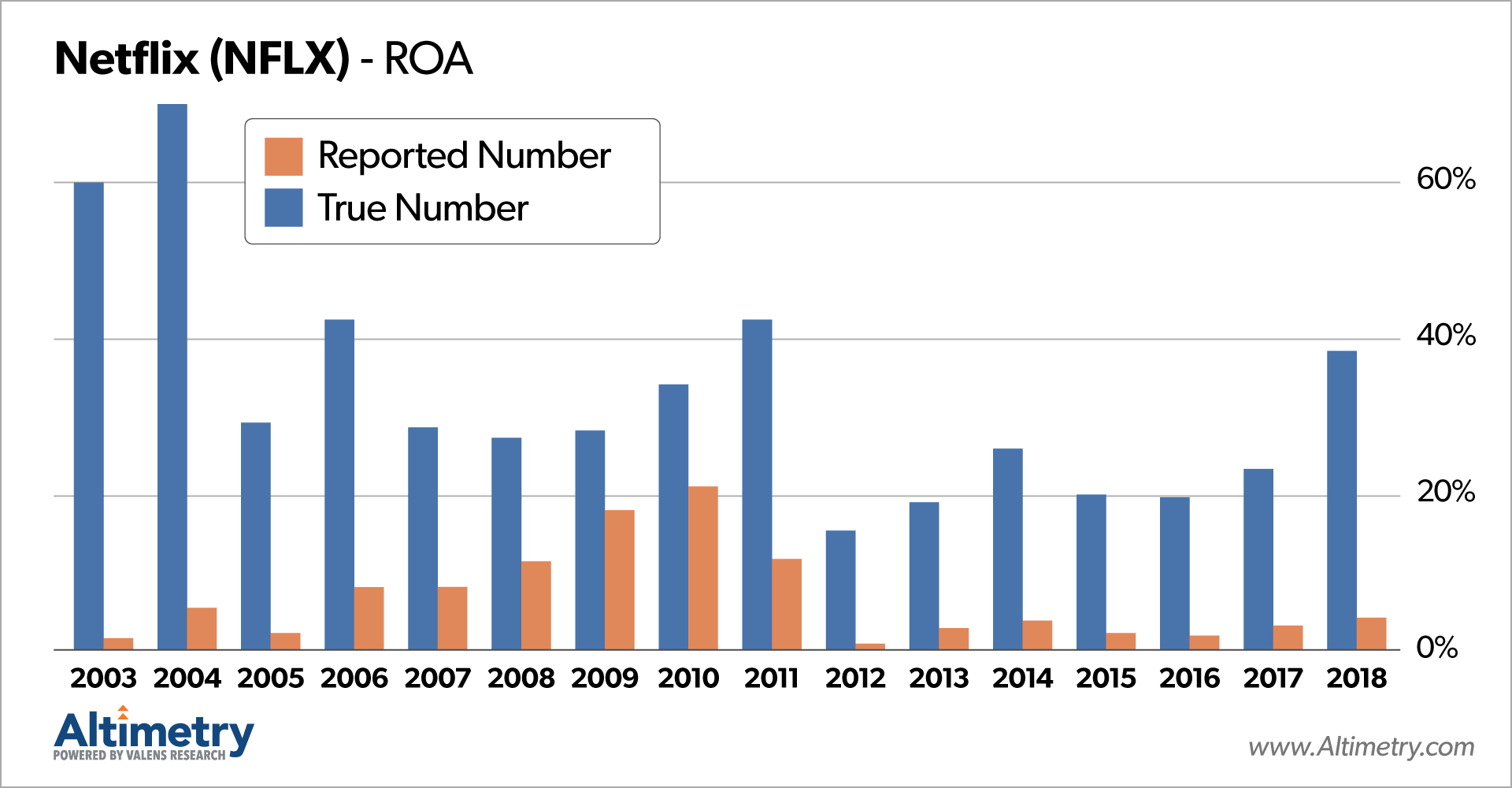

The blue bars are our adjusted and REAL returns on assets for Netflix, dating back to 2003.

These are 36 TIMES higher in some cases.

We arrived at this number by deconstructing and then rebuilding Netflix's entire balance sheet, correcting all the built-in mistakes.

You could have bought the stock based on just this information alone as late as 2013, and still made 15 times your money.

Even as of last year, there's still a major discrepancy in the reported return on assets. It's almost nine times higher than what the public believes to be true.