Travel destinations are rethinking their commitment to some parts of the industry...

Travel destinations are rethinking their commitment to some parts of the industry...

The travel and leisure industries have spent the past year shellshocked as travel plans around the globe screeched to a halt during the coronavirus lockdowns.

Major cruise lines and airlines are a long way from recovering to their pre-pandemic levels.

However, as vaccine rollouts continue to expand in the developed world (and hopefully soon in less developed countries), the travel industry is excited to get back to work.

The popular travel destinations have had a year to reflect on their sometimes-unhealthy relationship with parts of the travel industry, and they aren't necessarily as excited for things to return to business as usual.

For instance, if you've ever stayed at one of the major Caribbean islands – particularly on land, rather than on a cruise ship – you may recall the chaos released when a cruise ship lands at a port.

Specifically, once cruise passengers descend on an island's biggest town, it transforms that town for a few hours as tourists essentially double the port of call's population.

Tourists account for much of the economy for many ports of call in the Caribbean, Alaska, the Mediterranean, and anywhere else huge cruise lines sail. So, for some time, these locations have put up with the craziness.

However, as a recent Bloomberg article highlighted, some of these communities are having second thoughts about opening back up.

With almost one full year under their belts without cruise lines docking in their ports, these communities have been able to experience a different world, and they've figured out how to survive.

After realizing the wear and tear that cruises put on their communities, they're now thinking about limiting how often cruise lines can come back in the future.

Any disruption for the cruise lines might add insult to injury for a group of companies already stretched thin...

Any disruption for the cruise lines might add insult to injury for a group of companies already stretched thin...

Royal Caribbean Group (RCL) and Carnival (CCL), along with many others, are desperately trying to get their companies back up and running... or at least get some people back on their boats again.

So community skepticism about even letting them back into port is a worrisome development. Worse, some ports of origin – like those in Florida – are resistant to requiring the cruise lines to require testing or vaccination for their travelers.

These challenges within the industry, coupled with other macroeconomic headwinds, paint a picture of a recovery that will not be nearly as strong as the cruise lines and their investors have hoped.

Out of the two major companies in the cruise line industry, Royal Caribbean's recovery outlooks seems particularly dire...

Out of the two major companies in the cruise line industry, Royal Caribbean's recovery outlooks seems particularly dire...

This is even more apparent when taking a look at the company's credit profile.

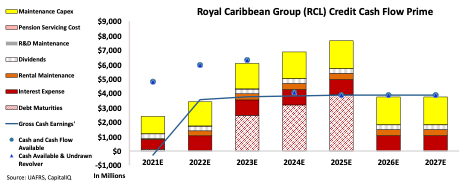

Using our Credit Cash Flow Prime ("CCFP") analysis, we are able to get to the heart of the firm's true credit risk.

Without a strong recovery in the cruise-line industry, Royal Caribbean could face significant headwinds in the coming years.

In the below chart, the stacked bars represent the firm's obligations each year for the next five years. These obligations are then compared to the firm's cash flow (blue line), as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As you can see, Royal Caribbean has a lot of debt coming due from 2023 to 2025. Fortunately, it's sitting on a lot of cash right now... But these headwinds give it a relatively short window of time to refinance.

With the company forecasted to lose money even before any of its obligations in 2021, and cash flows well above all obligations in 2023-2025, it's in trouble even if the entire world does reopen successfully. If it has to curtail routes or make other concessions to keep its destinations happy, it could see even weaker returns.

Even in years where the company has no debt coming due, cash flows barely match all operating obligations, which doesn't even factor in any of the other potential disruptions to a full-blown recovery in tourism.

Given the uncertainty about how strong a recovery in the cruise-line industry will be, it makes sense that the outlook for Royal Caribbean's credit rating is grim.

Using the CCFP analysis, Royal Caribbean has a 25% chance of defaulting within the next five years. Investors lending it money in the corporate bond market at only 3.4% through 2023 may be in for a rude awakening when they come to collect on their principal.

This will be an important company to keep an eye on to see if tourism starts to return to pre-pandemic levels.

Regards,

Rob Spivey

May 19, 2021

Travel destinations are rethinking their commitment to some parts of the industry...

Travel destinations are rethinking their commitment to some parts of the industry...