Parents and lawmakers are opposing increasingly violent video games...

Parents and lawmakers are opposing increasingly violent video games...

As video game consoles become home entertainment centers and individuals carry powerful computers in their pockets with gigabytes of memory, video games are more lifelike than ever.

Parents and psychologists are increasingly concerned that this content might influence a person's moral and ethical compasses, with many of today's popular video game titles containing violent and gruesome elements.

And lawmakers are started to become more involved. Not only are they concerned that video games contain too much violence, but they're focused on whether they are too addictive.

In China, lawmakers have introduced policies that restrict children's time playing video games.

The big concern is the new monetization model that video game manufacturers use. Instead of selling a game for a large one-time purchase, publishers offer games at low or no cost, with smaller purchases available within the game itself.

These smaller purchases, or microtransactions, can be tokens, networks, missions, or other add-ons. Often, these games become nearly impossible to continue without additional in-game purchases.

The legal argument is that these games are creating gambling transactions, with free "casino" entry and steep and addicting gameplay costs. Like a casino, a small, "high roller" subset of the gaming population is responsible for purchasing the vast majority of microtransactions.

Why acquiring a mobile game company makes sense for this legacy video game maker...

Why acquiring a mobile game company makes sense for this legacy video game maker...

Microtransactions are a huge moneymaker for the industry, no matter where you fall on the debate. More than 73% of industry revenues come from these small purchases.

This means that every game studio is looking to get in on the action.

A major winner of microtransactions is Zynga (ZNGA). That's why Take-Two Interactive (TTWO) wants a piece of the profits.

Zynga is best known for its flagship games such as FarmVille, Words With Friends 2, and other branded games made from existing intellectual property ("IP") franchises like Game of Thrones and Star Wars.

With consumers already addicted to social media, FarmVille was the perfect gaming and social platform to stay in touch with acquaintances when Facebook rose to prominence in the late 2000s.

FarmVille is the perfect example of a game that is free to download and play but encourages in-game purchases. Therefore, Zynga is well-positioned to succeed in this new in-game spending environment.

Take-Two saw what Zynga has built since 2007 and recently announced its acquisition of the company for more than $12 billion to help the company pivot to mobile gaming and a recurring revenue model.

Are investors missing the hype about recurring game revenue?

Are investors missing the hype about recurring game revenue?

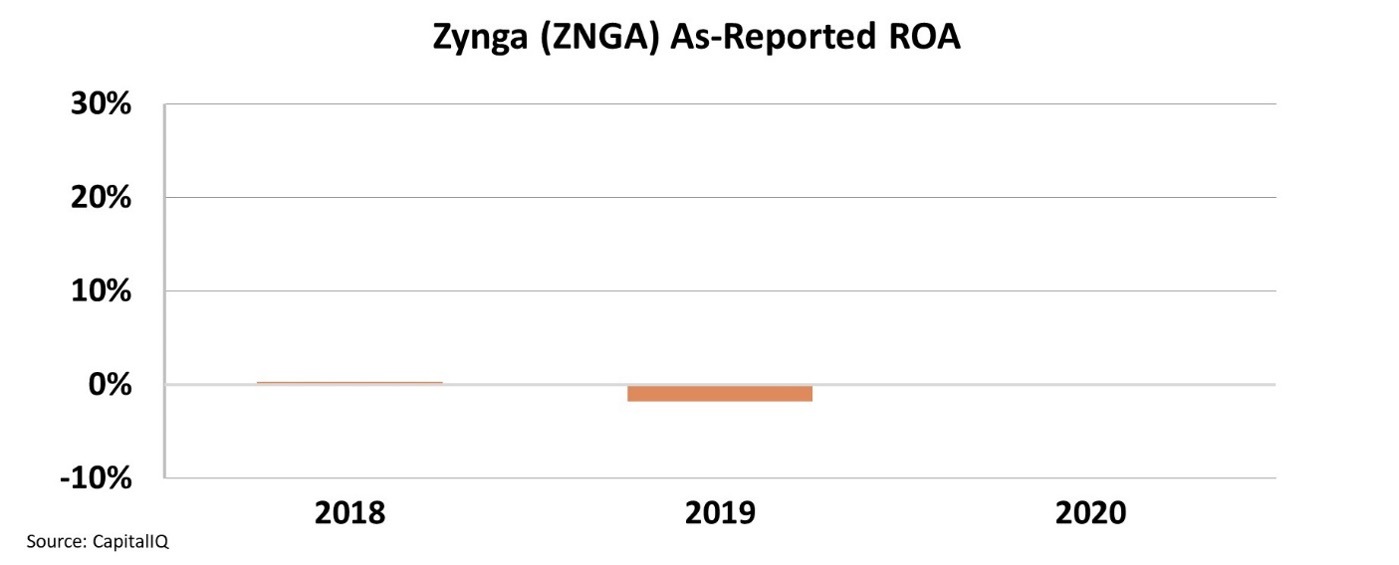

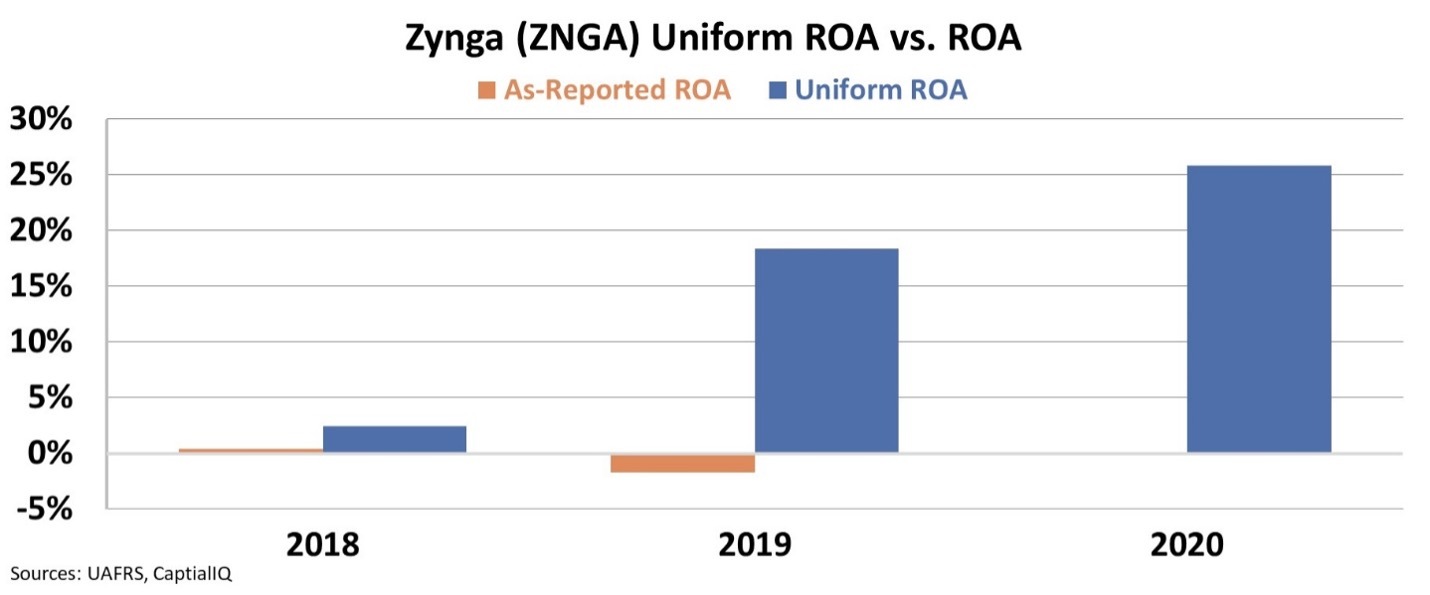

On the surface, investors may struggle to understand why Take-Two would want to acquire Zynga. Looking at the as-reported metrics, its return on assets ("ROA") was effectively zero in 2020 and negative in 2019.

But here at Altimetry, we use our Uniform Accounting framework to account for GAAP-based distortions in financials.

The Uniform Accounting data shows the value in successfully implementing a microtransaction model and what Take-Two is after. Uniform ROA reached 18% in 2019 and 26% in 2020.

Recurring customers are valuable customers, and the Uniform numbers reflect it.

When we look at the Uniform numbers, we see the story flip.

Zynga is a highly profitable business, increasing its return over the past three years... with expectations of continuing this trend. Returns are forecast to stay above 20% for the next two years.

As Take-Two aims to compete in this changing video game environment, its investment in Zynga is the perfect steppingstone to the new way of doing business.

While video game studios continue to put out large blockbuster games, the profits in the industry have pivoted from initial game sales to recurring revenue.

Investors would be wise to listen to Take-Two's focus on businesses with recurring revenue.

Online games are a bigger industry these days...

Online games are a bigger industry these days...

Nowadays, Software as a Service ("SaaS") provides the much-needed backbone to the evolving game industry, from powering 3D games to instant streaming for gaming anywhere.

But the reliance and need for SaaS transcends across other industries, too.

We recently ran a backtest of 75 SaaS companies... And we found that the average gain among these companies was nearly 760% – and that's counting the losers.

Some of the winners are extraordinary, which is why I was so excited when I found what I expect to be the next potential big SaaS winner. I recently put together a special presentation explaining everything you need to know.

You can watch it by clicking right here.

Regards,

Joel Litman

January 19, 2022

Parents and lawmakers are opposing increasingly violent video games...

Parents and lawmakers are opposing increasingly violent video games...