Boeing (BA) couldn't wait to oust its top dog...

Boeing (BA) couldn't wait to oust its top dog...

Back in March, Dave Calhoun announced plans to step down as CEO at the end of 2024... right as Congress kicked off investigations for alleged safety failures.

Then, at the end of July, Boeing decided Calhoun's reign had run its course. The struggling aircraft maker appointed Kelly Ortberg as CEO... effective pretty much immediately.

Ortberg is the former CEO of aerospace peer Rockwell Collins. And from where we stand, he's not joining a moment too soon.

Boeing has a long road ahead to make up for lost time. It's already losing ground to competitor Airbus (AIR.PA). The two companies usually deliver the same number of planes... but so far this year, Airbus has delivered 400 planes to Boeing's 218.

Ortberg doesn't have much time to settle in and get comfortable. He needs to make some serious strategy changes at Boeing. And some analysts are convinced a brand-new plane is the best path to recovery...

Boeing's 'newest' plane is the 787 model, which it started designing in the early '90s...

Boeing's 'newest' plane is the 787 model, which it started designing in the early '90s...

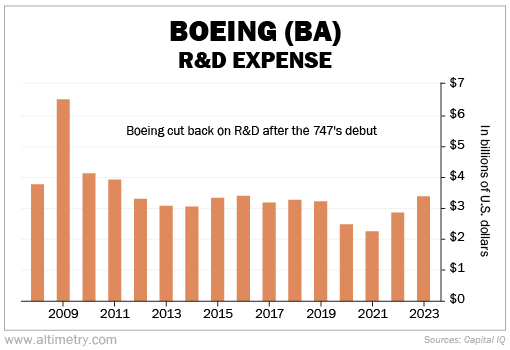

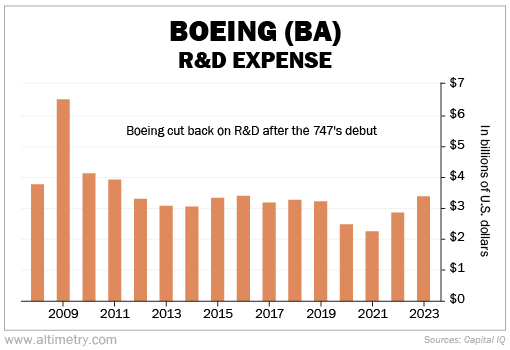

Research and development (R&D) costs peaked in 2009 at $6.5 billion. Commercial 787 flights began in 2011.

Since then, Boeing has slowed down R&D spending as much as it can. Its R&D budget settled around $3 billion per year for the past decade-plus...

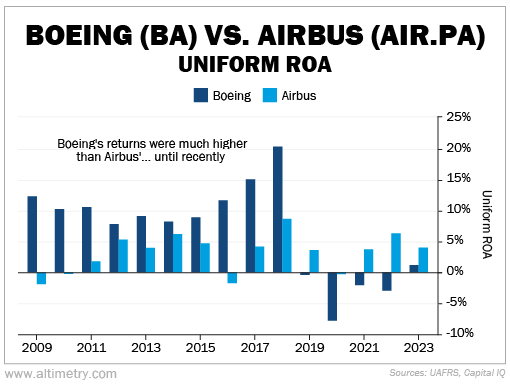

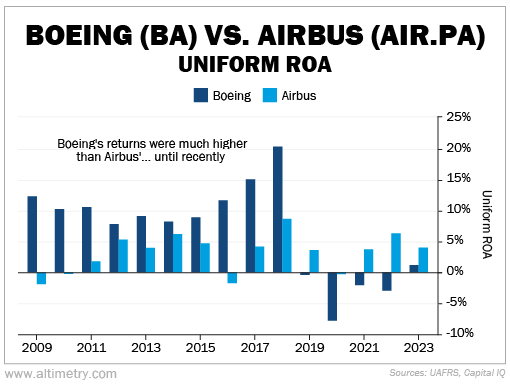

For a while, those lower R&D costs helped Boeing become way more profitable than Airbus. Uniform return on assets ("ROA") averaged around 10%... and climbed as high as 20% the year before its production issues arose.

Airbus averaged closer to 5% in the same time frame.

Just take a look...

As you can see, Boeing was far outpacing the competition... until the past few years, as it dealt with crisis after crisis. Airbus has continued to grow and thrive. It has plenty of capital to invest in R&D and developing new products.

If new CEO Ortberg decides to build a completely new plane to earn back trust, it's going to be expensive. Boeing won't be as profitable for many years. And in the meantime, returns will keep falling behind Airbus.

He might not feel like he has much choice, though. The public has lost a lot of trust in Boeing's current models. And Boeing can't afford to fall behind Airbus in terms of innovation, either.

No matter what Ortberg chooses, investors are setting themselves up for short-term disappointment...

No matter what Ortberg chooses, investors are setting themselves up for short-term disappointment...

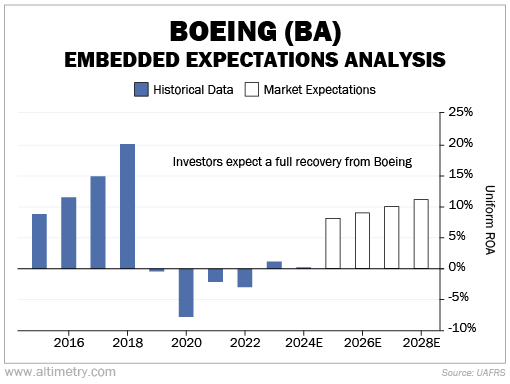

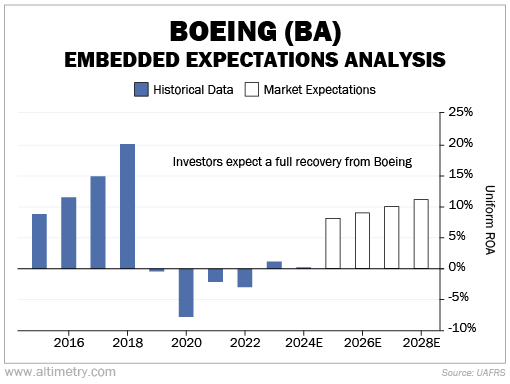

Their expectations are far too high for this beaten-down business. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA works a lot like a betting line in a sports bet. We use Boeing's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

The market is behaving as if Boeing's Uniform ROA will bounce back to 11% by 2028... slightly higher than its former average.

As you can see, investors don't seem at all worried about Boeing's returns.

These folks are in for a big surprise, no matter what Ortberg decides to do next. Boeing's struggles are far from over. A turnaround could take years, new plane or not.

Ortberg is stuck between two bad options with Boeing. And for investors, the only good option is to stay far away.

Regards,

Joel Litman

August 21, 2024

Boeing (BA) couldn't wait to oust its top dog...

Boeing (BA) couldn't wait to oust its top dog...