Union Pacific's (UNP) latest move could forever change domestic rail networks...

Union Pacific's (UNP) latest move could forever change domestic rail networks...

The largest U.S. rail operator is attempting to buy Norfolk Southern (NSC) in a rare, blockbuster deal.

If successful, it would form a $250-plus billion logistics titan. The combined rail network would stretch from Los Angeles to New York and cover nearly every major inland freight corridor.

This type of consolidation usually faces major resistance... due to the job cuts and supply-chain bottlenecks that often follow.

So it's surprising that both Union Pacific and Norfolk Southern support the deal. But, as we'll explain, investors aren't convinced that the benefits would outweigh the risks.

The industry leader could boost Norfolk Southern's performance...

The industry leader could boost Norfolk Southern's performance...

Union Pacific transports millions of tons of freight each year. The company has also pinned down the most efficient train schedules, which minimizes costs.

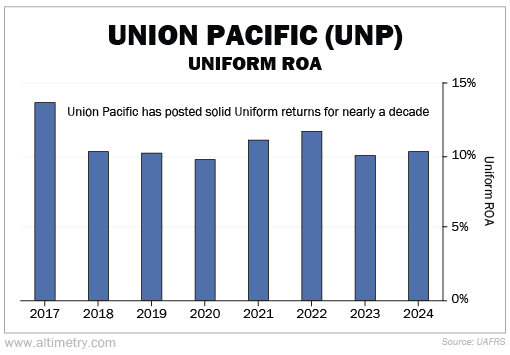

This translates into solid Uniform return on assets ("ROA")... Union Pacific's ROA has stayed at or above 10% for the past eight years.

Take a look...

Those are impressive returns compared with the broad U.S. railroad industry average of about 7%. And that strong profitability is why Union Pacific believes it could work wonders for Norfolk Southern.

Those are impressive returns compared with the broad U.S. railroad industry average of about 7%. And that strong profitability is why Union Pacific believes it could work wonders for Norfolk Southern.

This smaller rail operator lags behind Union Pacific... Its average five-year Uniform ROA is around 8%. And it has never exceeded 9%.

But Union Pacific has the muscle to boost struggling assets. And improving the quality and efficiency of Norfolk Southern's rail network would raise its profit margins.

However, the market hasn't caught on to the potential upside for Norfolk Southern...

However, the market hasn't caught on to the potential upside for Norfolk Southern...

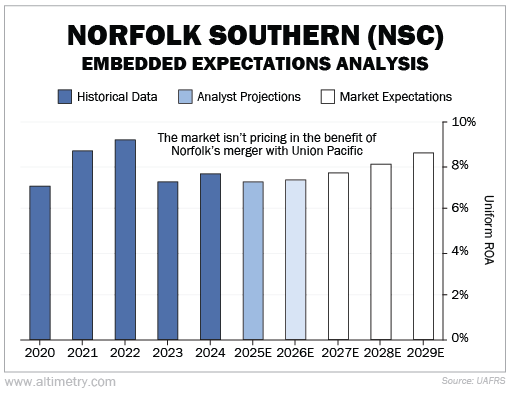

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Analysts expect Norfolk Southern's Uniform ROA to remain around 7% for the next two years... despite its likely merger with Union Pacific. The market is pricing in a slightly higher Uniform ROA of about 9% by 2029. Take a look...

Neither Wall Street nor investors are pricing in the full upside potential for Norfolk Southern. But we believe both companies would benefit from a merger...

Union Pacific would expand its already-vast rail network. And Norfolk Southern would improve its efficiency through better train scheduling.

Take a strong business model and apply it to a lagging, but valuable, peer...

Take a strong business model and apply it to a lagging, but valuable, peer...

That's what Union Pacific is preparing to do with Norfolk Southern... And it should boost returns for both companies.

A similar deal took place two years ago, when Canadian Pacific acquired the smaller Kansas City Southern. And it rewarded shareholders nicely... By 2025, Canadian Pacific Kansas City (CP) increased its quarterly dividend by 20%.

Given the industry dynamics, it's rare for top rail operators to agree on a major business strategy. That alone suggests the Union Pacific-Norfolk Southern deal could be transformative.

The boards of both companies have already approved the merger. And while the regulatory process will take time, the deal should close by 2027.

That gives investors a window to examine what combined returns could look like... before the market acknowledges what's coming down the pike.

Regards,

Joel Litman

August 28, 2025

Union Pacific's (UNP) latest move could forever change domestic rail networks...

Union Pacific's (UNP) latest move could forever change domestic rail networks...