Joel's note: The Altimetry offices are closed on Monday in observance of Independence Day, so look for the next Altimetry Daily Authority on Tuesday, July 6. I hope everyone has a safe and enjoyable holiday!

Whenever I try out a new language, I'm fascinated with the idioms...

Whenever I try out a new language, I'm fascinated with the idioms...

If you know a language's idioms, you get to understand a lot more about the roots and culture of the people. Across the globe, I've learned about some amazing differences and similarities.

For instance, in business and in life in general, you hear the American idiom, "rolling with the punches." That traces back to our country's historical interest in boxing. It means to adapt to life's changes, much like how a boxer moves with a punch instead of against it.

Wall Street has its own idioms. The bull and bear markets are the most obvious. However, cats also find themselves in regular Wall Street conversation. "A dead-cat bounce" refers to when a stock falls far and then has a little rebound. Another one is, "You can't swing a dead cat without finding one," which indicates lots of investment opportunities.

It seems there's a fascination with cat idioms across the globe...

It seems there's a fascination with cat idioms across the globe...

And thankfully, not just the dead ones spoken about on Wall Street (though still not always so polite).

While we in the U.S. say we have "other fish to fry" when we have more important things to do, the French say they have "other cats to whip." But it sounds better in French: "J'ai d'autres chats à fouetter!"

In Spanish, a dangerous task would be "putting a bell on a cat." Imagine a group of mice choosing the one mouse who would risk himself so that the other mice would always know where the cat is in the future... once the bell is successfully placed around its neck.

Folks have their own ways for mastering languages... but I don't think you could ever master one without learning its idioms. I've been going a fun route, learning some of the idioms of other languages first, whether or not I'll ever master something other than English!

Humans aren't the only ones trying to master languages...

Humans aren't the only ones trying to master languages...

Machines are also trying to improve their grasp on human languages. As we rely more on machines for transcribing and translation, they need to be able to understand idioms and other complex language tools.

Demand for this type of technology can be attributed to the increased desire for artificial intelligence ("AI") to be better able to interact with humans.

New AI innovations are allowing humans to automate more complex tasks. From automatic transcription to on-the-fly translation services, AI has proven to be a valuable tool in helping humans interact faster and more accurately.

This is a big reason why tech giant Microsoft (MSFT) recently spent roughly $20 billion acquiring Nuance Communications (NUAN)...

This is a big reason why tech giant Microsoft (MSFT) recently spent roughly $20 billion acquiring Nuance Communications (NUAN)...

Nuance is a pioneer in AI innovations that bring intelligence to everyday work and life.

Microsoft is betting that Nuance, as the biggest player in the transcription space, can help it scale up on the AI side of its business as it looks to innovate in the area.

Nuance has a particularly large presence in the medical field, where doctors and nurses are able to transcribe accurate notes to save time and more accurately record important details.

This is one of Microsoft's largest acquisitions in recent history, so it's beneficial to take a look at what the market is pricing for Nuance before fully evaluating the acquisition.

To gain a greater understanding about what the market is pricing in, we can use our Embedded Expectations Framework.

To gain a greater understanding about what the market is pricing in, we can use our Embedded Expectations Framework.

It breaks down like this...

Stock valuations are typically determined using a discounted cash flow ("DCF") model. This takes assumptions about the future and produces the "intrinsic value" of the stock.

But here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Framework, we use the current stock price to determine what returns the market expects.

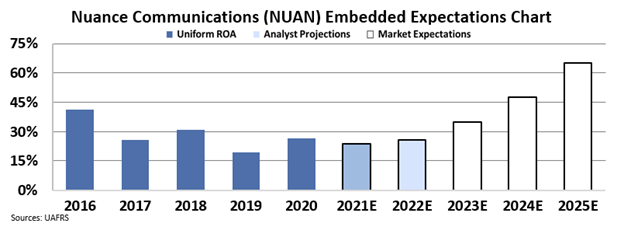

In the chart below, the dark blue bars represent Nuance's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's return on assets ("ROA") will shift over the next five years.

Since 2016, Nuance's ROA levels have ranged from 19% to 41%.

As our Embedded Expectations analysis highlights, investors would need the company's ROA levels to reach historical highs of greater than 65% for the stock to be fairly valued today. Wall Street analysts have more bearish expectations – pricing Nuance's Uniform ROA to remain around 25% through 2022.

By analyzing the Embedded Expectations for Nuance, we can understand how big of a bet Microsoft is taking on the name. Microsoft is paying a hefty premium, hoping the large acquisition can create sustainable new revenue streams.

Considering the big potential for AI in the world of language and beyond, Microsoft's bet could pay off... but Nuance would have to hit massive profitability to live up to the market's expectations.

Regards,

Joel Litman

July 2, 2021

Whenever I try out a new language, I'm fascinated with the idioms...

Whenever I try out a new language, I'm fascinated with the idioms...