The AI arms race just crowned a surprise front-runner...

The AI arms race just crowned a surprise front-runner...

September 10 marked a turning point in Oracle's (ORCL) nearly five-decade history. Shares of the software giant rocketed 36% in a single day, its biggest surge since 1992.

The move came as management revealed an eye-popping $455 billion cloud-services backlog. That's up from about $100 billion just a year ago... a staggering 359% jump.

Oracle has now secured multibillion-dollar deals with AI giants like OpenAI, Nvidia (NVDA), and ByteDance's TikTok. It's no longer playing catch-up in cloud computing. It's sprinting ahead of legacy rivals in one of the most capital-intensive races on the planet.

And yet, the September jump isn't what grabbed our eye. Oracle's stock was already up 45% this year before the news broke. It's up more than 250% since AI mania began.

That's why we started paying attention. Because when stocks double before their breakout... something bigger is usually underway.

The news was huge... but Oracle's price told the story first...

The news was huge... but Oracle's price told the story first...

Before earnings, the software giant had quietly outpaced the S&P 500 for most of 2025. It's a trend we've seen time and again in major tech rallies...

Back in 2013, Tesla (TSLA) jumped 120% before it turned its first profit. Nvidia (NVDA) rallied in late 2022... months ahead of its generative AI breakout in 2023.

Oracle followed the same path. Its blowout announcement confirmed what the stock had been signaling for months – a deep shift in its business model.

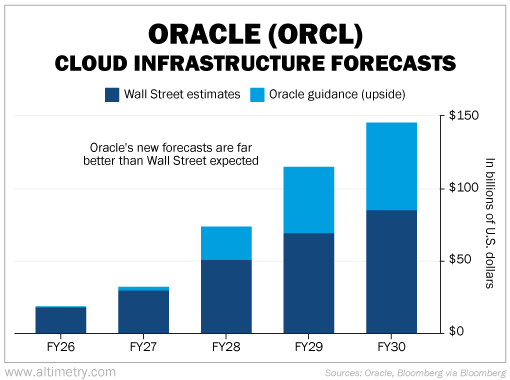

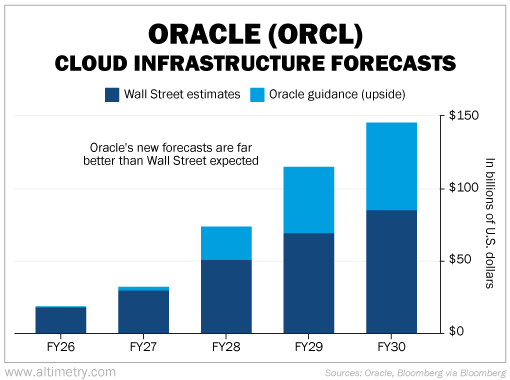

The company expects its cloud-infrastructure business to grow 77% this year to $18 billion. By 2030, it's targeting $144 billion in annual revenue from that segment alone.

That's way more than what Wall Street was counting on. Before the guidance update, analysts thought cloud infrastructure would hit $84 billion by 2030...

Oracle is already pulling ahead of key rivals. Its $455 billion backlog is now four times larger than Google Cloud's. That's a complete reversal from where it stood just two years ago.

And its new expectations would put 2030 Oracle ahead of where Amazon Web Services is today.

Four massive contracts in a single quarter helped fuel that shift. But it's the customers behind those contracts that matter most...

OpenAI is reportedly planning to spend trillions of dollars on new AI infrastructure over the next decade. And it's turning to Oracle for help.

The company's AI hardware is optimized for Nvidia's (NVDA) latest processors... the gold standard in large model training.

In other words, Oracle is shaping up to be one of the key players of the AI boom.

Momentum like this doesn't come out of nowhere...

Momentum like this doesn't come out of nowhere...

Oracle's stock didn't double before earnings by chance. The market knew it was investing big in AI, even if it didn't have much to show for it at the time.

And when investors catch on, headlines tend to follow.

The company has been building toward this shift for years. Shrewd investors knew not to count Oracle out. The stock's recent moves were just the rest of the market catching up.

My team and I have been studying Oracle's moves – and similar setups dating back to the 1990s.

We've found six "breakout" stocks that have already doubled, like Oracle... and like Oracle, they look set to soar again in the coming weeks and months.

You can still get their names – along with almost $15,000 in free research and bonuses – at a special, limited-time discount. But the window of opportunity is closing fast. Full details here.

We've seen this playbook time and again from previous tech-led booms. The next Oracle is out there right now... waiting to be found.

Regards,

Joel Litman

September 22, 2025

The AI arms race just crowned a surprise front-runner...

The AI arms race just crowned a surprise front-runner...