We ought to pay more attention to Brazil's weather patterns...

We ought to pay more attention to Brazil's weather patterns...

Over the past few years, many conversations have centered around the devastating California wildfires, which have ruined millions of acres of farms, wineries, and homes across the Golden State.

What doesn't get as much attention is an even more important story for the modern economy: changing weather patterns in Brazil.

Brazil, one of the world's biggest agricultural producers, faces dramatic droughts, rampant fires, and devastating frosts that are now ravaging global food stocks.

For context, Brazil's farms produce the vast majority of the world's orange juice exports, half of its sugar exports, a third of coffee exports, and a third of the soy and corn used to feed livestock worldwide.

The world's fifth-largest country is vital to global food supply chains. Its ability to feed the world is being seriously challenged by unpredictable weather events that destroy farms and ruin entire growing seasons.

Scientists tracking data points such as water, soil, humidity levels, deforestation, and rising global temperatures see a little reprieve in the future. If anything, experts say, the droughts and ensuing fires may get worse.

This means the impacts to Brazil's economy and the world's food security are up in the air.

One big U.S.-listed company is keeping a close eye on the weather in Brazil...

One big U.S.-listed company is keeping a close eye on the weather in Brazil...

The entire world is watching the events unfold in Brazil, which has massive implications for the prices of agricultural commodities, such as coffee, sugar, soy, and orange juice – especially in developing economies where a higher percentage of average income is spent on food.

Rising global food prices not only impact individuals and governments, but large corporations as well.

As one of the members of the "ABCD" group of companies – alongside Archer-Daniels-Midland (ADM), Cargill, and Dreyfus – Bunge (BG) is one of the largest agricultural commodity trading and logistics firms in the world.

Bunge is a nearly $12 billion company that purchases, stores, transports, and then sells a variety of commodities used to feed people and animals around the world. Unsurprisingly, the company has massive exposure to Brazil, buying many of its products from there, particularly soybeans.

One might hope such a dominant player in a large-scale, essential industry would be prepared to survive uncertainties.

Yet, a quick look at The Altimeter – which shows users easily digestible grades to rank stocks on their real financials – suggests that Bunge doesn't have a large margin of safety to protect itself from weather trouble in Brazil, or anywhere for that matter.

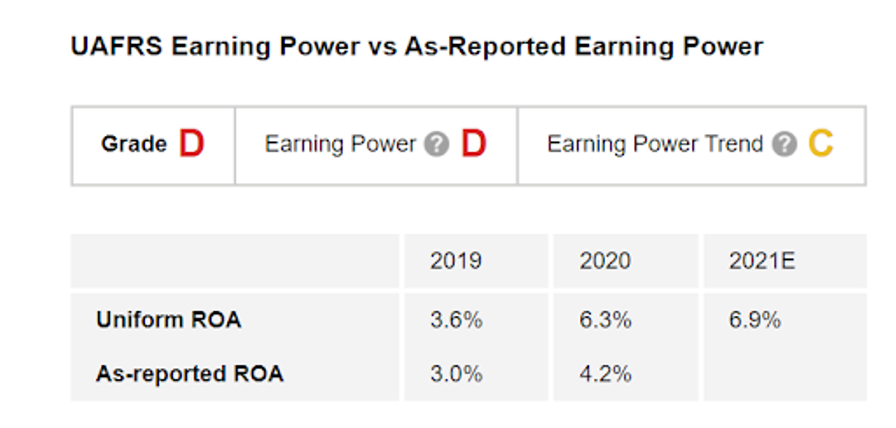

The company earns a "D" grade for Earning Power, with its weak 6% Uniform return on assets ("ROA") only slightly above average cost of capital levels in the U.S. Meanwhile, its "C" grade for Earning Power Trend says that while earnings aren't declining, which is positive given the stress in the market, they aren't exactly growing either.

In total, this leaves Bunge with an unattractive "D" grade for overall performance.

As supply problems in Brazil only worsen, Bunge could see Uniform ROA and earnings growth roll further. With such weak profitability, to begin with, any kind of crisis could create serious problems for the company in the future.

Is BG a good stock to short?

Is BG a good stock to short?

The market is well aware of Bunge's challenges going forward, meaning it's likely not a screaming short.

To know for sure, though, we need to look at the multibillion-dollar food company's valuation to see if the market has already priced in negative expectations around profitability and the weather crisis in Brazil.

Our Altimeter subscribers can click here to see how Bunge is valued based on Uniform Accounting... and if the market has already picked up on the severity of the challenges facing the international soybean exporter.

Brazil is an agricultural gatekeeper, meaning with so few competitors in the industry, buyers are forced to go to them for their basic foodstuff needs.

At Altimetry, we love finding "Gatekeepers of Booming Industries" since they make for great investments. When an industry is seeing high demand, a company can erect large competitive moats within that industry can earn an outsized return.

Altimetry's Microcap Confidential newsletter has made six open stock recommendations for the Gatekeepers of Booming Industries' investment theme. And one of our tiny company picks in this category is set to soar 380% by December 31.

This gatekeeper stock has some of the biggest profit-making potential on Wall Street... And most investors haven't discovered this stock disruptor yet, making it a huge opportunity for investors who get in today.

But you have to act quickly. That's why I urge you to check out my brand-new video presentation where I detail this story in full. You can watch it here.

Regards,

Joel Litman

October 21, 2021

We ought to pay more attention to Brazil's weather patterns...

We ought to pay more attention to Brazil's weather patterns...