We don't have every company's second-quarter earnings... But the numbers so far are encouraging across a range of sectors.

We don't have every company's second-quarter earnings... But the numbers so far are encouraging across a range of sectors.

For the first time since 2022, non-AI companies have started growing their earnings... Even the smallest firms are making progress.

Of course, the "Magnificent Seven" technology stocks have carried the market...

Collectively, Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) generated almost half the gains of the top 500 U.S. companies in early 2024.

These seven stocks also accounted for 29% of the S&P 500 Index by market cap... And they've repeatedly boosted the index to all-time highs.

But now, other companies are showing up.

Most of them are reporting second-quarter earnings this month, and they've been working hard to catch up to the Magnificent Seven...

The net income for non-Magnificent Seven companies has reached its highest level since early 2022. The Magnificent Seven's growth, on the other hand, has slowed to its lowest rate in a year.

And as we'll explain today, that's actually a great sign for the long-term health of the market.

The Magnificent Seven are losing their lead...

The Magnificent Seven are losing their lead...

These mega-cap tech stocks have been driving market performance for years. Yet recent earnings-growth trends show a clear, and substantial, shift...

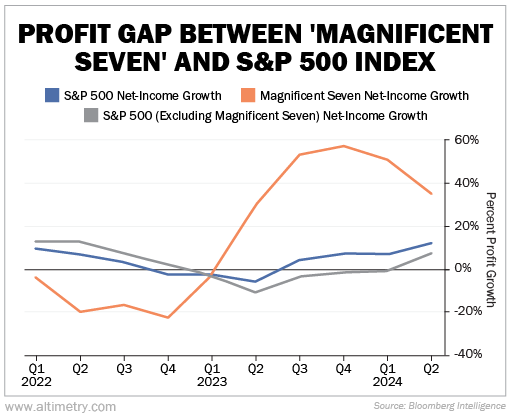

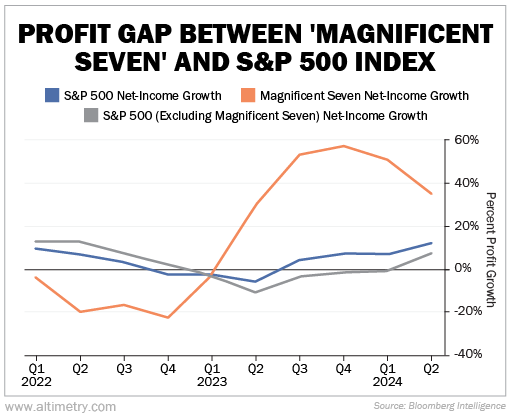

In the first quarter of 2024, these stocks' corporate earnings grew by 51%. Excluding the Magnificent Seven, the S&P 500 fell by 1%.

Compare that with the second quarter... The Magnificent Seven's earnings growth declined to 35%. Meanwhile, the S&P 500 without the Magnificent Seven saw 7% growth.

And the earnings-growth spread between the two groups decreased from 52% to 28% in a single quarter.

Moreover, the second quarter marks the first time non-Magnificent Seven companies saw positive earnings growth since the fourth quarter of 2022.

In fact, their growth is beginning to converge with that of the Magnificent Seven. Just look at this chart...

This data highlights the beginning of an important shift... from concentrated performance in a few stocks to strong showings across different sectors.

Of course, our economy still relies on the Magnificent Seven. (Remember, AI isn't going anywhere.) So we don't want their growth to slow down too much, especially because...

Good investment alternatives have been hard to find...

Good investment alternatives have been hard to find...

Elite hedge funds are a good example. They've long invested in large-cap tech companies. And over the past year, most of them have struggled.

Top funds posted gains of roughly 7.5% in the first half of 2024, significantly underperforming the overall market.

Now, hedge funds haven't necessarily lost their edge...

They've just grappled with a limited number of major winners (namely, the Magnificent Seven) and a disproportionate number of losers.

Simply put, hedge funds had two choices... They either held the Magnificent Seven or underperformed the market.

Now the landscape is changing...

The good news is, the rest of the economy is starting to pick up the slack...

The good news is, the rest of the economy is starting to pick up the slack...

Recent growth trends are making way for stock picks outside of the Magnificent Seven.

We're entering a market phase where small caps and microcaps will finally start to matter...

In general, these stocks have a lot more growth potential than large caps... It's much harder for a $2 trillion company (like Nvidia) to double its earnings than a microcap that's still in the early stages of growth.

Over time, we believe these smaller companies will generate a lot of wealth.

A broader, healthier market means more winners... and more opportunities for investors in the long term.

Regards,

Rob Spivey

September 16, 2024

We don't have every company's second-quarter earnings... But the numbers so far are encouraging across a range of sectors.

We don't have every company's second-quarter earnings... But the numbers so far are encouraging across a range of sectors.