Beijing used to point to its solar industry with pride...

Beijing used to point to its solar industry with pride...

Once hailed as the "future of China's economy," solar represented green innovation and industrial strength for the country. And for a while, that future seemed unstoppable.

Solar-panel production doubled from 2019 to 2022... and then doubled again. Companies like LONGi Green Energy Technology, Trina Solar, and JA Solar Technology raced to dominate the global market.

But last year, the dream began to unravel. Roughly 87,000 jobs vanished from China's top solar firms – nearly a third of their combined workforce.

Profits collapsed. Bankruptcies surged. Prices cratered amid brutal overcapacity.

Last month, Chinese President Xi Jinping finally stepped in. He called for an end to "disorderly price competition" as the government scrambles to restore order.

But it's too late to stop the damage from spreading. China's solar-industry meltdown is reshaping the global market... and the fallout could pave the way for U.S. solar firms to emerge stronger.

China's solar industry didn't fall apart overnight...

China's solar industry didn't fall apart overnight...

This crisis has been building for years.

After the real estate sector began slowing in the late 2010s, Beijing started channeling capital into strategic growth areas such as solar, electric vehicles, and batteries.

By mid-2023, China had built out enough solar-production capacity to supply the entire world twice over.

That might have worked... if global demand had kept up. Instead, global solar-panel prices collapsed by more than 50% by early 2024. An estimated $60 billion in profits have been wiped out across the Chinese solar industry.

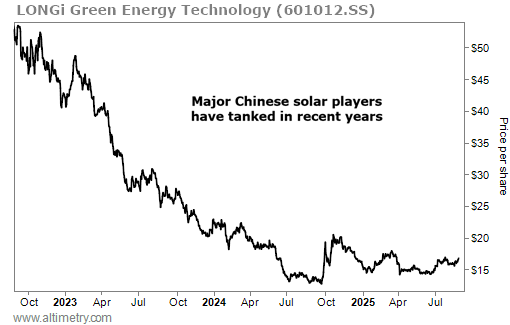

China's largest solar company LONGi Green Energy Technology, is down 68% over the past three years. Take a look...

It's a textbook case of overexpansion. More than 40 solar firms in China have either gone bankrupt, been acquired, or delisted since 2024.

Despite the carnage, local governments remain reluctant to enforce shutdowns...

Despite the carnage, local governments remain reluctant to enforce shutdowns...

Many solar factories are the largest employers in their regions.

Shutting them down risks social unrest. China's central leadership wants to avoid that prospect at all costs.

But the math doesn't lie. Analysts estimate that 20% to 30% of China's solar production needs to be permanently shuttered for the market to stabilize.

Industry leaders have even floated the idea of a supply alliance – like an OPEC for solar power – to rein in the chaos.

One thing is certain... the market's current trajectory is unsustainable. And the longer China delays a correction, the more painful the outcome becomes.

The Chinese solar boom has flipped into a bust... but it's opening new doors...

The Chinese solar boom has flipped into a bust... but it's opening new doors...

For investors, this shift could mark the beginning of a new phase in the global clean-energy market.

As weaker Chinese players are pushed out and pricing pressure eases, U.S. solar winners will look to capitalize.

Washington is already taking steps in this direction. The Inflation Reduction Act, passed in 2022, is reshaping the domestic solar landscape with tax credits, loan guarantees, and manufacturing incentives.

That timing couldn't be better. With global prices depressed and Chinese output declining, American firms can expand without getting crushed by cheap imports.

This is how secular shifts play out. First comes the excess... then the cleanup. Once the market resets, the survivors can grow profitably.

Watch the solar space closely. Once the dust settles in China, a more balanced and sustainable cycle may begin.

Regards,

Joel Litman

August 27, 2025

Beijing used to point to its solar industry with pride...

Beijing used to point to its solar industry with pride...