If chips ran the economy, we'd be in the clear...

If chips ran the economy, we'd be in the clear...

Semiconductors are having their biggest renaissance in years thanks to the ongoing AI boom.

In May, global chip sales rose 19% to $49 billion. Chipmaker Nvidia (NVDA) became the largest company in the world last month.

But chips don't run the economy... coffee does. And it's telling a far less exciting tale...

Even though the AI boom seems like it's keeping our economy afloat, consumer spending still makes up more than two-thirds of U.S. GDP. And folks simply aren't spending like they used to.

Consulting firm McKinsey monitors consumers' "intent to spend" on categories like essentials (gasoline, groceries)... semi-discretionary goods (skin care, household supplies)... and fully discretionary items (personal electronics, travel, and takeout meals).

The report gives us valuable insight into the state of the U.S. consumer. And right now, it's looking bleak.

Essential goods are expected to hold flat. But consumers expect to slow down spending across almost every other category in the next quarter.

In personal electronics – as close as most folks get to buying chips from companies like Nvidia – consumers expect to spend about 5% less. They intend to spend 10% less on international flights.

Overall, consumers are reeling in spending as fast as they can. As we'll discuss today, this is a sign that the economy is not "all clear"... even as chipmakers keep raking in the big bucks.

Even more damning than electronics, consumers expect to spend 4% less at 'quick service' restaurants...

Even more damning than electronics, consumers expect to spend 4% less at 'quick service' restaurants...

This category includes coffee chains like Starbucks (SBUX), which offer a reliable glimpse into how consumers are doing.

Even before McKinsey's bleak survey results, Starbucks was already giving us warning signs. U.S. same-store sales fell 3% in the second quarter. Transaction volumes fell 7%.

And management warned that the rest of the year would be bleak, too. Starbucks slashed its full-year revenue guidance from "up 7% to 10%" to just "low single digits."

The company is clearly worried consumers will keep spending less. The reason is simple... consumers are running out of money to spend.

When money gets tight, people are forced to spend less and borrow more. That means higher credit-card balances, bigger auto loans, and more monthly payments.

This can work for a while... but it always reaches a breaking point if it goes on for too long.

And we seem to be rapidly approaching that breaking point...

And we seem to be rapidly approaching that breaking point...

We're several years past pandemic-era stimulus packages. Student-loan payments resumed nine months ago. And consumers are showing signs of stress.

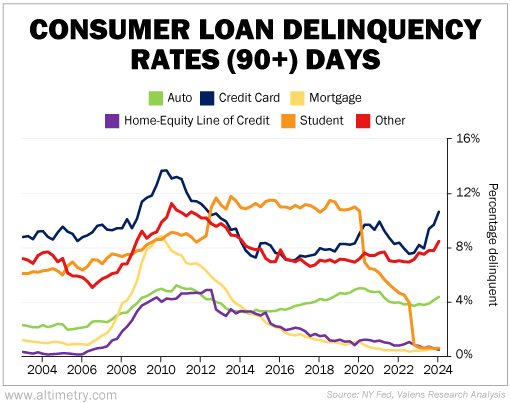

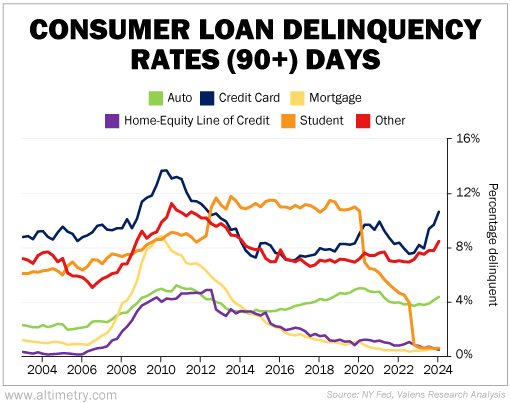

Over the past few quarters, consumer-loan delinquency rates have started rising... fast.

The following chart shows the percentage of consumer loans that are at least 90 days delinquent in any given period, for every quarter in the past two decades.

Between the fourth quarter of 2023 and the first quarter of 2024, every major loan category besides home-equity lines of credit had higher delinquencies. Take a look...

Credit-card delinquencies are particularly worrying. The 90-day delinquency rate reached 10.7% in the first quarter... up from just 8.2% the first quarter of 2023.

No wonder folks aren't willing to spend as much on nonessentials... They don't have the cash, or the spare room on their credit cards.

AI and computer chips are helping power roughly 60% to 70% of U.S. stock market capitalization.

It's a massive transformation for corporate investment... and will have a lasting impact on the economy. It'll also likely keep parts of the economy strong in the coming quarters.

But we can't expect earnings growth to really accelerate when two-thirds of the U.S. economy – in other words, the U.S. consumer – is on the ropes.

And until consumer health starts rebounding, our outlook remains cautious... even with our optimism about AI.

Regards,

Rob Spivey

July 12, 2024

Editor's note: No matter how much faith you have in the AI story, Rob says you need to be careful in today's economy. In fact, Rob's colleague and Altimetry founder Joel Litman is tracking a huge AI announcement that could soon trigger outright panic across the market... and blindside unsuspecting investors.

Joel is dropping everything to share what he knows. On Thursday, July 18 at 1 p.m. Eastern time, his update goes live... revealing exactly how you can prepare... in what he's calling an "AI Panic Summit." And if you sign up to attend now, you'll get free access to his "AI Stock Screener" tool in the days leading up to the event. Click here to RSVP.

If chips ran the economy, we'd be in the clear...

If chips ran the economy, we'd be in the clear...