Nvidia could be at the center of a massive 'fraud'...

Nvidia could be at the center of a massive 'fraud'...

At least, that's what famed short-seller Michael Burry believes.

Burry – the legendary trader of Big Short fame and founder of Scion Capital – shocked markets with a single post on social media platform X earlier this month.

Over the past few years, he has made headlines for plenty more successful bets... like one in favor of struggling video-game retailer GameStop (GME) before it became a meme stock.

But now, Burry has set his sights on AI.

At the start of November, filings revealed Burry had shorted Nvidia (NVDA) and Palantir Technologies (PLTR) – two of the market's AI darlings.

Less than a week later, he went after AI hyperscalers on X for allegedly overstating their earnings. He claimed they were understating the depreciation of assets like chips and servers... calling it "one of the more common frauds of the modern era."

And since then, to defend his bet, he has begun an all-out tirade against hyperscalers.

Burry has garnered a lot of respect over the years. So when he shorts a stock, the market listens. Nvidia shares fell 4% on the news of Burry's short position. Palantir dropped 8%.

But we're not convinced this time. There seems to be more going on with this bet than meets the eye...

It all boils down to depreciation...

It all boils down to depreciation...

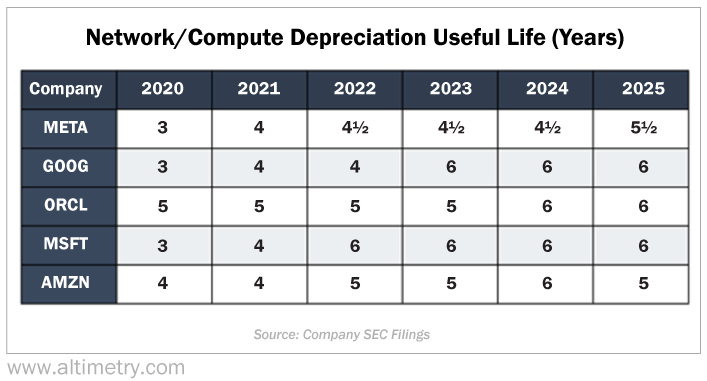

Burry published a chart featuring all five major hyperscalers – Facebook owner Meta Platforms (META), Google parent Alphabet (GOOGL), Oracle (ORCL), Microsoft (MSFT), and Amazon (AMZN).

It shows how each company's "depreciation useful life" for server and networking assets has changed since 2020.

Take a look...

Hyperscalers have increased the useful life of these assets across the board. The average is up from 3.6 years in 2020 to 5.7 years today.

In other words, Big Tech now expects its assets to last almost twice as long as they used to.

This kind of metric is only published in a company's annual filings. It's not going to make headline news... or even make it into quarterly presentations.

And aside from accountants, most folks typically wouldn't care.

But Burry isn't "most folks." He homed in on these numbers, labeling them outright fraud. He claims they're inflating valuations and profitability for some of America's biggest AI players.

Burry thinks hyperscalers are playing games to boost their earnings...

Burry thinks hyperscalers are playing games to boost their earnings...

That's because under generally accepted accounting principles ("GAAP"), depreciation has a massive impact on profits.

Let's say Company A has a $1 million asset. This asset helps it generate $100,000 in gross profit every year. And it will last five years.

Said another way, under GAAP, Company A must depreciate that $1 million over five years... or $200,000 per year.

If Company A earns $100,000 in gross profit, but subtracts $200,000, that's a net loss of $100,000 in a year. Depreciation makes it seem like the company is losing money.

But let's say the same asset lasts 20 years. Now, Company A only has to depreciate it to the tune of $50,000 per year. Subtracting that from the same $100,000 gross profit, you get a net gain of $50,000.

Nothing changed about the company or the business model. The only difference is how long the asset will supposedly last.

Of course, the reality is much more complicated. There are lots of other factors to consider. But this is the basic idea behind Burry's thesis.

Burry doesn't accept that hyperscaler assets now last twice as long as they used to...

Burry doesn't accept that hyperscaler assets now last twice as long as they used to...

These companies are spending billions of dollars on new data centers filled with powerful computer chips, including Nvidia's top-of-the-line graphics processing units ("GPUs"). In Burry's opinion, those kinds of assets still deserve a three-year lifespan.

And he says this seemingly small change could understate these companies' depreciation expenses by a combined $176 billion in the next three years.

If Burry is right, AI leaders will have to adjust the numbers eventually. The resulting drop in earnings could send tech stocks tumbling.

And that's exactly what he wants to happen.

Remember, Burry is currently short two high-profile AI-related stocks. He stands to benefit if folks start doubting the AI industry's numbers.

But as we'll explain tomorrow, we believe his claims are wrong on a fundamental level.

Burry hasn't shown all of his cards yet. But while drip-feeding information about his grand plan, he has mentioned that he'll reveal all tomorrow – November 25.

We'll be watching and waiting... And in the meantime, there's a lot more to dig into.

Regards,

Joel Litman

November 24, 2025

Nvidia could be at the center of a massive 'fraud'...

Nvidia could be at the center of a massive 'fraud'...