Pharmaceutical giant Novo Nordisk (NVO) has ruled the obesity-drug market for years...

Pharmaceutical giant Novo Nordisk (NVO) has ruled the obesity-drug market for years...

The company's GLP-1 treatments, including Wegovy and Ozempic, have become household names. Between 2021 and 2024, they boosted its revenue from $21.5 billion to more than $40 billion.

But Novo Nordisk is no longer the only player in the GLP-1 ring. Eli Lilly (LLY) has stormed ahead recently... with superior weight-loss results in clinical trials.

By 2030, Eli Lilly is expected to command more than 50% of the global GLP-1 market, which could top $100 billion.

And right now, Novo Nordisk is bleeding... Shares are down more than 60% from their June 2024 peak. But this isn't a knockout blow. Novo Nordisk's leadership is putting up a fight.

Today, we'll explain why the new CEO's recent moves could spark a comeback... and why the market may be underpricing that turnaround.

Maziar Mike Doustdar is working to slash costs, rewrite the sales playbook, and ditch pharmacy middlemen...

Maziar Mike Doustdar is working to slash costs, rewrite the sales playbook, and ditch pharmacy middlemen...

Doustdar has frozen hiring across "non-critical" areas of the 77,000-person company... And he may even cut jobs.

The new CEO is also rolling out a direct-to-consumer sales model for Ozempic and Wegovy. In other words, he wants to bypass pharmacy benefit managers ("PBMs") and ship medications straight to patients.

On top of that, the company has cut some GLP-1 prices by more than 45%. Ozempic, for example, is now $499 per month – down from its $936 sticker price.

That may sound like corporate suicide, but it's actually good economics...

PBMs are supposed to reduce drug prices. But they often do the opposite, grabbing millions of dollars in hidden fees. Removing these middlemen allows Novo Nordisk to capture more value per prescription, even at lower prices.

Novo Nordisk is sacrificing short-term margins for long-term market share...

Novo Nordisk is sacrificing short-term margins for long-term market share...

However, investors don't expect the company to make a comeback anytime soon.

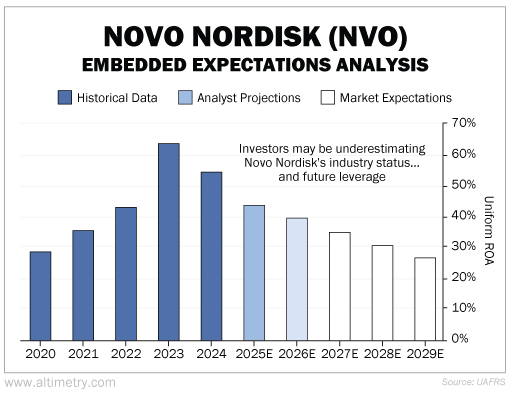

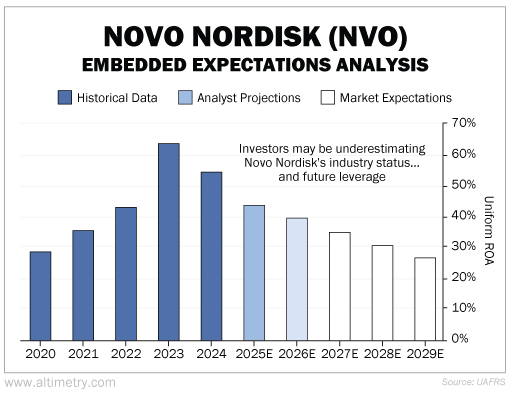

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Novo Nordisk's Uniform return on assets ("ROA") steadily increased from 29% in 2020 to 64% in 2023... before dipping to 55% in 2024. Analysts are projecting a Uniform ROA of about 40% by 2026.

Investors are even more pessimistic... They expect Novo Nordisk's profitability to free fall to 27% by 2029. That's even lower than its pre-GLP-1 returns.

Take a look...

In reality, Novo Nordisk could regain more leverage than investors think... through a leaner drug-distribution model and strategic price cuts.

Despite Eli Lilly's swift rise, Novo Nordisk isn't letting up...

Despite Eli Lilly's swift rise, Novo Nordisk isn't letting up...

Novo Nordisk has strong brand recognition, massive production capacity, and a big global footprint.

The question is... Will the company's new CEO be able to keep costs down and go straight to the consumer?

If so, it may regain market share faster than Wall Street expects.

Novo Nordisk has already absorbed the blows in a booming pharmaceutical market. And now it's re-entering the GLP-1 ring.

Investors who assume the fight is over may want to take another look.

Regards,

Joel Litman

September 3, 2025

Pharmaceutical giant Novo Nordisk (NVO) has ruled the obesity-drug market for years...

Pharmaceutical giant Novo Nordisk (NVO) has ruled the obesity-drug market for years...