Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below for our thoughts on an ad campaign that's taking the world by storm...

We usually stay out of the 'meme stock' conversation...

We usually stay out of the 'meme stock' conversation...

Most of the time, it's a lose-lose situation. Meme stocks are usually dying businesses that, for one reason or another, have attracted retail investor attention.

While they tend to rise fast... they often fade into oblivion within a few news cycles.

The latest meme-stock craze is different, though.

American Eagle Outfitters (AEO) has been a run-of-the-mill clothing retailer for years. But the stock gained attention after a new ad campaign featuring controversial Hollywood star Sydney Sweeney.

The ad, which aired late last month, features Sweeney decked out in American Eagle clothes with the tagline "Sydney Sweeney has great jeans."

Critics were quick to weigh in. Some called the ad racist. Others claimed it promotes eugenics. President Trump even voiced his opinion on social media platform Truth Social, writing...

Sydney Sweeney, a registered Republican, has the "HOTTEST" ad out there. It's for American Eagle, and the jeans are "flying off the shelves." Go get 'em Sydney!

Amid the controversy, the meme-stock community jumped right in. American Eagle shares rose... and rose... and rose. They're up 26% since the ad aired two weeks ago.

This might look like your typical hot meme stock that could fizzle out within a few months. But the underlying company is another story.

Unlike a lot of other meme stocks, American Eagle's business is sound...

Unlike a lot of other meme stocks, American Eagle's business is sound...

The company has seen solid growth over the past decade. Revenue is up from $3.5 billion in 2015 to $5.3 billion last year... a jump of more than 50%.

Controversy notwithstanding, it's obviously still spending to keep its advertisements relevant. And it has made a few brand acquisitions since 2015 to appeal to broader demographics... like menswear brand Todd Snyder and slow-fashion retailer Unsubscribed.

But outside of the meme-stock realm, investors are wary of American Eagle's business. Shares are down 23% since the start of the year.

Part of that has to do with tariffs. The company makes most of its clothes internationally. So tariffs will likely eat into profits.

Still, the market is going overboard. Despite a decade of good performance – and despite the stock's recent pop – American Eagle stock is cheap.

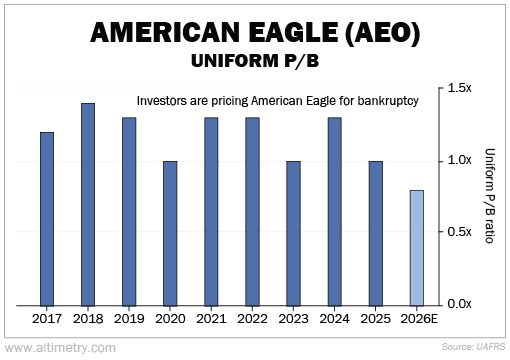

We can see this through the Uniform price-to-book (P/B) ratio...

The Uniform P/B ratio compares a company's total value with the value of the assets on its balance sheet (or "book"). The higher the P/B ratio, the more investors are willing to pay for those assets.

Said another way, it measures how valuable investors think American Eagle's assets are.

A company normally trades below a Uniform P/B ratio of 1 when the market is worried about bankruptcy risk. American Eagle has traded at 1 or higher for the past 15 years.

But this year, it's trading at just 0.8 times...

Tariffs alone shouldn't be cause for such a low ratio. Plenty of retailers are dealing with the same issues.

Valuations like these are typically reserved for companies that are going out of business... and selling their assets for pennies on the dollar.

It's not just that shares are cheaper than they should be...

It's not just that shares are cheaper than they should be...

Investors have absolutely no faith in American Eagle's prospects. They think the business is about to tank... forever.

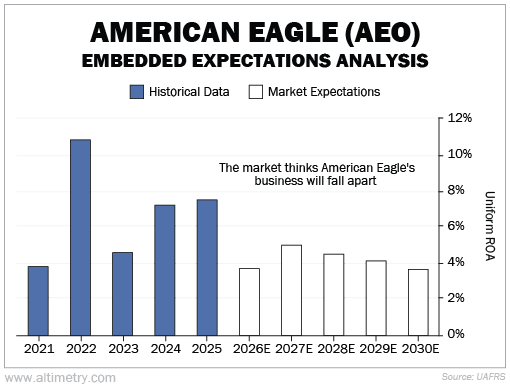

We can also see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet... We use American Eagle's current share price to calculate what investors expect from future performance and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

American Eagle's business has remained profitable as it grows. Uniform return on assets ("ROA") has averaged around 7% since 2021.

But investors think returns will fall below 4% by 2030. We've only seen returns that low one other time – the height of the pandemic.

Take a look...

Even after the meme-stock jump, investors expect the worst for American Eagle.

That gives it a lot of room to impress the market.

We wouldn't be surprised if this was the meme stock to buck the trend...

We wouldn't be surprised if this was the meme stock to buck the trend...

No matter your thoughts on the Sydney Sweeney ad, there's no denying it got a lot of attention. Retailers like American Eagle need to stay relevant... and this campaign more than delivered.

It may or may not translate into a huge sales boost. But either way, the stock is extremely cheap today. It's worth keeping an eye on.

Meme-stock status could be just what American Eagle needs to get back on track.

Regards,

Joel Litman

August 8, 2025

P.S. We'll dive deeper into American Eagle Outfitters in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

We usually stay out of the 'meme stock' conversation...

We usually stay out of the 'meme stock' conversation...