Elon Musk is known for his role in several successful companies and just bought a stake in a new one...

Elon Musk is known for his role in several successful companies and just bought a stake in a new one...

Elon Musk is famous for founding remarkably successful companies in different industries including PayPal (PYPL), Tesla (TSLA), SpaceX, the Boring Company, and Neuralink.

But more recently, he has been making waves for his actions on social media site Twitter (TWTR), where he's the eighth-most followed person on the platform.

Musk regularly tweets whatever he finds interesting, including information about his companies, politics, financial markets, and the blockchain. Furthermore, he doesn't shy away from talking about hot investing topics, often resulting in criticism.

Using his massive audience, he has sent Tesla stock, the meme cryptocurrency dogecoin, and many other financial instruments swinging with a single tweet.

His posts have even led to several rebukes and fines from the U.S. Securities and Exchange Commission ("SEC") and other authorities due to his effects on financial markets.

In late March, Musk appeared interested in Twitter for more than just sharing his thoughts. He polled his followers, asking whether Twitter adheres to the principles of free speech, then asking if a new social media platform was needed.

This created buzz that Musk was about to do something that could shake the social media industry, perhaps even creating a new social media platform.

However, Musk took the world by surprise when he took a different action... buying a 9.2% stake in Twitter.

It looks like this move wasn't enough for Musk...

It looks like this move wasn't enough for Musk...

Musk's followers expected him to attend Twitter's next board meeting and push business-changing and out-of-the-box ideas. However, Musk showed once again that he likes to surprise investors.

Last week, he offered to buy 100% of Twitter for $54.20 per share, a 38% premium to the day his investment was publicly announced. He also stated that the company needs to be taken private so that he can unlock its true potential.

To see if Musk is putting practicality before preference, or if he truly doesn't care about the real performance of the company, we need to look at more than as-reported metrics.

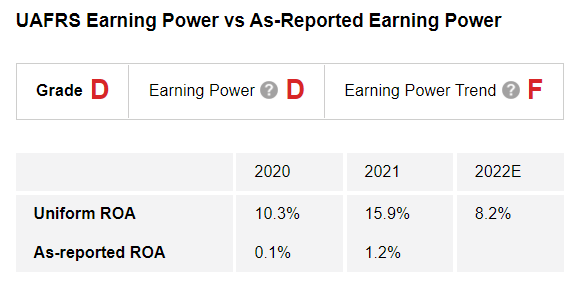

We can use The Altimeter, which shows users easily digestible grades to rank stocks on their real financials, to see how Twitter is performing.

As The Altimeter shows, Twitter will need a lot of radical changes to reach profitability, as the company gets a "D" Performance grade. After a strong 2021 performance with Uniform return on assets ("ROA") reaching 16% for the first time since 2014, Twitter is expected to see Uniform ROA dip to 8% in 2022.

Earning Power Trend is graded even worse, earning an "F." This tells us Twitter's earnings aren't expected to get much better either.

These expectations highlight that the company is struggling to execute and may have a hard time reaching the same level of profitability it did in 2021.

Can Musk turn Twitter around?

Can Musk turn Twitter around?

Twitter's stock has already bounced nearly 25% following the news of Musk becoming the shareholder, increasing from below $40 to around $50. It's obvious that the market is expecting Musk to be an activist investor, pushing the firm to turn around its weak profitability.

Musk might be successful in changing the business of Twitter and pushing management for larger profits, but it's not going to be easy.

If Twitter cannot make money in the current environment, with everyone glued to their screens thanks to people like Musk making waves, it's doubtful that even he can turn it around.

Regards,

Rob Spivey

April 21, 2022

P.S. While investors speculate on the future of Twitter, my team and I have been laser focused on an ignored corner of the market where BlackRock (BLK) CEO Larry Fink says "the next 1,000 unicorns" will come from. We've just put the finishing touches on a series of special reports so you can get your money there first. Watch our brand-new presentation here.

Elon Musk is known for his role in several successful companies and just bought a stake in a new one...

Elon Musk is known for his role in several successful companies and just bought a stake in a new one...