Cybersecurity stocks are astonishingly overpriced right now...

Cybersecurity stocks are astonishingly overpriced right now...

As we covered yesterday, the iShares Cybersecurity and Tech Fund (IHAK) is about four times more expensive than the market average. And the typical cyber stock is nearly twice as expensive as the average tech stock.

These astronomical valuations come with equally high risks.

You see, cybersecurity is built on trust... Companies trust cyber firms to protect their data and investors trust them to keep growing.

And one breach can destroy the whole foundation. Just look at what happened to cybersecurity leader CrowdStrike (CRWD) last July...

Its faulty software update disrupted computer systems at major banks, hospitals, and airlines across the U.S. Delta Air Lines (DAL), for one, had to cancel more than 5,000 flights.

To be clear, this wasn't a data breach... It was a breach of trust. As a result, CRWD fell 36% in less than a month. The stock has barely recovered from its pre-outage high more than one year later.

The combination of sky-high valuations and fragile trust makes most cybersecurity stocks high-risk ventures... especially in the AI era.

But that doesn't mean you should avoid all of them. Today, we'll explain what investors should look for before jumping into the cybersecurity space.

Companies like SentinelOne (S) need to focus on profits...

Companies like SentinelOne (S) need to focus on profits...

SentinelOne's software automatically detects, blocks, and responds to cyberattacks in real time... without human intervention. Its behavioral AI models help identify suspicious activity and stop attacks before they spread.

That's a big improvement over traditional antivirus programs, which rely on patterns of network activity (called "threat signatures") to pinpoint issues.

As more developers build apps using AI technology, security threats will rise. And that's fueling demand for innovative cyber firms like SentinelOne.

The numbers look promising... Its revenue has soared from $46 million to $820 million since 2020 – an annual growth rate of more than 77%. But that's not enough...

Back in May, the stock fell 12% after SentinelOne reported year-over-year revenue growth of 23%. Wall Street analysts expected a higher number... and that caused investors to panic.

You see, growth is just about the only thing SentinelOne has going for it. And it still hasn't turned a profit.

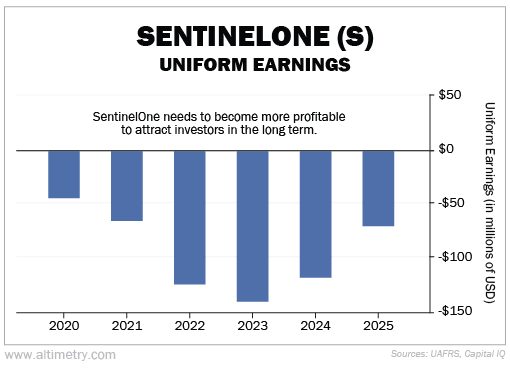

The company's Uniform earnings have been negative since before it went public in 2021. SentinelOne's Uniform earnings ranged from negative $139 million to negative $43 million. Take a look...

Ultimately, it doesn't matter how great its cybersecurity services are, or how big the consumer market is. If SentinelOne keeps losing money, investors will walk away.

Capitalize on the challenges and opportunities in cybersecurity...

Capitalize on the challenges and opportunities in cybersecurity...

As we explained yesterday, AI-assisted development is here to stay. And we've only scratched the surface of AI-induced cyberattacks.

That means the demand for smart, scalable security will continue to grow.

It's why companies like SentinelOne may become an essential part of cutting-edge software and AI teams. But that may not translate into high returns...

SentinelOne needs to prove that it can protect devices, networks, and cloud systems as well as margins. Until then, investors should tread carefully.

The market may reward innovation in the short term... But over time, it will demand profits. Investors shouldn't go all-in on cybersecurity without a clear path to returns.

Regards,

Joel Litman

August 20, 2025

Cybersecurity stocks are astonishingly overpriced right now...

Cybersecurity stocks are astonishingly overpriced right now...