No one expected United Airlines' (UAL) recent comeback...

No one expected United Airlines' (UAL) recent comeback...

The carrier is returning to New York's John F. Kennedy International Airport after nearly a decade away... through something called the Blue Sky alliance.

This new partnership, with JetBlue Airways (JBLU), is built around shared bookings, loyalty perks, and airport slots. It's helping both airlines expand their reach without big investments.

For United, it's a long-overdue fix after what CEO Scott Kirby called a "misstep"...

The airline exited JFK Airport in 2015 and let competitors gain ground in key coastal markets. Now that New Jersey's Newark International Airport faces severe congestion, United is hedging its bets by reentering New York.

JetBlue also has a lot to gain... It has been struggling to recover after a merger collapse and the forced breakup of a key alliance.

Today, we'll explain how the Blue Sky partnership could help JetBlue regain leverage in the airline industry – and why the market hasn't caught on yet.

Blue Sky is setting up opportunities JetBlue couldn't afford on its own...

Blue Sky is setting up opportunities JetBlue couldn't afford on its own...

JetBlue has spent the past year stabilizing operations after two big blows...

A U.S. District Court struck down its Northeast Alliance in 2023 due to antitrust violations. Soon after that, regulators blocked its bid for Spirit Airlines.

With a stretched fleet and weak pricing power, JetBlue lost access to the very partnerships that helped it compete. Blue Sky offers a way back in...

This deal, pending regulatory sign-off, gives United up to seven daily round-trip slots at JFK Airport as early as 2027. JetBlue gets eight slots at Newark Airport. They'll also be able to cross-sell tickets and offer reciprocal perks for frequent flyers.

For JetBlue, the partnership offers a practical path for growth without major costs. It opens doors to United's long-haul routes and international market. And it doesn't require new aircraft, terminal builds, or route launches.

That kind of low-cost expansion is rare in the aviation world... and it could kickstart JetBlue's recovery. Yet the market still isn't paying attention.

Uniform Accounting shows that investors are writing JetBlue off...

Uniform Accounting shows that investors are writing JetBlue off...

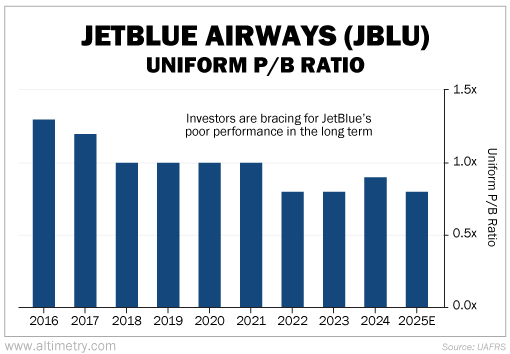

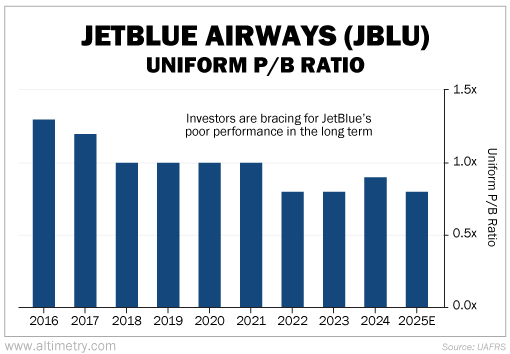

The company's stock has been trading below its book value for much of the past five years. And from 2015 to 2019, JetBlue's Uniform price-to-book (P/B) ratio hovered around, or just above, 1 times.

In other words, investors were reasonably optimistic about its operations.

Today, that ratio has fallen. A Uniform P/B ratio below 1 times means investors don't believe the company can generate returns above the value of its assets.

Simply put, the market thinks JetBlue is stuck – with no clear route to profitability. But the Blue Sky alliance could change that.

JetBlue is already starting to regain its footing...

JetBlue is already starting to regain its footing...

The airline is positioning itself to reach more premium markets and fill more airplane seats.

All told, JetBlue has a good shot at improving returns. And thanks to Blue Sky, it can skirt the regulatory drama and major capital spending.

But investors haven't priced in a turnaround... At current Uniform P/B levels, they're assuming JetBlue's story is over.

But if passenger volume and profitability improve even a little bit, the market will have to rewrite that story... and fast.

Regards,

Joel Litman

June 5, 2025

No one expected United Airlines' (UAL) recent comeback...

No one expected United Airlines' (UAL) recent comeback...