Early-stage biotechs don't make money...

Early-stage biotechs don't make money...

And Landos Biopharma (LABP) was no exception.

After a successful initial public offering ("IPO") in 2021, things were looking bleak for the company. Landos was strapped for cash.

Landos' business involved trying to develop immunology drugs. Like any other early-stage biopharma, it was a money sink.

These companies have to spend millions – if not billions – of dollars to build labs, research potential drugs, and fund tests to get those drugs to production. Only after all that can they make any revenue.

Landos raised about $100 million in its IPO. But that doesn't last long when you're burning about $40 million per year, as it was back in 2021.

By 2023, investors lost interest. The stock was down more than 90% from its IPO price. Landos was worth less than the cash on its balance sheet.

Then, last month, everything changed for Landos...

And as we'll explain, a small subset of other early-stage biotechs are now in a similar position.

Landos floundered until late March... when biopharma giant AbbVie (ABBV) scooped it up for $138 million.

Landos floundered until late March... when biopharma giant AbbVie (ABBV) scooped it up for $138 million.

The stock soared almost 175% overnight. Anyone who bought in when Landos was dirt-cheap made a killing once AbbVie caught on to the bargain.

This was a rare setup for investors. For a company to be worth less than its cash on hand – what we call negative enterprise value, or "negative EV" – something has to be really wrong.

It could be something wrong with the business itself. There are more than a few negative-EV companies that deserve their shoddy valuations. They'll burn through cash in a few years... and go out of business with no revenue.

It could also be something wrong with the market.

There are usually only a handful of negative-EV companies at any given time. Even the worst biotechs and startups often have some promise.

But during tough economic times, investors forget this... and they sell out of perfectly safe companies like Landos.

The number of negative-EV stocks skyrocketed during the previous two major recessions...

The number of negative-EV stocks skyrocketed during the previous two major recessions...

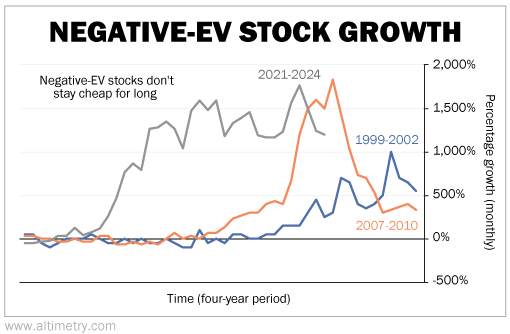

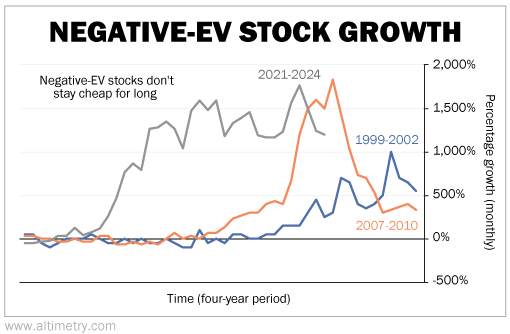

During both the dot-com bubble and the Great Recession, investors panicked. Many valuable stocks ended up trading below the value of their cash on hand.

The same thing is happening today... only we're not in a recession yet.

In each of the two previous downturns, the market came to its senses after a few months. Those negative-EV stocks started rising. Or in some cases, they were bought out like Landos Biopharma.

Take a look...

We've identified 51 true negative-EV stocks in today's environment. That's far more than you'd usually see while investors are still bullish... and it's because of the Federal Reserve.

With interest rates so high, investors think a lot of companies will end up bankrupt. They're pricing these companies to run out of cash before they've actually done so.

Many of these overhated companies will survive. In fact, some are already starting to get repriced... or gobbled up.

Take Fusion Pharmaceuticals (FUSN), a maker of radiopharmaceuticals – drugs that contain radioactive isotopes.

The company announced on March 19 that it's being acquired by pharma giant AstraZeneca (AZN) for $2 billion. Shares of Fusion shot up 99% the day the news broke.

Wall Street caught on to the negative-EV story earlier this year...

Wall Street caught on to the negative-EV story earlier this year...

Only because of all the red tape, most "pros" haven't been able to buy in.

But we're not Wall Street.

My team and I began building a list of negative-EV biotech stocks that have been unfairly beaten up. We narrowed the list to just 22... and they're being picked off like flies.

One stock we were tracking jumped 166% in less than two months. Another rose 239% in a little more than two weeks. And a third soared 275%, again in two weeks.

Each time, investors who got in early could have made massive gains. And the story isn't over yet...

We winnowed our official list down to just five negative-EV biotech picks. One is already up 49% since we first recommended it at the end of March... and as we go to press, it's still trading below our buy-up-to price.

We're not in a recession (yet). Frankly, we shouldn't be seeing this many negative-EV stocks in the current environment. I certainly don't expect them to stay so beaten down for long.

For a short time, you can still claim access to our portfolio of negative-EV biotech stocks – plus a "Watch List" of another eight that could soon be screaming "buys" – for 50% off the usual price.

Plus, we'll include nearly $1,500 in free bonuses and giveaways. Get the full details here.

This is a rare setup... and it's all because the market is being irrational. When you find those unlikely opportunities, be sure to make the most of them.

Regards,

Joel Litman

April 5, 2024

Early-stage biotechs don't make money...

Early-stage biotechs don't make money...