Inflation was all anyone could talk about in 2022 and 2023...

Inflation was all anyone could talk about in 2022 and 2023...

Now, it seems we're ready to turn the page on that narrative.

The Federal Reserve's preferred measure of inflation, the core personal consumption expenditures ("PCE") price index, has continued to cool.

Core PCE (which excludes volatile food and energy prices) hit annual growth of 2.9% in December. That's down from 3.2% in November and 3.4% in October. Headline PCE (which includes food and energy prices) remained steady at 2.6%.

This is great news heading into 2024. It's a sign that many of the risks folks were worried about, such as a wage-price spiral and hyperinflation, may not come to pass.

Regular readers know that today's economy reminds us a lot of the late 1940s – from the Fed's aggressive quantitative tightening to record-high inflation.

Today, we'll talk about how the economy's recovery after World War II also mirrors what's currently playing out...

In the late 1940s, the U.S. was emerging from the shadow of World War II...

In the late 1940s, the U.S. was emerging from the shadow of World War II...

For years, production had been geared toward the war effort. That meant there were limited consumer goods. Instead of cars, home appliances, and toys... factories were churning out weapons and military equipment.

That, combined with the government's rationing programs, led to high savings rates. In other words, there was a significant amount of cash waiting to be spent when the war was over.

Consumers were eager to put their money to work. And demand soon rose above the available supply of goods... which, in turn, drove up prices...

Inflation rates went from around 2% during the war to nearly 20% in 1946 and 1947.

However, that period of high inflation was relatively short-lived.

As inflation surged, the Fed got serious about slowing down lending and cooling off the economy. It hiked interest rates... tightened bank reserve requirements... and sold off a ton of Treasurys to control prices.

The Fed's monetary policies worked. By November 1948, inflation had fallen back to 3%. The following year, it dropped to negative 2%.

History doesn't repeat, but it does rhyme...

History doesn't repeat, but it does rhyme...

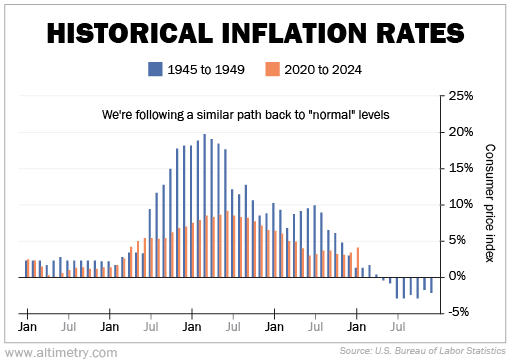

When we compare inflation trends from the late 1940s and today (2020 to present day), there are striking similarities.

The COVID-19 pandemic pretty much put a halt to economic activity worldwide. That resulted in global supply-chain issues and, in turn, a surge in demand when economies reopened.

Like in the late 1940s, this drove U.S. inflation rates higher. The consumer price index – the most commonly used measure of inflation – peaked at around 9% in June 2022. While not as extreme as the inflation peak post-WWII, that's still a significant spike from normal levels.

Take a look...

The key driver behind today's inflationary period and that of the late 1940s is an imbalance in supply and demand.

In the late 1940s, the economy adjusted as supply chains caught up and consumer spending stabilized. Inflation rates then began to fall, even flirting with deflation.

We're beginning to see a similar scenario today... Supply-chain issues are gradually resolving. Demand is normalizing. And inflation is easing.

The Fed also remains steadfast in its monetary policies. As Chairman Jerome Powell has made abundantly clear... the central bank won't lower interest rates until it's confident inflation is heading toward 2%.

This gives us reason to be optimistic... but still cautious.

This gives us reason to be optimistic... but still cautious.

Inflation remains on a downward path and may soon near target levels. That's encouraging news.

However, the resolution of post-WWII inflation also coincided with a minor recession that lasted from 1948 until 1949.

It was a brief and relatively mild contraction... but it's still a reminder that we're not out of the woods just yet.

And we should keep that in mind as we continue to navigate this post-pandemic economy.

Regards,

Rob Spivey

February 12, 2024

Inflation was all anyone could talk about in 2022 and 2023...

Inflation was all anyone could talk about in 2022 and 2023...