The Murdoch family is going through a big shake-up...

The Murdoch family is going through a big shake-up...

Anyone who tunes in to the news is probably familiar with the Murdochs. The family controls Fox (FOX) and News Corp (NWS), the Wall Street Journal, and a host of other publications in Australia and the U.K.

It's also the inspiration for Succession – a popular HBO show that highlights the brutal fight to control a global media conglomerate as the aging family patriarch slows down.

But lately, even the show's Machiavellian power plays don't compare with the real battles waged inside Murdoch's own media empire...

Murdoch filed a petition in late 2023 to amend the irrevocable family trust... and redefine the members' roles in the family business.

The 93-year-old media magnate is trying to strip three of his four children of their rights to control Fox and News Corp. And he's doing it all under a cloak of secrecy.

Today, we'll discuss the factors driving this real-life plot twist... and what it means for one of the world's biggest media companies.

Originally, the trust would have given equal voting shares to Rupert's four eldest children...

Originally, the trust would have given equal voting shares to Rupert's four eldest children...

Lachlan, James, Elisabeth, and Prudence would have shared control over the Murdoch media empire upon their father's death.

But the proposed change would give Lachlan, Rupert's oldest son, exclusive control over all the media companies.

Lachlan is already CEO of the conservative Fox News channel. And he follows Rupert's business approach to a T. James and the other children have distanced themselves from the company due to their more liberal politics.

Despite the high-profile nature of this case, all the proceedings have taken place in secret. There's no public record or docket, which is very unusual.

Media outlets like CNN, the New York Times, and Reuters have filed a petition for the court to unseal these proceedings. They argue that the public has a right to know who will control one of the world's largest and most influential media empires.

And whether you love Fox News or hate it, they have a point...

This case has massive implications for the media industry as a whole...

This case has massive implications for the media industry as a whole...

For one, it could determine if Fox sticks with its current conservative trajectory... or if it takes a different path under new leadership. The latter could prove to be very risky for the business.

Traditional media is largely dying out, but Fox has remained wildly profitable. And its conservative voice is a big part of its success.

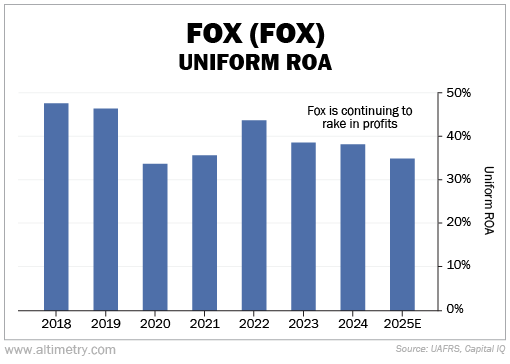

The company's Uniform return on assets ("ROA") has been above 30% since at least 2018... far beyond the 12% corporate average.

Take a look...

Fox still mints money... largely because it has consolidated media outlets around its core audience. That has transformed it into the U.S.'s top conservative media company.

To maintain that dominance, Rupert wants to preserve Fox's current voice. He believes Lachlan will do just that after he's gone... and, therefore, protect the immensely valuable business.

As the data shows, he might be right – no matter what you think of Rupert's politics.

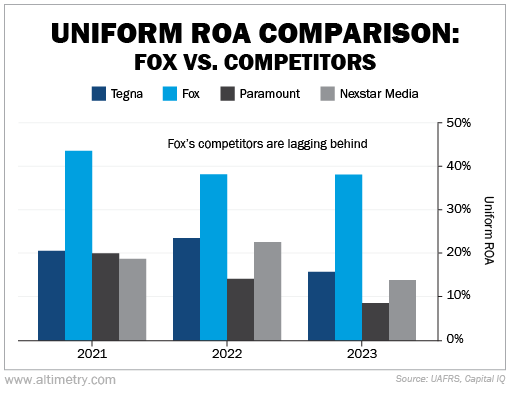

Fox isn't just performing well. It's blowing the competition out of the water. Its Uniform ROA was more than twice as high as its next-closest peer, Tegna (TGNA), in both 2021 and 2023.

Check it out...

Tegna, Paramount (PARA), and Nexstar Media (NXST) had a combined average Uniform ROA of only about 13% last year.

Bigger traditional media players, like Disney (DIS) and Comcast (CMCSA), are also lagging behind Fox... Disney's Uniform ROA is a mere 7%. Comcast's is 13%.

The bottom line is, Fox's business model works. So it's no wonder the Murdoch patriarch wants his successor to run the business based on his vision.

Fox's future hinges on its conservative base...

Fox's future hinges on its conservative base...

The numbers don't lie. Fox has built profitability by catering to its core audience. That's how it cemented itself as the leading conservative American media outlet.

If Fox strips away the politics, the numbers might suffer.

In fact, any shift in political stance risks alienating Fox's base and gutting its impressive returns... now and in the future.

Rupert has made his move. Now it's up to the judge – and the market – to decide what comes next for the company.

Regards,

Rob Spivey

October 16, 2024

The Murdoch family is going through a big shake-up...

The Murdoch family is going through a big shake-up...