In the midst of the pandemic, many wondered if Uber (UBER) could survive...

In the midst of the pandemic, many wondered if Uber (UBER) could survive...

During the height of the coronavirus, no one was going anywhere or using Uber's ride-share service. Meanwhile, the company's food delivery service Uber Eats was substandard against competitors GrubHub and DoorDash (DASH), and it was still hemorrhaging money.

Yet, in its recently reported first-quarter results, Uber is starting to demonstrate it has finally hit some level of critical mass.

Uber saw revenue grow 136% year over year, significantly exceeding expectations. Trips surged through the beginning of 2022, with rides up 18% from last year. The amount of people using its platform was also up 17%.

As the world returns to normal and people return to offices and are eager to travel, they'll start using Uber again.

Throughout the pandemic, Uber improved its food delivery service and expanded to grocery delivery as well. Even as people have returned to restaurants and grocery stores in person this quarter, Uber Eats still grew 12%.

These powerful network effects show that changes from the At-Home Revolution will carry on even as the world reopens.

However, it wasn't all great news for Uber this quarter. Despite the fundamental improvement in the business, the company lost $5.6 billion thanks to investments in other ride-sharing companies, such as Chinese company DiDi (DIDI). To grow outside of its markets, Uber has been funneling money into other ride-sharing companies, and it has come back to bite them.

The irony is, while the pandemic hurt these other ride-sharing apps Uber invested heavily in, it may have finally helped Uber achieve what it has been chasing for so long...

Uber has forever been betting on scale, and perhaps the pandemic was the final push...

Uber has forever been betting on scale, and perhaps the pandemic was the final push...

Tough market conditions accelerated the natural market process of the losers falling behind and the winners taking share.

When the app first debuted, Uber's technology was complex and hard to imitate, giving it a competitive advantage. However, over time, the technology became much simpler to imitate. This has made it easy to commoditize ride-sharing, hurting returns across the industry.

However, when the pandemic hit, the ride-sharing market crumbled because people weren't leaving their homes. The smaller companies simply ran out of money. This left Uber and Lyft (LYFT) as the main players in the field.

While one would expect a company like Uber to be crushed by the pandemic, it's surprisingly on the rise.

With less competition keeping prices low, and with tech investors starting to look for less growth and more profitability, companies like Uber have been taking steps to get profitable as fast as possible.

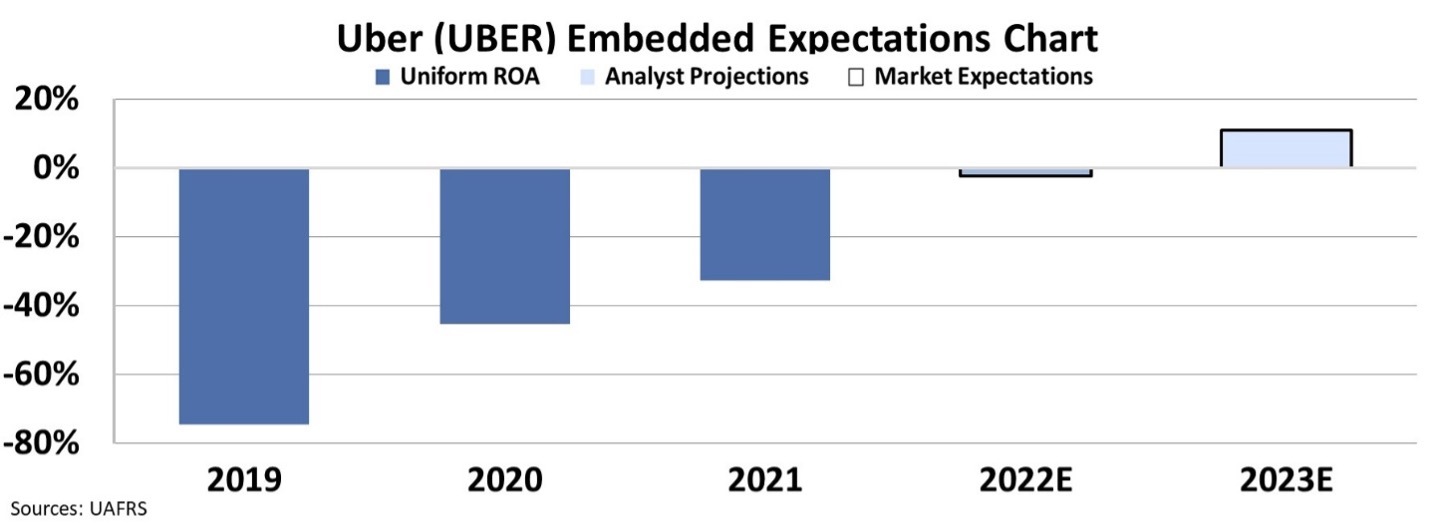

By looking at Uber's Uniform return on assets ("ROA"), we can get a better idea of the company's past performance, as well as where it's expected to go in the future.

Uniform ROA shows us that while Uber is yet to be profitable, it has seen major improvement, up from negative 75% in 2019 to negative 33% in 2021. While that's still deeply negative, analysts expect Uber might come close to breaking even in 2022. Come 2023, Uber is expected to finally turn a profit, reaching an 11% ROA.

While it has taken Uber a while to finally become profitable, things may finally be turning around for the innovative ride-sharing service.

Thanks to Uniform Accounting, we can see not only Uber's history in context, but also what the analysts covering Uber are expecting the company to do in the future. Without using the right numbers, investors would have no context to base any investment decision on, which is the first step of any investment.

Regards,

Joel Litman

May 18, 2022

In the midst of the pandemic, many wondered if Uber (UBER) could survive...

In the midst of the pandemic, many wondered if Uber (UBER) could survive...