In the summer of 2023, China's youth unemployment rate hit unprecedented numbers...

In the summer of 2023, China's youth unemployment rate hit unprecedented numbers...

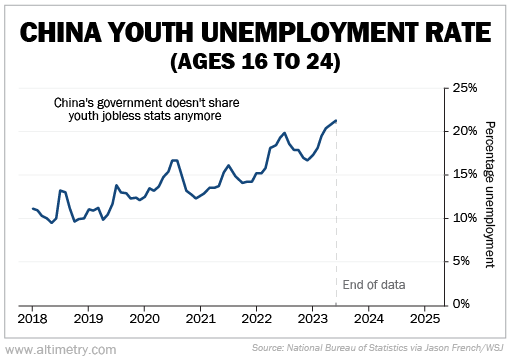

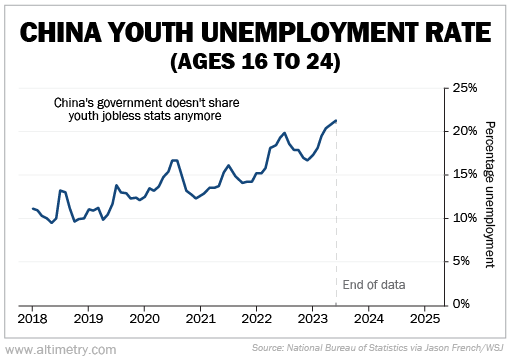

At 21.3%, it was the highest level ever recorded. Economists were shocked.

And they were shocked again a few weeks later... when the figure disappeared from the record. The Chinese government stopped publishing it entirely.

That 21.3% wasn't the only number to vanish. Data on consumer spending, local government debt, and even cremation rates suddenly disappeared.

Dozens of once-routine statistics were either "postponed" or permanently shelved. It was the government's form of damage control.

Despite the official narrative of 5% GDP growth last year, China's economy is faltering.

And beneath the surface lies an even more troubling trend... one the country's leadership would rather the world not see.

Fear is driving a dramatic shift in Chinese consumer behavior...

Fear is driving a dramatic shift in Chinese consumer behavior...

Chinese households added more than 50% to their savings balances in the past three years. It's not because they're getting richer. It's because they're bracing for the worst.

Home equity was once the cornerstone of wealth in China. Today, property values are falling in nearly every major city.

Mortgage defaults are rising. And jobs, especially for younger workers, are hard to come by.

According to research firm Gavekal Dragonomics, about 30 million people defaulted on personal loans in 2024 alone... twice as many as in 2019. And when you include overdue borrowers not yet in default, the number could climb as high as 83 million.

Roughly 1 in 14 Chinese adults now face some level of financial distress. Rising savings balances are what happens when an entire population starts losing faith in the system.

The consequences are especially severe because China has no personal bankruptcy system...

The consequences are especially severe because China has no personal bankruptcy system...

In the U.S., debt discharge offers a clean slate. But Chinese borrowers can't escape what they owe.

Instead, they remain blacklisted from air travel – and even some jobs – for life. This limbo traps Chinese consumers in a desperate cycle.

Many turn to online lending apps, which promise fast approvals and target borrowers shut out of traditional banks.

These services now finance everything from restaurant meals to school tuition. But they come at a cost, often charging interest rates far higher than credit cards.

The result is a modern-day debt spiral. Borrowers take on new loans just to repay old ones... and the state's silence only deepens the crisis.

Meanwhile, the economic data that could help outsiders assess the situation has gone dark...

Meanwhile, the economic data that could help outsiders assess the situation has gone dark...

Remember that embarrassingly high youth jobless rate from 2023? Some economists estimate the real figure was closer to 46.5%.

But there's no way to know for sure. Beijing hasn't published another number since...

Even seemingly neutral indicators like land sales, soy sauce consumption, and cremation counts have been scrubbed from public reports.

It's clear that in China, controlling the story has become more important than confronting the truth. And as we explained yesterday, that's not just an isolated political choice. Investors rely on credible economic data to make decisions.

Compared with Western economies, China's debt burden might seem modest on paper...

Compared with Western economies, China's debt burden might seem modest on paper...

But the numbers are misleading. The Chinese financial system is far less transparent than ours. (And you know from yesterday that the U.S. has its fair share of data issues.)

The Chinese government exerts such tight control over data that markets have no accurate way to assess the risk. That's a major problem for global investors.

Chinese consumption was once a pillar of global growth. That's no longer true. And it's only getting worse as credit access deteriorates.

Beijing has a lot of work to do to restore data transparency... and address the structural issues dragging down household finances.

And until then, China will remain a high-risk market – no matter what the official numbers say.

Regards,

Joel Litman

August 26, 2025

In the summer of 2023, China's youth unemployment rate hit unprecedented numbers...

In the summer of 2023, China's youth unemployment rate hit unprecedented numbers...