Just a few weeks ago, Pop Mart (9992.HK) was the hottest stock on the Hong Kong Exchange...

Just a few weeks ago, Pop Mart (9992.HK) was the hottest stock on the Hong Kong Exchange...

Its shares had skyrocketed more than 400% in one year, driven by the explosive success of a quirky line of vinyl toys.

Labubu dolls – wide-eyed, impish figurines packaged in mystery boxes – became an overnight obsession in China and across Asia.

Suddenly, everyone wanted them. The toys went global, and they were next to impossible to find. Retailers couldn't keep them stocked, so many folks ended up paying double or triple on the secondary market.

All that attention drove investors, including the retail crowd, into the stock. At its August peak, Pop Mart was worth more than $50 billion. That's more than Monopoly and Nerf maker Hasbro (HAS) and Barbie and Fisher-Price maker Mattel (MAT) combined.

Now, the story is falling apart...

In less than a month, Pop Mart has lost a quarter of its value... with nearly $13 billion in market cap vanishing since its August peak.

JPMorgan Chase also recently downgraded the stock, warning that its valuation was "priced for perfection" and dangerously exposed to a drop in demand. Pop Mart's stock saw a sharp, nearly 9% drop in a single trading day on the news.

Today, we'll show why Pop Mart's collapse is a textbook case of bubble dynamics.

The Labubu hype sent expectations soaring far beyond reality...

The Labubu hype sent expectations soaring far beyond reality...

Pop Mart's meteoric rise was built almost entirely around one toy... Labubus turned a niche toymaker into a cultural phenomenon.

We've seen this playbook many times before... Beanie Babies created a frenzy in the 1990s, and kids in the early 2000s had Silly Bandz bracelets. During COVID-19, folks turned to Funko's (FNKO) vinyl bobbleheads.

These Pop! bobbleheads are typically styled around recognizable brands like Marvel and Star Wars. Funko did great in the early COVID era... doubling revenue from $653 million in 2020 to $1.3 billion by 2022.

But like the rest of those toy fads, it didn't last long. By the end of 2022, management started warning about the coming years. Revenue slipped below $1.1 billion in 2023, and over the past 12 months, it has fallen below $1 billion.

Funko's stock is down 83% since management started warning that the fad was coming to an end.

The same thing is happening with Pop Mart.

The Labubu craze sent Pop Mart's stock to dizzying heights. But Pop Mart isn't Apple (AAPL) or Nike (NKE). It's a collectible toy company with limited product diversity and no recurring revenue model. In other words, the company only stays valuable as long as the fad continues.

More importantly, the stock was priced as if Labubu wasn't just a hit but a permanent fixture of global culture.

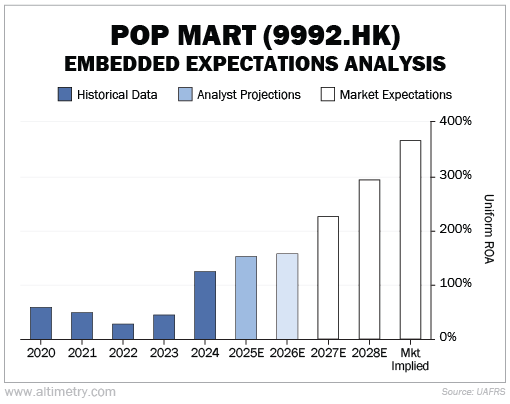

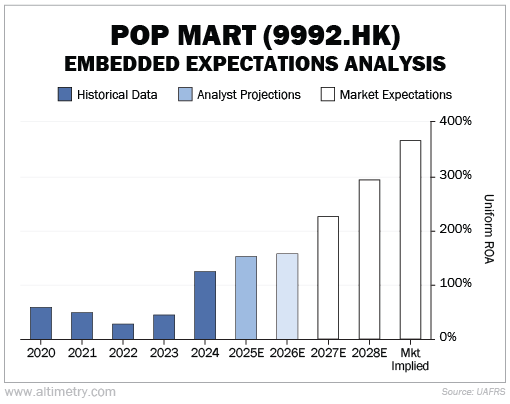

As we said a month ago in Altimetry Authority, our Embedded Expectations Analysis ("EEA") implied a Uniform return on assets ("ROA") of nearly 400% sustained indefinitely.

For comparison, companies like Meta Platforms (META) and Alphabet (GOOGL) have Uniform ROAs around 20% to 25%.

For comparison, companies like Meta Platforms (META) and Alphabet (GOOGL) have Uniform ROAs around 20% to 25%.

Now, the cracks are showing...

Labubu resale prices in Chinese marketplaces are falling. Some resellers have cut prices by more than 50%.

Even Wall Street analysts at firms like JPMorgan note the company's pipeline "lacks visibility and momentum," raising serious doubts about future growth.

The hype-driven rally is unwinding, and investors are still holding the bag...

The hype-driven rally is unwinding, and investors are still holding the bag...

Beanie Babies, Silly Bandz, and Pops! all fueled investor and collector manias... which only faded once the novelty wore off.

And none of these stories ended with a lasting recovery. Once the magic is gone, it doesn't return.

Pop Mart investors mistook a temporary trend for a sustainable business model. And now that the fantasy is unraveling, there's no moat left to protect the stock.

In short, Pop Mart may still have fans, but hype isn't a business model. Without a path to recurring growth, diversified product success, or operating leverage, this company is what it always was... a toymaker with one big hit.

Regards,

Joel Litman

October 2, 2025

Just a few weeks ago, Pop Mart (9992.HK) was the hottest stock on the Hong Kong Exchange...

Just a few weeks ago, Pop Mart (9992.HK) was the hottest stock on the Hong Kong Exchange...