Orders for the world's top chipmaker are running hot...

Orders for the world's top chipmaker are running hot...

Taiwan Semiconductor Manufacturing (TSM) reported a 61% jump in net income for the recent second quarter. That beat already-high expectations and marked its strongest growth in more than a year.

The company's forecast was even more impressive... Management raised its 2025 revenue growth outlook from the mid-20% range to 30%.

CEO C.C. Wei confirmed the reason behind this trend... Demand for the chips that power AI infrastructure keeps rising.

Taiwan Semiconductor produces Nvidia's (NVDA) most advanced chips – the ones that fuel virtually every AI model out there. And as an industry leader, its recent performance signals an important shift.

Despite a tough economic backdrop and ongoing tensions with China, Taiwan Semiconductor is doubling down to meet rising demand.

Today, we'll break down what that means for AI infrastructure as a whole... and how investors can capitalize on the next tech wave in this sector.

High-performance computing makes up about 60% of Taiwan Semiconductor's total revenue...

High-performance computing makes up about 60% of Taiwan Semiconductor's total revenue...

That's up from just 31% in 2020.

This technology includes the powerful processors used in data centers and servers – the critical infrastructure needed to build and run AI systems.

That shift is also reshaping how Taiwan Semiconductor allocates capital... The company plans to spend about $40 billion on manufacturing capacity in Taiwan this year alone. Another $100 billion is earmarked for long-term-capacity projects in the U.S.

On top of that, Taiwan Semiconductor is the only manufacturer capable of producing enough of Nvidia's H100 and B200 chips to keep up with demand.

And now, Taiwan Semiconductor is set to produce the most complex semiconductors in history – the 2-nanometer chips that will power the next wave of AI hardware.

None of that would be possible without the uptick in demand. In other words, management sees a long runway ahead... and it's preparing for it.

Yet the market doesn't grasp Taiwan Semiconductor's full potential...

Yet the market doesn't grasp Taiwan Semiconductor's full potential...

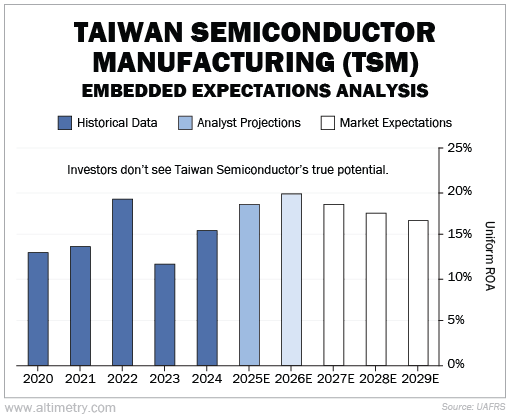

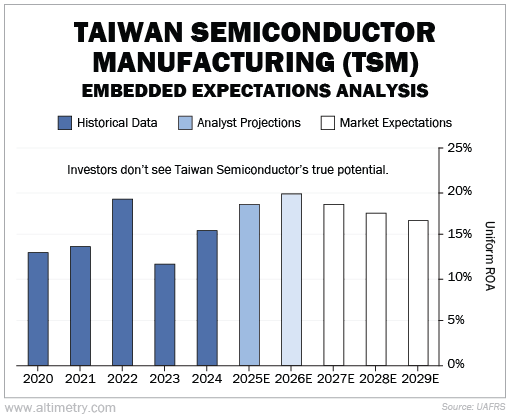

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Taiwan Semiconductor's Uniform return on assets ("ROA") has averaged around 15% over the past five years. That's a bit higher than the 12% corporate average.

Analysts expect the company's Uniform ROA to gradually increase to 20% by 2026. Yet, investors expect it to stabilize around 17% by 2029. Take a look...

The bottom line is, Taiwan Semiconductor is very cheap right now. But with strong AI tailwinds behind it, the company has significant upside potential.

The AI buildout is far from finished...

The AI buildout is far from finished...

Chip technology is evolving... and sales are soaring. Taiwan Semiconductor is stepping up to meet that demand by expanding manufacturing on a global scale.

After all, it's the chip supplier. It's poised to win no matter whose chips are most sought-after.

Of course, the AI boom impacts a range of businesses. These include chip designers like Nvidia, server manufacturers, and even utilities.

To lock in long-term gains, investors need to understand how all of them contribute to the AI backbone... and the new wave of technology.

Although it's currently undervalued, Taiwan Semiconductor is a big part of that story. The market will reward investors who see, and capitalize on, its true potential.

Regards,

Joel Litman

August 7, 2025

Orders for the world's top chipmaker are running hot...

Orders for the world's top chipmaker are running hot...