When your taxi driver gives you a stock tip, you know you're at the market peak...

When your taxi driver gives you a stock tip, you know you're at the market peak...

It's commonly accepted on Wall Street that when everyone is talking about stocks, it's time to get out. It's a sign that sentiment has gotten too hot and we're due for a sell-off.

The bad news used to come when a taxi driver, a shoe shiner, or a barber started giving investment advice. These days, the same can be said for social media influencers.

For the past few years, everyone under the sun seemed to be grifting for crypto investments. And now, they're starting to get into trouble... Lawsuits are popping up for celebrities involved with failed crypto exchange FTX, including athletes like Tom Brady and Shaquille O'Neal.

Even actress Lindsay Lohan has tweeted about which new coins she liked. (Regulators are now suing her and seven other celebrities for not disclosing that the endorsements were paid ads.)

What many folks don't realize is that it wasn't limited to crypto. Influencers and celebrities like socialite Kim Kardashian, tennis champion Serena Williams, and rapper Jay-Z were pushing private-equity ("PE") and venture-capital ("VC") investments just as hard.

Now, interest rates are soaring. Debt isn't as cheap and accessible as it once was. And those once-popular markets are crumbling.

We wrote to you last Wednesday about the big problems facing "vampire squid" Blackstone (BX) – a shadow bank that's not being regulated like a bank. With operations in many of the riskiest parts of the market, Blackstone will likely face a reckoning sometime soon.

Today, we'll delve deeper into the tangled web of Blackstone's offerings. As we'll explain, the company is struggling under the weight of its PE and VC investments... and it has found a way to shift the burden onto investors.

We're not the only ones who think the tide is turning for PE and VC...

We're not the only ones who think the tide is turning for PE and VC...

Just ask Nate Koppikar, who runs short-focused hedge fund Orso Partners. He has been watching as these media personalities are forced to take responsibility for their shoddy investment advice.

Koppikar believes this is a sign that the bubble is cooling off... and the proverbial lights are finally coming on in the bar at the end of the night. He has been actively betting that we're past the market peak. And he's predicting that PE and VC will be at the downturn's epicenter.

Many hedge funds got into the PE and VC investing world in the most recent bull market. Big investors like Tiger Global Management dove head-first into private investments to try to turbocharge their returns.

Now, they're living with the pain of illiquid assets... and all their investors know it.

These hedge funds can't sell their PE and VC investments easily. At some point, they might have to sell some of their more liquid equity holdings to pay for redemptions.

That's why Orso has been shorting the overvalued public stocks of these funds. Koppikar is confident they'll continue tumbling, too.

And as the world's biggest alternative-investment manager, Blackstone is up to its elbows – or rather, tentacles – in PE and VC...

And as the world's biggest alternative-investment manager, Blackstone is up to its elbows – or rather, tentacles – in PE and VC...

The PE giant has already been having problems. Its stock has been struggling for more than a year. It's down 35% since the beginning of 2022.

Take a look...

Blackstone is clearly having a tough time as the PE and VC environments take a turn for the worse.

And yet, the stock is holding up much better than it should... because the vampire squid has figured out how to make some of these toxic investments other people's problem.

After the Great Recession, regulators cracked down on banks. New rules mandated that they keep a portion of the loans they make on their balance sheets. That way, if the loans went bad, the banks couldn't push them all off onto someone else. They'd feel the pain as well.

The goal was to make banks into more responsible lenders. Unfortunately, as we explained last week, Blackstone is not regulated like a bank. And it has found some creative ways to bypass those bank rules.

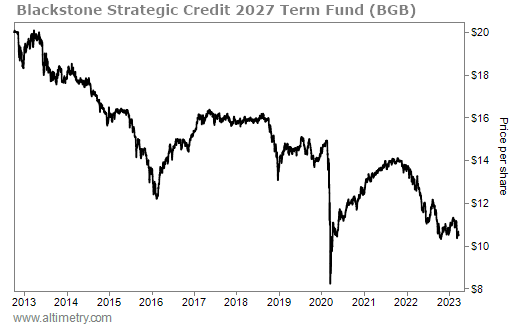

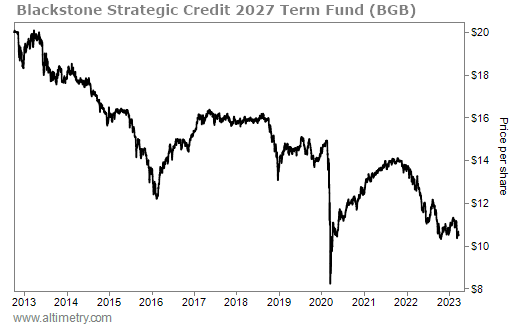

One of those workarounds is the Blackstone Strategic Credit 2027 Term Fund (BGB)...

One of those workarounds is the Blackstone Strategic Credit 2027 Term Fund (BGB)...

Anyone can invest in this publicly traded fund. Blackstone uses it to invest in loans to companies that are going through PE deals.

The concept is simple. When other PE players like Carlyle Group (CG) or KKR (KKR) are looking for debt funding for transactions, Blackstone steps up to help... with other people's money. It uses BGB to pawn that debt onto uninformed investors.

After it makes the loans, Blackstone could choose to sell that debt to qualified institutional and high-net-worth investors through its normal funds. Instead, it packages this debt up and dumps it on the general public.

Blackstone is essentially foisting these loans onto other people, as opposed to the investors who made the loans in the first place. And those investors are protected from their own losses.

That's wild. At least, it would be... if it were any company but Blackstone.

With a deal like this, it's no surprise that the price of the fund has steadily tanked. It's down nearly 50% since inception.

Check it out...

The fund pays a healthy dividend. Its current dividend yield is 8.6%. And despite that, it has still only earned investors 2% per year since late 2012.

That's an abysmal performance, even for a debt product.

Most investors would be disappointed, to say the least. Not Blackstone... It collects a 1% annual fee from investors to manage BGB.

Much of the public doesn't grasp the risk Blackstone is taking on other people's behalf...

Much of the public doesn't grasp the risk Blackstone is taking on other people's behalf...

As small, private-equity-owned companies fail to pay their debt and grapple with rising interest rates, investors are being punished. BGB has dropped fast since late 2021. It's down 25% already... and will likely fall more from here.

All the while, Blackstone continues to rake in the cash from BGB.

We'll keep diving into Blackstone's web of operations in the coming weeks. So be sure to keep checking back.

For now, we'd still recommend staying away from PE exposure altogether. It's not the safe haven it's cracked up to be. BGB is only the tip of the iceberg... Things are getting a lot worse beneath the surface.

Watch out for more warning signs in the PE space in the coming months. And avoid taking unnecessary risks that others create for their own good.

Blackstone's fat dividend payout should be a red flag to investors. When a company as savvy as Blackstone is offering yields this juicy, you need to ask yourself why.

Regards,

Joel Litman

March 29, 2023

When your taxi driver gives you a stock tip, you know you're at the market peak...

When your taxi driver gives you a stock tip, you know you're at the market peak...