Liberation Day marked one of the sharpest pivots in investor sentiment this year...

Liberation Day marked one of the sharpest pivots in investor sentiment this year...

The White House's sweeping tariffs caught both America's allies and investors off guard. They were broader and much more aggressive than most expected... even hitting long-standing trade partners in Europe and Asia.

That frustrated a lot of folks, and it sparked fear among international investors...

If the U.S. was willing to weaponize trade policy this aggressively, then American assets – long viewed as the bedrock of global portfolios – suddenly looked much less appealing.

It became the "sell America" trade.

Foreign investors turned into net sellers of both U.S. Treasurys and equities. The Apollo Academy estimates that they pulled roughly $50 billion from U.S. markets in April.

By some measures, it was the largest monthly divestment from U.S. capital markets in more than a decade.

However, as we'll cover today, the sell America trade seems to have fallen apart almost as quickly as it formed...

Foreign investment in the U.S. market has come roaring back...

Foreign investment in the U.S. market has come roaring back...

According to research from Apollo, foreign investors pulled capital out of U.S. assets almost across the board after Liberation Day.

U.S. Treasurys and equities both experienced net outflows... a rare occurrence that typically signals broad concern about America's economic outlook.

Yet, by May and June, foreign capital was surging back into the U.S. market.

May alone saw nearly $350 billion in inflows. That was followed by another $200 billion in June. In other words, the so-called "sell America" trade lasted basically a month.

Not to mention, fund managers are getting increasingly more bullish on the U.S. market.

Even prior to President Donald Trump's Liberation Day announcement, global fund managers were extremely tentative about U.S. stocks.

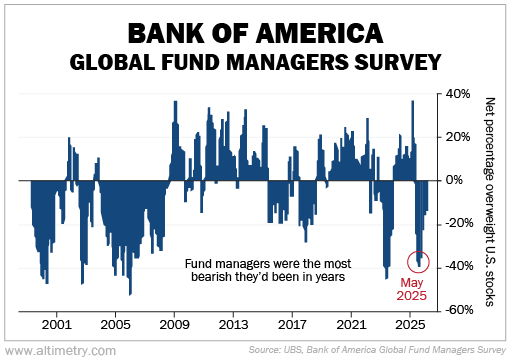

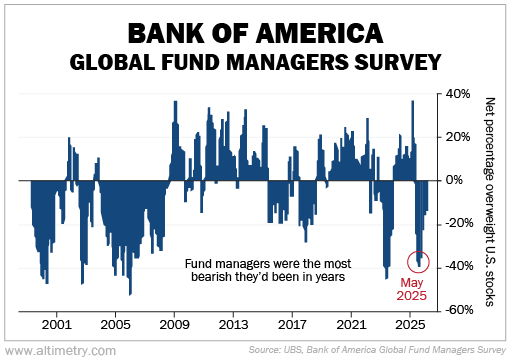

In March, Bank of America's Global Fund Manager Survey – which tracks how overweight or underweight fund managers are to U.S. stocks – showed that managers were ditching U.S. stocks at record levels.

Fund managers were already 23% underweight U.S. stocks by March. That fell to 36% in April and cratered to 38% by May.

This marked the fifth-lowest weighting of U.S. stocks since the late 1990s...

Typically, it takes several months (if not years) for a weighting this low to recover to neutral or overweight.

However, fund managers have already begun steadily buying back into the U.S. market.

Last month, fund managers were underweight U.S. stocks by only 16%. Earlier this month, they were underweight by just 14%.

This has helped fuel the U.S. stock market's recent rally...

This has helped fuel the U.S. stock market's recent rally...

The S&P 500 Index is up 34% from its Liberation Day low, thanks in no small part to the unraveling of the sell America trade.

That said, despite how fast investors have bought back into U.S. stocks, they're still underweight the U.S. market.

But given how central American companies are to the AI-driven tech boom, we expect investors to keep plowing back into U.S. stocks as they have every month since April.

In sum, "sell America" was short-lived. Since May, we've started to see more of the typical "buy America" mentality.

And that buying activity has the potential to drive the U.S. market for months to come.

Regards,

Joel Litman

September 30, 2025

Liberation Day marked one of the sharpest pivots in investor sentiment this year...

Liberation Day marked one of the sharpest pivots in investor sentiment this year...