Strategy (MSTR) was once known as the first public company to go all-in on bitcoin...

Strategy (MSTR) was once known as the first public company to go all-in on bitcoin...

This was back in 2020. CEO Michael Saylor transformed the business into a kind of shadow exchange-traded fund ("ETF"). He issued debt and equity to pile bitcoin onto Strategy's balance sheet.

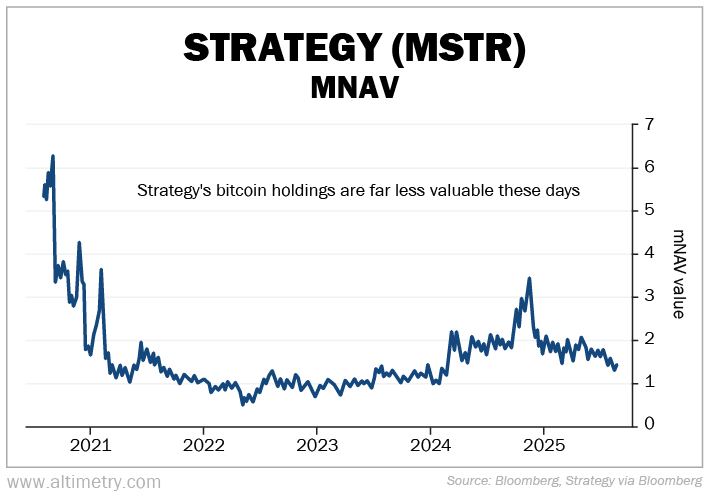

The "crypto treasury" model worked well for a time. At its peak in 2020, Strategy's market value was 6 times that of its bitcoin per share – a figure known as market net asset value ("mNAV").

Investors believed Strategy could unlock greater value through leverage, hype, and savvy treasury moves.

But that's not the case anymore. Shares of Strategy slid 16% in the first half of October.

It's a sharp reversal for a company that once acted as a bullhorn for bitcoin believers.

And as we'll explain today, this isn't a buy-the-dip opportunity.

Strategy's collapsing mNAV is a warning about the entire crypto treasury concept...

Investors are paying less and less for Strategy's stock versus the crypto it holds...

Investors are paying less and less for Strategy's stock versus the crypto it holds...

The shift reflects more than just pessimism about Strategy itself. The market may be done paying up for "crypto treasurys" altogether.

While Strategy was the first to embrace this model, it wasn't the last. Today, public and private companies hold more than $108 billion worth of bitcoin... nearly 5% of total supply.

Until recently, Strategy was the poster child for the idea that corporate stock can act as a bitcoin multiplier.

But that multiplier is fading fast.

The company's mNAV peaked around 6.3 in late 2020... before crashing to 0.6 by mid-2022. President Donald Trump's administration's enthusiasm toward bitcoin adoption fueled a small, short-lived recovery.

And since then, Strategy's mNAV has declined to 1.4. Take a look...

Investors are no longer willing to pay a premium for someone else to manage their crypto. They're simply pricing in the coin count.

Strategy is trying everything to impress investors...

Strategy is trying everything to impress investors...

Earlier this month, it attempted to raise fresh capital via preferred shares. (Preferred shares offer similar stock returns to common stock, plus a guaranteed dividend.)

These types of moves are designed to avoid diluting common shareholders. But demand was weak. The offering raised only $47 million... far below the $500 million-plus offering it sold earlier this year.

The recent offering was also supposed to raise $500 million. So to bridge the gap, the company had to backtrack and issue common stock anyway.

And that spooked investors, sending mNAV even lower.

This is the core danger of the crypto treasury model. When mNAV compresses, every dollar raised buys fewer coins. Future performance becomes weaker. And further dilution is even more painful.

The market just has better options. The approval of spot bitcoin ETFs in the U.S. means anyone can gain direct exposure to bitcoin. And they can do so with none of the accounting gymnastics involved in understanding mNAV... or needing to trust another company's promises.

And unlike Strategy, ETFs hold a stable number of coins. So the price per share only moves based on the price of bitcoin.

The market doesn't need crypto proxies anymore...

The market doesn't need crypto proxies anymore...

For years, investors were willing to pay a multiple for what was pretty much just packaged exposure. But with the rise of ETFs, easier custody, and broader institutional access, that wrapper has lost its luster.

Strategy is now just one of many ways to gain crypto exposure. It's arguably one of the most expensive ways.

And its mNAV collapse is a repricing of the business model itself. This isn't a buying opportunity.

Strategy helped usher in an era of balance sheets as bitcoin bulls. But its falling mNAV shows just how quickly that model can flip from premium... to penalty.

Regards,

Joel Litman

October 28, 2025

Strategy (MSTR) was once known as the first public company to go all-in on bitcoin...

Strategy (MSTR) was once known as the first public company to go all-in on bitcoin...