Amazon's latest move has the tech world buzzing...

Amazon's latest move has the tech world buzzing...

And for once, it's not about AI. At least, not directly...

Last month, Amazon (AMZN) shocked the industry by announcing that all corporate employees must return to the office five days a week in January.

For a tech giant that had previously embraced a hybrid model, this shift seems drastic.

Employees are already voicing concerns. They see it as a rollback of the flexibility that has become the norm across the tech world. Amazon's leadership argues its culture of speed and innovation thrives in the office.

Today, we'll break down why Amazon is committed to this path... and what this might mean for the company's future growth.

Amazon's decision isn't just about filling seats – it's about sparking the 'next big thing'...

Amazon's decision isn't just about filling seats – it's about sparking the 'next big thing'...

This is a company that has always approached its workforce differently, with an emphasis on focus and efficiency over perks and lavish campuses.

Unlike peers like Google parent Alphabet (GOOGL) or Facebook owner Meta Platforms (META), Amazon keeps its culture rooted in fast-paced execution.

CEO Andy Jassy says being together in person helps maintain the high-energy culture that led to breakthroughs like Amazon Web Services ("AWS").

Some folks also argue this is a cost-driven decision... and they may have a point.

With everyone back in the office, Amazon could see higher productivity from face-to-face work. Amazon could also reduce headcount without layoffs, as some people will choose to leave the company rather than return to in-person work full time.

It's a twofold strategy – generating higher productivity while keeping costs under control.

But the market seems pessimistic about what this could mean for Amazon's returns...

But the market seems pessimistic about what this could mean for Amazon's returns...

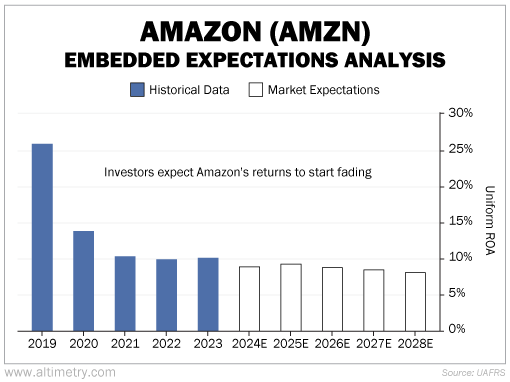

We can see this using the Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows.

We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Amazon has generated returns of about 10% or higher for years. But at today's prices, investors are treating the company as if its growth will taper off... with Uniform return on assets ("ROA") expected to fall below 10%.

Take a look...

The return-to-office move could drive significant productivity gains... or spark the next AWS-level breakthrough.

If that happens, investors' conservative estimates could prove too low.

Amazon is returning to the formula that fueled its greatest successes...

Amazon is returning to the formula that fueled its greatest successes...

Its bold mandate isn't a step backward. It's a bet on what has worked before.

By bringing everyone back under one roof, the company is aiming for the type of high-level teamwork that turns ideas into profit engines.

And for investors, that could mean a significant boost to returns... as Amazon reaps the rewards of a tightly managed, innovation-driven strategy.

Regards,

Joel Litman

October 29, 2024

Amazon's latest move has the tech world buzzing...

Amazon's latest move has the tech world buzzing...