Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below to learn about a little-known industry enabling the AI revolution...

The nation's next energy race is already underway...

The nation's next energy race is already underway...

Across the mid-Atlantic, wholesale electricity prices are up more than 250% since 2020.

The PJM Interconnection power network – which serves 13 states, from Illinois to New Jersey – added nearly $10 billion in extra consumer costs last year.

And in Baltimore, where our parent company is based, average household electricity bills have jumped nearly 80% in just three years.

Power-hungry data centers have sent energy demand skyrocketing... and consumers are footing the bill.

But it's not an even divide. In parts of the Midwest and Texas, which have abundant natural gas reserves, power still trades for cheap – or in some cases, negative – prices.

The country is splitting into two very different energy economies, revolving around one key commodity.

And a little-known side of the industry dictates just how much natural gas we can rely on.

All these new data centers are pushing grids to the limit...

All these new data centers are pushing grids to the limit...

U.S. electricity demand was flat for more than a decade. But now, it's climbing again... and fast.

Consulting firm ICF expects total consumption to jump roughly 25% by 2030. That would be the sharpest rise since the 1990s.

Data centers alone could triple their power draw by 2035, accounting for nearly half of new load growth this decade.

Regular readers know natural gas is our best near-term option for dealing with that extra demand. U.S. production outpaces every other country. And it's a relatively cheap energy source.

No wonder utilities are racing to add new capacity. Developers have proposed about 26 gigawatts of additional gas-fired generation through 2028 – double last year's pipeline.

In short, natural gas will power more new data centers than any other energy source.

Beneath the surface, one overlooked industry is powering the AI revolution...

Beneath the surface, one overlooked industry is powering the AI revolution...

Siemens Energy (SMNEY), GE Vernova (GEV), and Mitsubishi Heavy Industries (MHVIY) control more than 70% of the world's gas-turbine supply.

These turbines are the core engines of natural gas power plants. They convert gas combustion into the electricity that keeps data centers running.

Turbine factories are booked years in advance. GE Vernova is already negotiating orders into the 2030s. Mitsubishi Heavy Industries is doubling its turbine capacity to catch up with soaring demand.

And even though these companies are ramping up quickly, the AI boom is near-insatiable.

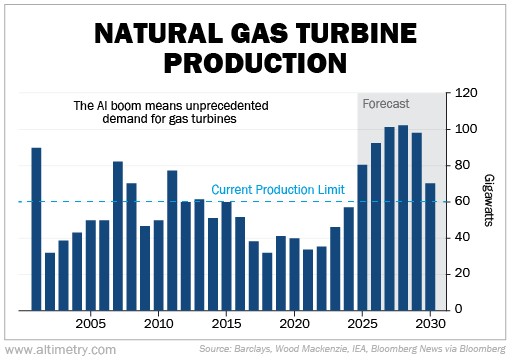

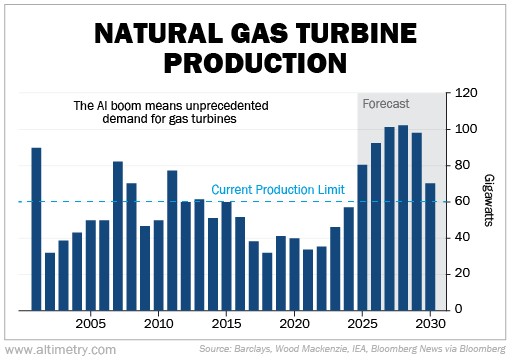

Demand for gas turbines is typically below the industry's production limit. It has only spiked above capacity a handful of times since 2001.

But demand is expected to outstrip supply starting this year... and that trend is set to last through the rest of the decade.

Take a look...

Customers are lining up to get turbines as fast as possible. As long as demand stays high, turbine makers will be sitting pretty.

All three of the major gas-turbine makers are blasting past the market this year...

All three of the major gas-turbine makers are blasting past the market this year...

GE Vernova is up 87% versus 13% for the S&P 500. Mitsubishi Heavy Industries is close to doubling. Siemens has already doubled... up an impressive 135% this year.

It's true that other sources of energy, like solar and nuclear, are coming on line. But it's a slow process. We're years away from those options posing a threat to natural gas.

And in the meantime, these industry titans are just getting started.

Regards,

Joel Litman

October 17, 2025

P.S. We'll dive deeper into the gas-turbine industry in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

The nation's next energy race is already underway...

The nation's next energy race is already underway...