After years of pent-up demand, the gold rush around weight-loss drugs is entering a new phase...

After years of pent-up demand, the gold rush around weight-loss drugs is entering a new phase...

Companies are restocking glucagon-like peptide-1 (GLP-1) products and the U.S. Food and Drug Administration ("FDA") is stamping out counterfeit drugs.

Novo Nordisk (NVO) – one of the pharmaceutical powerhouses in the GLP-1 movement – is also doubling down...

It's slashing prices and inking exclusive deals to expand access to these medications. That includes a pivotal partnership with CVS Health's (CVS) pharmacy benefit manager Caremark.

Regulators are also pulling the plug on compounding pharmacies, which offered drug knockoffs when supply was tight.

In other words, the GLP-1 market is evolving... and Novo Nordisk is seizing control. Yet, the market doesn't see its full potential.

Today, we'll explain why the market is mispricing Novo Nordisk's future... despite being one of the strongest players in the weight-loss-drug boom.

The drug-pricing war is unlocking a wave of new demand...

The drug-pricing war is unlocking a wave of new demand...

Just a few months ago, patients had to fight to get their hands on injectable GLP-1 drugs like Novo Nordisk's Wegovy.

This opened the door to copycats – legally compounded versions that skirted the high prices of original brands.

That door is now slamming shut.

The FDA no longer permits compounded GLP-1 drugs when branded versions are well stocked. This is a big win for companies like Novo Nordisk.

The pharmaceutical leader is finally regaining its pricing power. And that's laying the foundation for its next growth phase...

Health plans that use CVS Caremark will now offer Wegovy at a discounted rate. For millions of Americans, that could be the difference between filling a prescription... and not.

And as compounded versions disappear, many patients are reverting to branded names.

Novo Nordisk is becoming the default option for a massive segment of the market...

Novo Nordisk is becoming the default option for a massive segment of the market...

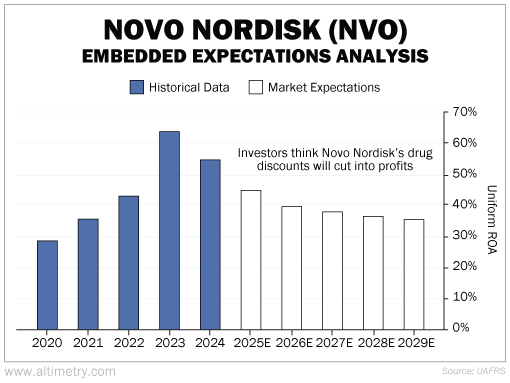

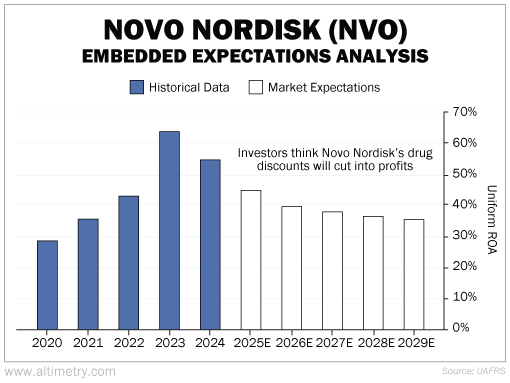

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Between 2020 and 2023, Novo Nordisk's Uniform return on assets ("ROA") jumped from 29% to 64%. And yet, investors expect its Uniform ROA to fall back to 35% by 2029. Take a look...

The company achieved the same Uniform ROA in 2021 – the year it released Wegovy. In other words, investors believe the GLP-1 boom is nearing its peak.

But that's not the case... An oral version of Wegovy is working its way through the FDA pipeline. And if approved, it could be a game changer for Novo Nordisk.

In time, all these tailwinds could supercharge the company's profitability...

In time, all these tailwinds could supercharge the company's profitability...

Yes, the GLP-1 adoption cycle is evolving. But lower prices, stricter regulations, and new drug development are clearing the field for Novo Nordisk.

The company leads the industry in distribution and pricing, and its oral drug is nearing approval.

Yet, the market is still treating this like the end of Novo Nordisk's story. In reality, it's the beginning of a new chapter.

The company remains one of the best opportunities in the multidecade weight-loss-drug megatrend.

Regards,

Joel Litman

May 22, 2025

After years of pent-up demand, the gold rush around weight-loss drugs is entering a new phase...

After years of pent-up demand, the gold rush around weight-loss drugs is entering a new phase...