Zero-interest loans are piling up, and so are the late payments...

Zero-interest loans are piling up, and so are the late payments...

American consumers are using the "Buy Now, Pay Later" ("BNPL") option for nearly every purchase these days... from laptops to lunch.

Fintech companies like Affirm (AFRM) and Klarna pitched it as a flexible, zero-interest payment solution back in 2012.

And at first, it seemed to work... The BNPL option boosted consumer spending by up to 26% per transaction. But now, cracks are starting to form.

Klarna, one of the biggest BNPL providers, just reported a 17% year-over-year ("YOY") rise in credit losses. Moreover, the Consumer Financial Protection Bureau ("CFPB") found that most BNPL users have risky credit profiles.

As households experience more financial strain, this could be the start of a new credit crisis.

Today, investors are ignoring mounting default risks in the BNPL sector... and that's especially dangerous for public players like Affirm.

BNPL lenders are brushing off warning signs even though defaults are quietly surging...

BNPL lenders are brushing off warning signs even though defaults are quietly surging...

Klarna claims that defaults make up a "tiny share" of total loans. And Affirm insists there are "no signs of stress" among its borrowers.

The reality, though, is very different. BNPL transactions in 2023 topped $75 billion in the U.S. And folks who used this payment option were often already in debt.

These loans may be interest-free... but they're not risk-free.

Julie Margetta Morgan, president of the Century Foundation think tank, noted that many Americans have turned to BNPL services as a temporary fix... on top of their existing debt.

The CFPB's latest data shows that nearly two-thirds of BNPL borrowers have some form of subprime credit. And BNPL lenders approved 78% of their loan applications.

Additionally, 63% of BNPL borrowers had at least two concurrent loans. And 33% had acquired BNPL loans from multiple providers.

Klarna's rising credit losses and Affirm's expanding loan book (which is up 36% YOY) are both warning signs.

With delinquencies climbing and the rollback in regulatory oversight (including within the CFPB) under President Donald Trump's administration, BNPL players are flying into a storm without any radar.

Yet the market is pricing in high profitability for these companies...

Yet the market is pricing in high profitability for these companies...

Affirm is the only major public BNPL lender. But it hasn't generated a single year of positive operating income since going public in 2021. Still, investors seem convinced that the company will soon turn things around.

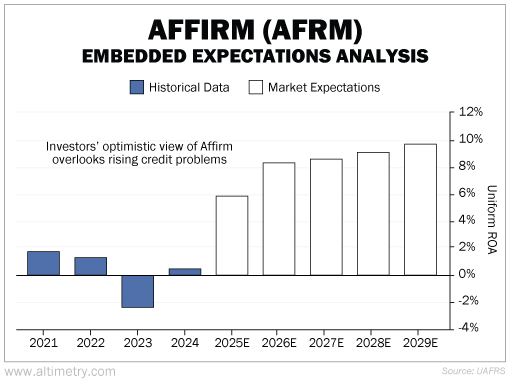

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Affirm's Uniform return on assets ("ROA") has been far below its cost of capital since 2021, ranging from negative 2% to 2%.

Yet the market expects the company's Uniform ROA to improve significantly over the next two years, reaching 8% by 2026. Investors think returns will even hit 10% by 2029. Take a look...

In other words, the market expects Affirm to go from losing money to churning out profits by 2025... and keep improving from there.

Right now, the consumer-debt environment is still very risky...

Right now, the consumer-debt environment is still very risky...

BNPL lenders are approving borrowers who are already stretched thin. And Affirm's projected Uniform ROA doesn't reflect that danger.

As more people miss payments and regulations loosen, the fallout could be severe.

Affirm investors won't be the only ones who suffer, either... Stores, credit-card issuers, and the broader economy could all feel the effects.

What started off as a consumer-friendly tool to split up purchases could turn into the next big consumer-credit mess.

The bottom line is, investors should be skeptical of companies that rely on fragile borrowers to keep growing.

Regards,

Rob Spivey

June 25, 2025

Zero-interest loans are piling up, and so are the late payments...

Zero-interest loans are piling up, and so are the late payments...