Japan's Nippon Steel (5401.T) acquired U.S. Steel (X) for $15 billion last week...

Japan's Nippon Steel (5401.T) acquired U.S. Steel (X) for $15 billion last week...

And it wasn't the usual high-profile business deal.

The merger handed the U.S. government a "golden share" – a special type of equity that provides veto power over key business decisions.

It's practically unheard of in American industrial policy. Unlike typical public shareholders, the government won't need a majority stake to exert control over U.S. Steel.

That means it can influence board appointments, oversee production, and intervene in strategic issues... all without owning any part of the company.

The problem is, golden shares – along with growing government intervention – may distort the market and harm investors.

Washington is exerting more control over corporations...

Washington is exerting more control over corporations...

Back in August, it was clear that the U.S. was entering a new age of industrial policy. That began to take shape with the U.S. Steel sale and its golden shares.

These shares are designed to protect national interests. They're often used in countries like Brazil, China, and the U.K. to maintain sovereign control over strategic assets. They make sense during economic crises, but they can also damage healthy market competition.

It's a form of state-directed capitalism, which the U.S. has long discouraged. But times are changing...

Right before President Donald Trump took office, the Biden administration blocked the U.S. Steel deal over security concerns. The Trump administration later approved the merger, largely due to the golden-share setup.

The last such deal took place in 1997, when Boeing (BA) acquired fellow aerospace manufacturer McDonnell Douglas...

The last such deal took place in 1997, when Boeing (BA) acquired fellow aerospace manufacturer McDonnell Douglas...

At the time, the government felt it wouldn't harm competition. Yet Boeing became the U.S.'s de facto aerospace monopoly.

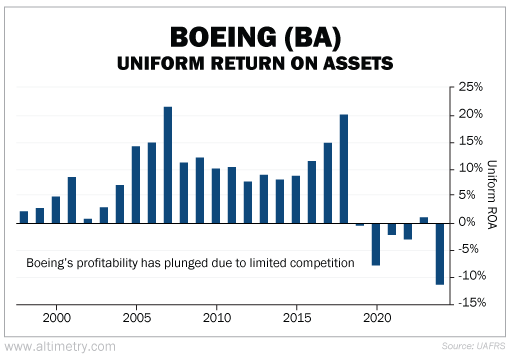

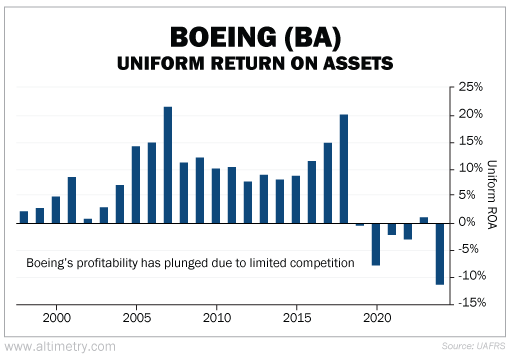

Overall, the deal didn't work out as expected. We can see this through Boeing's Uniform return on assets ("ROA")...

The company's Uniform ROA was just 2% in 1998, before rising to 9% in 2001. It fell to near-zero in 2002 due to the September 11 attacks.

Boeing then strengthened its market position and generated strong profits... Between 2005 and 2018, the company's Uniform ROA ranged from 8% to 22%.

However, it plunged to mostly negative levels between 2019 and 2024 due to various plane crashes and equipment malfunctions. Take a look...

Boeing has continued operating as a protected monopoly in the U.S. aerospace market. As a result, its profitability will likely continue to fall.

Golden shares blur the line between government oversight and private business...

Golden shares blur the line between government oversight and private business...

They replace competition with complacency. They favor insiders over innovators. And they set the stage for operational decay.

We've already seen this play out with Boeing... Without competitive pressure, its efficiency, innovation, and returns have all deteriorated.

The move toward state-directed policy could erode market efficiency... and damage long-term returns.

Investors can't afford to ignore this signal.

Regards,

Rob Spivey

June 26, 2025

Japan's Nippon Steel (5401.T) acquired U.S. Steel (X) for $15 billion last week...

Japan's Nippon Steel (5401.T) acquired U.S. Steel (X) for $15 billion last week...