AT&T (T) pulled off one of the largest telecom acquisitions in recent memory...

AT&T (T) pulled off one of the largest telecom acquisitions in recent memory...

In August, the company made a deal to buy certain wireless spectrum licenses from EchoStar (SATS) for $23 billion in an all-cash deal. These licenses cover more than 400 markets across the U.S. The deal strengthens its bandwidth nationwide.

Spectrum is the lifeblood of wireless carriers. The more airwaves you control, the more data you can transmit... and the faster your service can be. That's why Elon Musk's Starlink and T-Mobile (TMUS) were both reportedly bidding for the same licenses.

This seems like a big win for AT&T... And yet, so far, EchoStar shareholders are the ones who are winning out.

EchoStar's stock has more than doubled since the deal was announced. AT&T's stock is down roughly 10%.

It turns out, winning the 5G spending war may not be in AT&T's best interest...

Telecom giants have spent the past seven years pouring $190 billion into 5G...

Telecom giants have spent the past seven years pouring $190 billion into 5G...

The pitch was simple. 5G can carry more information than older network generations. That means it can offer users faster and more reliable connections across the board.

Not to mention, this is the first generation of wireless communication built to connect more kinds of devices than just cellphones.

It was clear to telecom companies that once 5G launched to the public, older networks would be basically useless.

Yet despite the massive investment, the billions of dollars spent on 5G haven't translated into telecom companies being able to charge more for their services.

You see, 5G is much better than older networks. But all of the telecom giants offer the same service.

Today, AT&T, Verizon Communications (VZ), and T-Mobile all offer nearly indistinguishable coverage... meaning 5G has effectively become a commodity.

Consumers are getting better service. But they're not paying more for it. And telecom providers are stuck investing heavily just to stay competitive.

That's brutal for profitability...

That's brutal for profitability...

Spending billions just to keep up with your competition isn't a winning strategy. We're seeing that play out in AT&T's profitability.

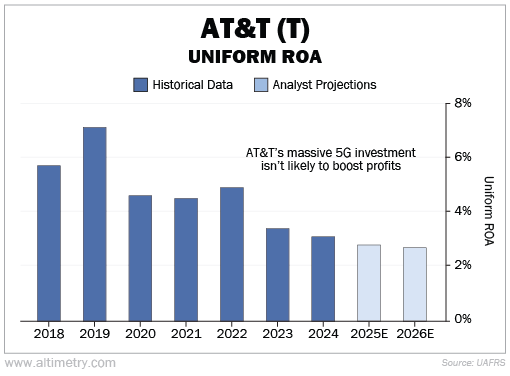

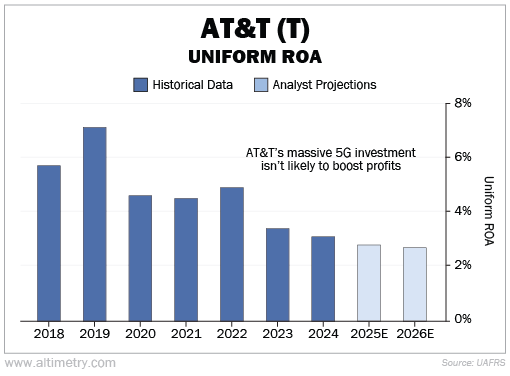

Ever since the 5G investment cycle kicked off, AT&T's Uniform return on assets ("ROA") has fallen. It peaked at 7% in 2019... fell to roughly 5% through 2022... and has been just 3% for the past two years.

And as the Altimeter shows, it's expected to fall below 3% within the next two years...

The corporate average Uniform ROA is roughly 12%... meaning AT&T is falling far behind.

Don't bet on a sudden turnaround...

Don't bet on a sudden turnaround...

AT&T may have outspent its rivals in acquiring those much-desired 5G spectrum licenses. But without any path to raising prices, those airwaves won't make a difference in its profits.

All three major carriers have strong nationwide networks... and consumers aren't paying more for the faster services they're already getting.

As long as AT&T keeps digging itself deeper into 5G, its stock is likely to suffer.

Regards,

Joel Litman

October 15, 2025

AT&T (T) pulled off one of the largest telecom acquisitions in recent memory...

AT&T (T) pulled off one of the largest telecom acquisitions in recent memory...