If Disney (DIS) needs a new blockbuster script, it doesn't have to look beyond its own boardroom...

If Disney (DIS) needs a new blockbuster script, it doesn't have to look beyond its own boardroom...

The entertainment giant has had a hectic few years.

Longtime CEO Bob Iger was finally supposed to retire after handpicking Disney veteran Bob Chapek to be his successor. But just as Chapek took over, COVID-19 forced the company to close its parks. It had to rely heavily on its new streaming service, Disney+.

While Disney+ subscriber numbers climbed, the economics weren't working. By 2022, the service had more than 160 million subscribers... and Disney+ was losing nearly $4 billion annually.

Disney's stock took a roughly 40% hit during Chapek's tenure. That's when Iger came out of retirement and took back his spot at the helm. But shares are still down around 4% since he returned.

Folks keep on hoping Iger can turn the ship around. But as we'll explain, Disney's problems now extend far beyond the reach of one CEO... even one as experienced as Iger.

Iger's first tenure as CEO was legendary...

Iger's first tenure as CEO was legendary...

He transformed Disney through acquisitions like Pixar, Marvel, Lucasfilm, and 21st Century Fox.

The company thought this foundation would translate into a profitable streaming empire. Instead, Disney was playing catch-up in the streaming space that Netflix (NFLX) has dominated for a decade.

And Chapek had Iger watching over his shoulder the whole time.

When Iger stepped down as CEO, he agreed to stay on as creative director and executive chairman for another two years. Tensions mounted as the two clashed over the company's direction.

Iger began to second-guess Chapek's decisions, especially with Disney+ burning through cash. The internal feuds eventually made their way to the press.

Disney needed a clear direction... not a battle of wills. By mid-2022, its debt load had ballooned to $48 billion. Activist investors began pushing for changes in leadership and strategy. Iger came back a few months later.

His return was supposed to stabilize the situation and quell investor concerns. But the leadership shuffle – and the power struggle between the two Bobs – only heightened the uncertainty.

And instead of being proactive about this pressure, Disney got reactive. It sold off TV networks and video-game divisions, and cut costs to slow the bleeding from streaming.

Despite Iger's previous success, Disney is still underperforming...

Despite Iger's previous success, Disney is still underperforming...

Disney+ continues to weigh down the balance sheet. And recent film releases have failed to reignite the company's fortunes.

Disney claimed four of the five biggest box-office flops in 2023. The Marvels, Indiana Jones and the Dial of Destiny, Wish, and Haunted Mansion lost the company a combined $628 million.

Even beyond streaming, its overall strategy feels disjointed. Disney hasn't found a winning formula in today's shifting entertainment landscape.

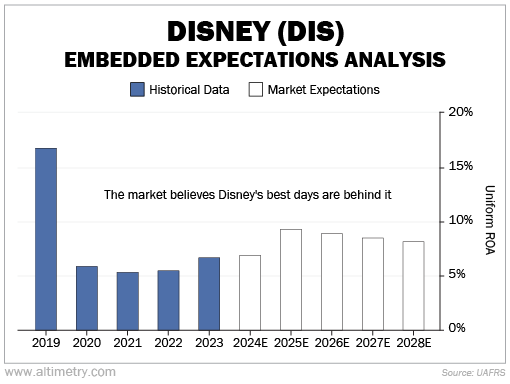

Uniform return on assets ("ROA"), which averaged 16% from 2015 to 2019, recorded a sharp drop to 6.7% last year. That's around half the 12% corporate average.

Investors aren't expecting any miracles, either. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows.

We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

The market expects Disney's Uniform ROA to climb to a modest 8% through 2028. While that's an improvement, it's far from a return to past profitability.

Take a look...

This a clear signal – investors don't think Disney will ever recover to its former heights. The best they're hoping for is stability.

Disney's current problems run deeper than what a single person can fix...

Disney's current problems run deeper than what a single person can fix...

It's facing profitability struggles... a shifting media landscape... and it's far too reliant on streaming. Iger still has a long road ahead.

With shares still down, this might seem like a chance to scoop up an entertainment mainstay at a discount. But the company hasn't shown a clear plan to fix what's broken.

And in the meantime, it lost a lot of trust from investors.

More bad news could send Disney's stock lower in a hurry. Don't bet on any miracles.

Regards,

Rob Spivey

October 15, 2024

If Disney (DIS) needs a new blockbuster script, it doesn't have to look beyond its own boardroom...

If Disney (DIS) needs a new blockbuster script, it doesn't have to look beyond its own boardroom...