The debate around inflation continues…

The debate around inflation continues…

When Federal Reserve Chair Jerome Powell delivered his keynote speech on Aug. 27 at the virtual Jackson Hole Economic Symposium, global central bankers, economists, and markets largely approved.

For most investors and Fed watchers, he struck the right chord with his message. The central bank was committed to slowing down or "tapering" its bond purchases in the near term. The Fed has been buying $120 billion in Treasury and mortgage bonds each month since March 2020 to encourage borrowing and keep longer-term interest rates low.

Powell stressed the Fed is going to stick to a patient approach centered around prevailing economic conditions.

But some economists disagree with the Fed's approach.

Adam Posen, president of the think tank Peterson Institute for International Economics, offered a note of caution on the Fed's recent comments on inflation.

Posen posted a thread on Twitter (TWTR), saying the Federal Reserve seems unwilling to admit that the transitory inflation we are currently experiencing may run longer than forecasts suggest.

With continuing COVID-19 outbreaks and ongoing global supply chains disruptions, he says the Fed's median projected interest rate for 2022 of 2.1% seems out of line with the economic reality of business conditions during the pandemic.

"The rises in inflation expectations shown in Powell's charts are suboptimal even for a 2% target. But that is now what they say. It would be closer to optimal to ride up the current inflation surge to a 3% target," Posen said in his tweet.

The central bank's new policy framework targets an average inflation rate of 2%, so it will tolerate inflation above 2% for a period of time to compensate for periods where it was below that level.

Powell and other Fed officials are keen to clarify that the inflation spike we are witnessing won't last long. Posen suggests this is contradictory because it suggests the bank will not tolerate inflation above 2%, undermining its new framework.

If its forecasts maintain that supply shocks will suddenly disappear in the coming months, it will be in for some heat if price increases continue into 2022.

This time is a little different…

This time is a little different…

As Posen highlights in his Twitter thread, most of the inflationary pressures we are seeing don't fit the classic "wage price" spiral inflation dynamic that concerns most economists and investors. This is when wage hikes lead to price increases, further wage hikes, and so on, forming a vicious, self-fulfilling cycle.

Today's conditions are more directly related to supply shocks. Decreases in the availability of inputs in an economy are driving up prices for producers and consumers.

This can be illustrated by the price action over the past year or so in markets such as those dependent on semiconductors, notably the auto industry.

A combination of pandemic-related shutdowns and a miscalculation of demand led many automakers to underestimate the number of semiconductor chips they needed to order from manufacturers.

When they suddenly realized vehicle demand was rebounding faster than anticipated and placed more orders for chips, automakers found that chipmakers could not meet the surge.

In the case of used cars, a reflection of a supply shock to the market for new vehicles, prices soared as drivers realized they couldn't buy the latest models.

Inflation is surely running hot right now as these supply disruptions continue to roil segments of the global supply chain. But the turmoil will not last forever.

Eventually, supply chains will normalize. For example, used car prices will return to more typical levels as new vehicles hit the market again.

The best indicators of this are the U.S. Treasury market and data points from surveys like the Cleveland Fed's inflation estimate.

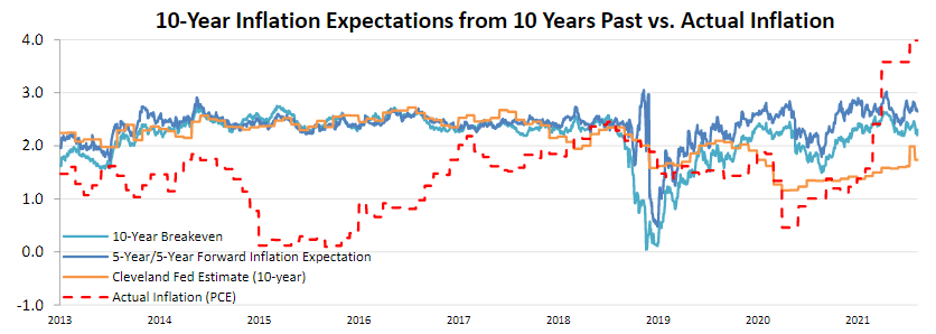

While the Personal Consumption Expenditures Index ("PCE") has recently shot to more than 4%, the 10-year Cleveland Fed estimate is currently sitting at just 2%. This shows conviction from professional economists that inflation isn't getting out of hand.

It's not just professional economists who have this view. Those with money on the line see the same thing.

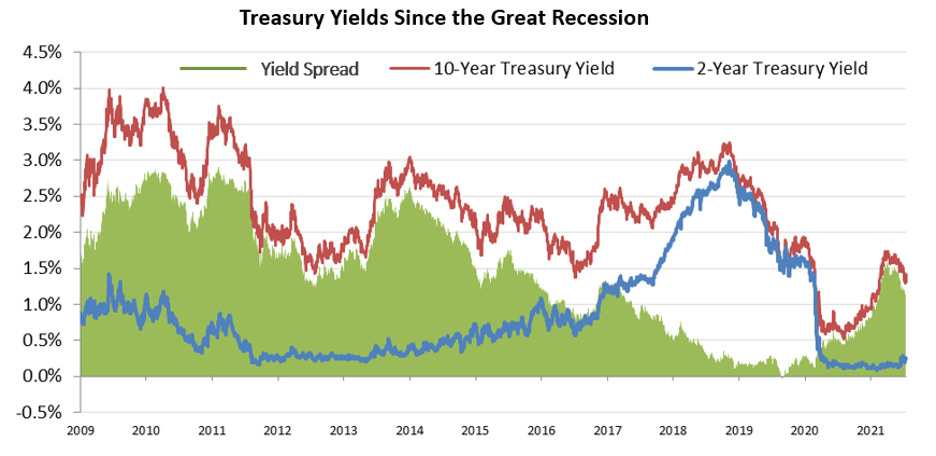

The 10-year U.S. Treasury yield, which reflects supply and demand for longer-term government bonds, is floating around 1.3%. This rate suggests bond investors aren't expecting inflation to be much of an issue.

If bondholders truly did, they would be selling bonds and pushing up yields in response. As bonds are claims to future cash streams, these assets inherently become less valuable when inflation rises.

So while Posen and other economists criticize the Federal Reserve's messaging and its implications for future credibility, the reality is that the near-term course of inflation will continue being driven by what happens with the coronavirus pandemic and supply chain disruptions.

As long as this remains the case, investors don't need to worry about inflation's impact on valuations or buying power.

If this delicate balance begins to shift and the Federal Reserve starts to adjust its bond-buying policies, we'll be the first to let you know.

Regards,

Rob Spivey

September 13, 2021

P.S. No matter what stories are dominating headlines, in Altimetry's Hidden Alpha, we're using our Uniform Accounting analysis to find big opportunities from the market's mispricing of stocks due to distorted GAAP metrics.

In the September issue, we've found a company that's focused on the areas where the U.S. military is growing most... The market doesn't realize it yet, but the stock is primed for massive upside ahead. Learn more about Hidden Alpha – and how to gain instant access to our latest recommendation – right here.

The debate around inflation continues…

The debate around inflation continues…