Normally, people tune in to Berkshire Hathaway's (BRK-B) earnings calls to see what stocks Warren Buffett is buying...

Normally, people tune in to Berkshire Hathaway's (BRK-B) earnings calls to see what stocks Warren Buffett is buying...

So it came as quite a surprise when a new stock wasn't the top news this time around. Instead, it was cash.

Berkshire Hathaway now has a record $157 billion in cash. Buffett was a net seller of stocks for the fourth quarter in a row.

This huge pile of money is just sitting in Berkshire's coffers, waiting to be put to use. Cash doesn't generate any kind of return. So it's not usually considered a smart investment choice.

But this isn't just about having a lot of money in reserve. It's a clear sign of a strategic shift.

Today, we'll dive into why Buffett is comfortable holding a ton of cash right now. And we'll look at some companies with huge cash balances that could follow in Berkshire's footsteps... and potentially make a lot of money in the process.

For the first time in years, Buffett can finally make money on his cash...

For the first time in years, Buffett can finally make money on his cash...

When a company lists cash on its balance sheet, it's not actually cash. It falls under a category called "short-term investments."

Short-term investments get treated like cash... because they can easily be converted into cash. This highly liquid category includes high-yield savings accounts, money market accounts, and even short-term U.S. Treasury bills.

Berkshire Hathaway's balance sheet includes about $126 billion in short-term investments. As interest rates have risen, many of these short-term investments became lucrative for the first time in years.

Take three-month Treasurys, for instance. They yield about 5.5% today... as opposed to 0.1% for most of the past 15 years.

If Buffett put all of Berkshire's cash into three-month Treasury bills at today's rate, he'd be making about $9 billion per year.

That's a huge sum... even for a company as big as Berkshire Hathaway. In the past 12 months, the company made $27 billion in free cash flow ("FCF"). Adding $9 billion from interest would increase its FCF by a third.

Berkshire isn't alone... any company with a ton of cash can invest in short-term assets to bring in more money.

Berkshire isn't alone... any company with a ton of cash can invest in short-term assets to bring in more money.

Investors don't seem to realize how valuable cash is becoming. Several companies out there have even more cash relative to market cap than Berkshire.

If these companies are able to earn more than 5% as they put that cash to work, they're likely better positioned than the market understands.

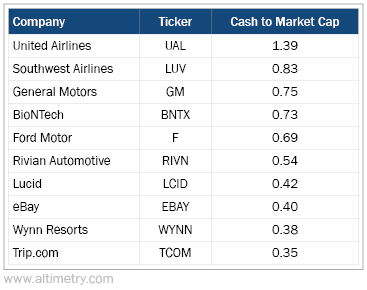

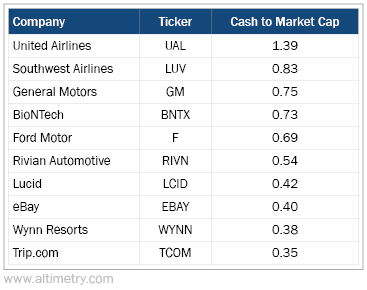

Take a look at the chart below. It shows the top 10 U.S.-listed stocks by their cash-to-market-cap ratio.

All of these companies have a ton of cash they can put to work...

As you can see, two of the biggest air carriers – United Airlines (UAL) and Southwest Airlines (LUV) – are at the top of the list. United has $17 billion in cash, and its market cap is only about $13 billion.

Now, that's not to say every company on this list is a guaranteed winner. There are a lot of factors that go into company and stock performance.

But with interest rates rising, any of these businesses could turn its cash holdings into a source of unexpected earnings. And in the coming months, companies with huge cash reserves stand to benefit.

They may report stronger earnings than expected. A positive surprise could help stock prices. At a minimum, once we enter a recession, all of these companies will have enough cash to handle the downturn.

Don't ignore the importance of cash reserves as the recession draws closer. Look for companies that aren't just sitting on their money... they're using it to make more money.

This strategy could be a game changer in the current economic climate.

Regards,

Rob Spivey

November 16, 2023

Normally, people tune in to Berkshire Hathaway's (BRK-B) earnings calls to see what stocks Warren Buffett is buying...

Normally, people tune in to Berkshire Hathaway's (BRK-B) earnings calls to see what stocks Warren Buffett is buying...