2022 may not be going as planned for this aviation company...

2022 may not be going as planned for this aviation company...

2022 was supposed to be the first summer of travel in three years, after the 2021 travel season was derailed by surges in COVID-19 cases, driven by the delta and omicron variants.

People were tired of being stuck at home, travel loyalty programs were overflowing with miles, and credit card bonus points were waiting to be spent to board planes and travel around the world.

After a long period of hunkering down, things were finally looking up for the industry.

However, the uptick in excitement didn't last for long.

This time, it's not a coronavirus variant derailing travel. Instead, the surge in oil prices combined with a return in travel demand is putting huge pressure on the global aviation industry.

With the different variants finally abating and government travel restrictions lifting, high demand should have been a boon to airlines who are finally able to ramp up to full capacity. However, with the Russian invasion of Ukraine, oil prices across the globe have spiked and don't seem to be coming down any time soon.

Consequently, high fuel prices have meant airlines are struggling to turn a profit, even as the pandemic has finally begun to retreat.

Let's look at one airline to see if a return to travel can overcome high oil prices...

Let's look at one airline to see if a return to travel can overcome high oil prices...

A great example to dig into is United Airlines (UAL), one of the biggest U.S. carriers. The airline makes the bulk of its money from front-of-cabin seating and international travel.

These are premium and extended duration seats that provide higher returns and often don't have budget competitors undermining pricing.

From the onset of the pandemic in March 2020 and for each new variant since, the business has consistently struggled and has needed outside financial help to stay afloat.

Even though passenger revenues were up 70% in 2021 compared to the previous year, revenue has yet to come close to 2019 levels. After two nonprofitable years, the aviation industry is hoping that 2022 will finally be a return to form.

Let's look at The Altimeter to see how 2022 looks...

Let's look at The Altimeter to see how 2022 looks...

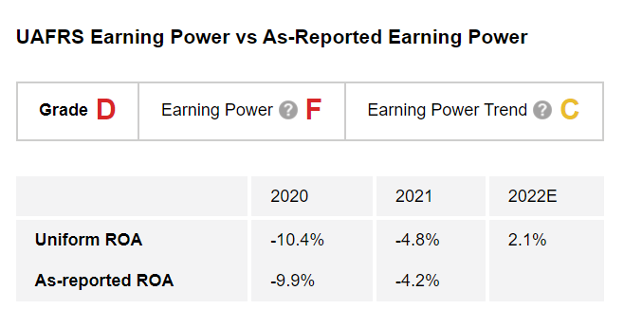

We can use The Altimeter, which shows users easily digestible grades to rank stocks on their real financials, to see how United Airlines is performing.

Unfortunately for United Airlines, even as returns are trending back up, The Altimeter indicates that the airline's suffering will likely persist for some time thanks to high oil prices.

While profits should be better than in 2020 and 2021, Uniform return on assets ("ROA") is barely going to be positive in 2022 due to the slow start of the year and high fuel prices.

As a result, this weak performance earns United Airlines an extremely low "D" overall Altimeter grade.

However, there are some improvements to United Airlines' earnings, as they turned positive this year, which suggests a moderate "C" Earning Power Trend grade.

The Earning Power Trend grade shows that profitability is still accelerating for the airline even with high oil prices... But that doesn't automatically mean it's a buy signal. The market could already be pricing it in, so the valuation of the company needs to be analyzed before going out to buy stock.

Altimeter subscribers can click here to see how United Airlines is valued based on Uniform Accounting and if the story is being correctly priced by the market. Using The Altimeter, you can see how United Airlines stacks up with more than 5,000 other U.S.-listed companies.

Regards,

Rob Spivey

April 28, 2022

2022 may not be going as planned for this aviation company...

2022 may not be going as planned for this aviation company...