Despite Alphabet's plenty of failures, its innovative ideas have paid off...

Despite Alphabet's plenty of failures, its innovative ideas have paid off...

What started as a search engine in the late 1990s, Google, later renamed Alphabet (GOOGL), emerged as one of the technology titans of our time. Overtaking Yahoo! in the early 2000s as the dominant search engine, Alphabet has shaped the way people use the Internet.

Most people think of the company's name as Google, not as Alphabet, after its well-known search engine.

But the company is also known for its string of flops, ranging from Google+, its attempt to corner the social media market, to Google Nexus, Alphabet's smartphone. These two products have since been discontinued, along with a long line of other misfires.

And people see these failures and assume Alphabet can only succeed as a search engine. But this may be more fiction than reality...

Misleading accounting reinforces this story...

Misleading accounting reinforces this story...

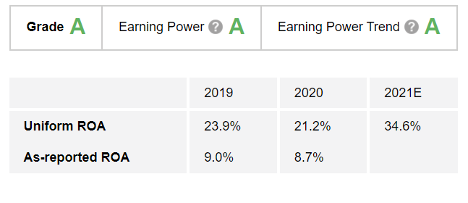

It appears that Alphabet's return on assets ("ROA") settled just below 10% for the last five years. Owning 90% of the worldwide market, Google is the dominant search engine, but it doesn't seem to offer much more...

It's easy for investors to see only a search engine, even if that is only the tip of the iceberg.

So how has Alphabet become the fourth largest company globally in terms of market cap? It can thank its hidden businesses.

While Alphabet has had its fair share of failures, people seem to forget its successes beyond the search engine.

Roughly 1.5 billion people have a Gmail account, and 2.7 billion use the Chrome browser.

The $1.7 trillion company bought YouTube in 2006, the second most-visited site on the Internet after google.com. And Alphabet owns several other companies, including Nest, Fitbit, Looker, and Waze, to name a few.

While as-reported metrics fail to show the power of Alphabet's businesses, Uniform Accounting sees it. We can tell exactly how profitably Alphabet is by using The Altimeter.

The Altimeter shows how the company generated a strong Uniform ROA of 21% in 2020, earning the company an "A" for Earnings Power.

Furthermore, returns are expected to climb significantly in 2021 to a robust 35%, giving the company an "A" for its Earnings Power Trend. This means the company gets an overall "A" grade for Performance.

If you're just looking at Alphabet as a search engine company, you're probably missing out...

If you're just looking at Alphabet as a search engine company, you're probably missing out...

Investors who bought GOOGL stock early on made gains as high as 5,105%.

The company's biggest source of revenue is Google Ads, generating more than 80% of its revenue, or $147 billion, in 2020.

And how about all those ads on YouTube? And those restaurant ads on Google Maps? That's money for Alphabet.

In reality, Alphabet is actually a massive advertising company – just like Meta Platforms (FB), formerly known as Facebook.

Advertisers bid on keywords that make their site come up first in relevant search results, bringing in a ton of money for Alphabet.

Alphabet is a prime example of what we call an iceberg stock, in which everyone sees the main product but misses other elements below the surface.

Advertising, YouTube, and Alphabet's smaller companies like Nest and Fitbit bring in the revenue that increases the Big Tech company's profitability.

And investors often overlook the profitability of Alphabet's other divisions, which is why the stock continues to go up...

Buying hidden businesses like Alphabet early can lead to windfall profits for investors...

Buying hidden businesses like Alphabet early can lead to windfall profits for investors...

Every year, companies like Alphabet, Amazon (AMZN), Apple (AAPL), and Meta Platforms rake in billions of dollars in under-the-radar revenue from their "hidden businesses."

And here at Altimetry, we've identified a new group of much smaller companies that are putting this powerful force to work... which could send their shares soaring as much as 852%.

In our brand-new presentation, my colleague Joel Litman even shares the full details of one of these companies, including its name and ticker, for free. Watch his time-sensitive presentation by clicking here.

Regards,

Rob Spivey

January 27, 2022

Despite Alphabet's plenty of failures, its innovative ideas have paid off...

Despite Alphabet's plenty of failures, its innovative ideas have paid off...