Investors love to sit where the grass is greenest...

Investors love to sit where the grass is greenest...

When interest rates were near zero, long-term corporate bonds traded near face value – also called "par" ($1,000). Some even climbed above par for a time.

Folks were hungry for stable income. They jumped at the prospect of earning 5% or more through bonds issued by blue-chip businesses. There was just no other way to lock in those kinds of returns for a decade-plus.

But when the Federal Reserve started driving rates higher in 2022, those same long-dated bonds were suddenly worth less on paper.

Even the biggest, safest companies on Earth pale in comparison with the U.S. government. It's bigger... has more money... and is all but guaranteed to keep chugging along.

So when short-term U.S. Treasurys started yielding as much as long-term corporate debt, the choice was obvious.

Investors fled to shorter-term debt... pushing prices down even though the underlying credit quality didn't change.

The Federal Reserve just announced a 0.25% rate cut – right on the heels of an identical cut in September. And bonds are still cheap today.

But as we'll explain, that likely won't be the case for much longer. And it's creating a rare opportunity for the folks who are paying attention...

Interest rates are still high relative to history...

Interest rates are still high relative to history...

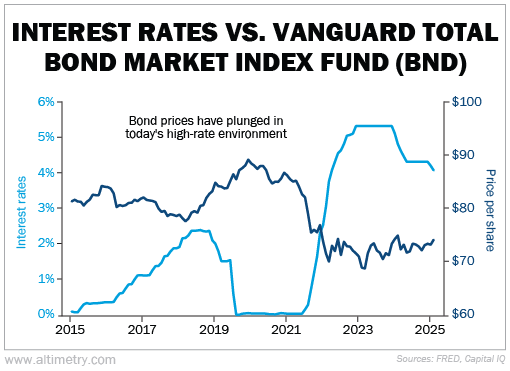

And bond prices – as measured by the Vanguard Total Bond Market Index Fund (BND) – are close to their lowest levels of the past decade.

Take a look...

You can see in the chart that bonds are trading at much lower prices, on average, because of higher interest rates. And importantly, it's not just distressed debt that's cheap...

It's the entire bond market.

The bonds of many stable, blue-chip businesses are trading at distressed prices – hundreds of dollars below par value ($1,000).

But as we said, this setup might not stick around for much longer.

The Fed cut rates three times in 2024. And after holding off for most of this year... it cut rates again in September and October.

Fed Chair Jerome Powell indicated we could see another cut at the Fed's final meeting of the year in December.

That likely won't be the end of near-term rate cuts...

That likely won't be the end of near-term rate cuts...

President Donald Trump has been pushing for lower rates all year. He has gone as far as threatening to remove Powell from his post.

While the Fed's current plan would leave rates around 3.5% to 3.75%... that's still much higher than Trump's 1% to 2% target.

We think Trump will get his way next year. Powell's term as Fed chair ends in May 2026. The Trump administration will be able to appoint a new chair who shares the president's views on rate cuts.

And when that happens... it will be like 2022 in reverse. Bond investors will ditch U.S. Treasurys when they stop being so attractive.

They'll hop right on over to the blue chips they've been ignoring for years.

As investors pile back in, the prices of those bonds will soar back toward par value.

That brings us to today's opportunity...

That brings us to today's opportunity...

Investors have a short window of time to buy in before the rush. And that's exactly what we said to do in our latest Credit Cashflow Investor monthly advisory.

Only we didn't just recommend our one favorite bond this month...

We recommended six.

The bonds were all issued by household names. You'd likely recognize most, if not all, of the underlying companies. There's no question about their stability.

And yet, they're trading for as little as 69 cents on the dollar.

All six of these bonds are below our recommended buy-up-to prices as we go to press. So there's still time to buy in. But the clock is ticking... Learn more here.

If Trump gets his way in 2026, our recommendations could appreciate far sooner than maturity. We could be ready to take profits in as little as a year or so.

Opportunities like this don't come around often. The past few years of high interest rates have turned the credit market on its head. The bonds of stable, trusted businesses are trading like "junk."

And folks who take advantage of this setup could be in for a sizeable reward.

Regards,

Rob Spivey

October 31, 2025

Investors love to sit where the grass is greenest...

Investors love to sit where the grass is greenest...