An activist hedge fund just made its biggest bet yet, and it's gunning for change...

An activist hedge fund just made its biggest bet yet, and it's gunning for change...

Last month, Elliott Investment Management took a $4 billion stake in PepsiCo (PEP). Now, it's pushing for a full corporate split. It wants to break Pepsi's beverage and snack divisions into two independent companies.

Pepsi has lost nearly $40 billion in market cap in the past three years. Over the past 20 years, it has lagged behind the S&P 500 Consumer Staples Index by 169%.

Historically, the market has largely overlooked that. Shares are up roughly 150% since October 2005. But now, it seems those days are over...

Earlier this year, investors pushed the share price down as much as 18%.

Today, we'll explore why Elliott believes Pepsi is ripe for a breakup and how it could give you gains of more than 50%.

One half of the business is thriving, and the other is holding it back...

One half of the business is thriving, and the other is holding it back...

Pepsi is a global giant, with 23 brands generating more than $1 billion each in annual sales. But within that empire, there's a clear imbalance.

Its snack division is a powerhouse.

Pepsi's Frito-Lay North America makes popular snacks like Lay's, Doritos, Miss Vickie's, Quaker Oats, Smartfood, and many more. This division represented 27% of the company's total business last year. It commands a huge market share, boasts strong margins, and maintains deep retail relationships.

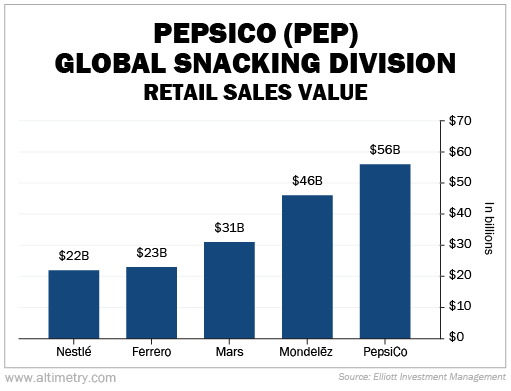

And it has continued to dominate the snack food market even through inflation and shifting consumer preferences. Pepsi has been the fastest-growing U.S. snack brand for the past decade. And with more than $32 billion in retail sales value last year, it's more than six times larger than its next biggest peer.

By contrast, Pepsi's beverage business is dragging its feet...

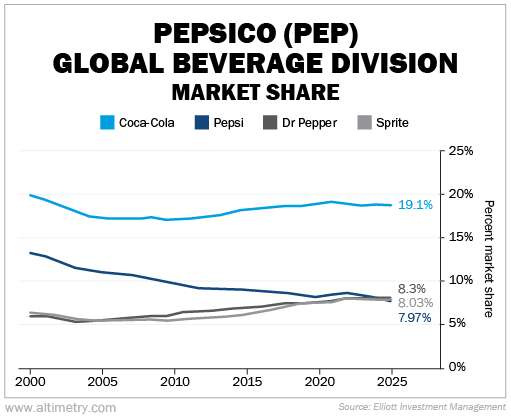

Coca-Cola (KO) has always been a dominant force. Its flagship soda (Coke) is the No. 1 soda in America. Pepsi used to be right behind it as the No. 2 soda brand. But now, it has fallen to the fourth spot, behind Dr. Pepper and Sprite.

Elliott's plan calls for Pepsi to take three steps. First, refranchise its bottling operations. Second, streamline the beverage unit by cutting underperforming products and selling off noncore assets.

And third, the big one, spin off the snack business entirely. According to Elliott, the market can't properly value Pepsi's best asset while it's buried inside a conglomerate. The math backs that up...

Let's look at Pepsi's Uniform price-to-earnings (P/E) ratio...

Let's look at Pepsi's Uniform price-to-earnings (P/E) ratio...

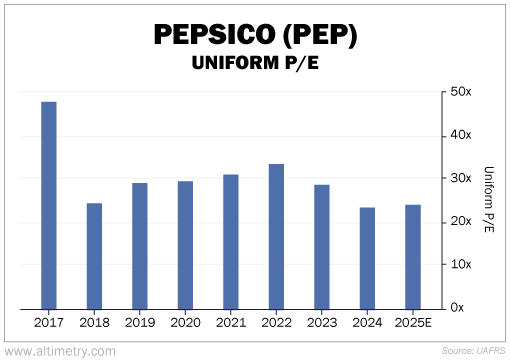

Frito-Lay North America has seen 26% revenue growth and 12% operating income growth over the past three years. And yet, its Uniform price-to-earnings (P/E) ratio is down.

The Uniform P/E ratio compares a company's total value with the value of the earnings it generates each year. The higher the P/E ratio, the more investors are willing to pay for Pepsi's earnings.

Said another way, this metric tells us how valuable investors think Pepsi's earnings are.

Pepsi's Uniform P/E ratio has been trending down since 2022.

At just 24 times, this is almost the lowest ratio the company has seen since 2018. Take a look...

The market is treating Pepsi like a company in freefall... even though its snack unit could thrive independently.

The real value may be trapped inside the bag of chips...

The real value may be trapped inside the bag of chips...

Elliott has a long history of pushing corporate giants to unlock value. Its campaigns at a handful of other companies all resulted in major restructurings and strong shareholder returns.

It pushed for computer maker Dell Technologies' (DELL) wildly successful acquisition of data-storage giant EMC. Since the two companies merged in September 2016, Dell's stock has soared about 1,100%.

Pepsi's current structure worked for decades. But today's market punishes complexity. Investors want clarity, focus, and execution.

As Elliott wrote in a letter to Pepsi's board...

PepsiCo finds itself at a critical inflection point. The company has an opportunity – and an obligation – to improve financial performance and regain its position as an industry leader.

Activist campaigns often fail. But when they succeed, the upside can be swift and substantial.

Elliott estimates that if Pepsi moves forward with even part of its plan, especially a spinoff, shares could climb more than 50%.

Regards,

Joel Litman

October 7, 2025

P.S. Our October Master Class live series starts tonight at 6 p.m. Eastern time. If you haven't RSVP'd yet, there's still time.

In this two-part series, we'll consider how you should prepare for the changes taking place in America today. First, we'll dig into the future of energy in the AI era – and how the tech boom could trigger investment opportunities somewhere you'd never expect. Then we'll explore the recent surge for both gold and stocks – a rare "goldilocks" opportunity.

These Master Class lessons are free to Altimeter Pro subscribers. You should have received your invitation last week. For anyone else who wants to join, reserve your spot (and a free 30-day Altimeter Pro trial) right here.

An activist hedge fund just made its biggest bet yet, and it's gunning for change...

An activist hedge fund just made its biggest bet yet, and it's gunning for change...