Even in the midst of the coronavirus pandemic, the valuations for perceived industry 'gatekeepers' keep rising...

Even in the midst of the coronavirus pandemic, the valuations for perceived industry 'gatekeepers' keep rising...

Despite the lockdown, investors are clamoring to invest in companies that control parts of the economy that are primed to boom over the coming years.

Last week, digital-payment platform Stripe announced that it had raised $600 million in funding from several high-profile venture-capital investors. This massive influx of cash now values the company at $36 billion.

Stripe isn't actually a "gatekeeper" business. The company faces far more competition in its space than investors may recognize... with PayPal (PYPL), Square (SQ), and many other startups and established firms all working to be the main point-of-sale platform in the world of digital payments.

That being said, the continued demand for Stripe's equity offering in the midst of the current environment points to how important investors believe owning the right companies in this space – and other major growth sectors – is.

This concept of industry gatekeepers isn't new to Altimetry's Hidden Alpha subscribers...

In last month's issue, we discussed three "Gatekeepers to Booming Industries." These are companies with exposure to sectors with massive secular growth trends and whose industries will enjoy long-term revenue and profit growth.

They're not just competing in those industries... they're supplying those industries.

Knowing which companies and which themes to own will be a major driver of whether investors outperform in the midst of the market recovery after this sell-off... And gatekeepers to those themes are going to be big winners.

If you want to find out the names of the companies we recommended – and have access to future businesses we're likely to highlight – you can learn more about a subscription to Hidden Alpha right here.

The auto industry is seeing three big trends right now...

The auto industry is seeing three big trends right now...

The first is a cyclical decline in demand.

While the world is at a virtual standstill right now, with everything including car sales in free fall, the decline in demand for new cars was already in progress long before the coronavirus pandemic.

It appears the automotive buying cycle peaked a few years ago, and we're now starting to see new-car demand slow like we normally do in the second half of a cycle.

But because it's a cyclical trend, this is to be expected... and it's not a real cause for concern.

That said, the next two trends are secular trends that are likely to change automotive demand forever...

The first secular trend is electric vehicles. These made up 1.5% of all new car sales as of last March.

While that's a small amount, it's growing rapidly. As the major carmakers begin producing lower-end electric models, we can expect to see more consumers making the switch to these vehicles.

And this trend has less to do with the total number of autos sold and is more focused on which companies will be successful...

Companies with no electric-vehicle development and manufacturers for traditional combustion engines are likely to lag behind what you'd normally expect in a cyclical recovery, as their electric-focused counterparts take market share.

The third and final trend is one of declining auto demand due to more reliance on ride-sharing apps and the like.

As ride-sharing apps become more popular – especially as young people are in no rush to move out of cities, where it's difficult to own a car – a growing number of adults are deciding against owning cars.

When identifying which automotive companies investors should be focusing on to survive these waves, looking at "best in class" operators is essential as we're entering a down cycle.

But more important, these companies need to be "future proof" with respect to trends like electric vehicles and ride sharing.

Seeing as car demand is slowing, companies that make replacement parts may have a slightly stickier business.

And in this space, auto supplier BorgWarner (BWA) has always been considered a best-in-class operator.

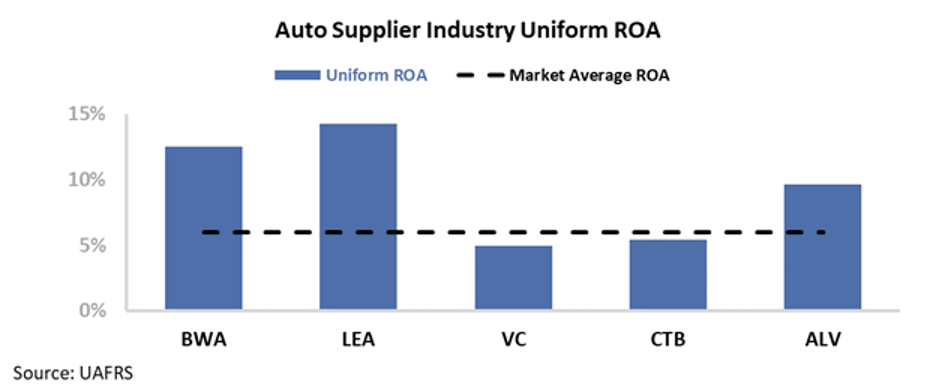

The company has one of the highest returns on assets ("ROA") in the industry, in line with competitor Lear (LEA) and well above other companies like Visteon (VC), Cooper Tire & Rubber (CTB), and Autoliv (ALV).

BorgWarner produces powertrain products like transmissions, clutches, and turbochargers. So at first glance, it appears the company would be vulnerable to rising electric-vehicle demand.

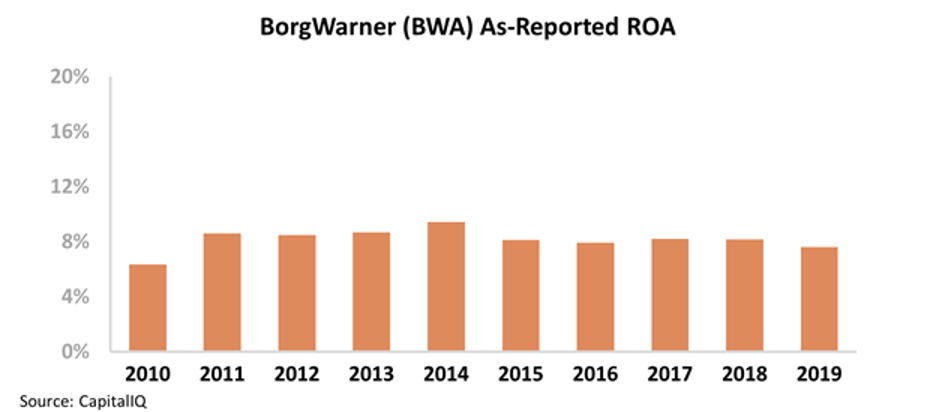

However, if we look at BorgWarner's profitability over the past several years, it appears the company has managed to be resilient... Even in the face of these new automotive trends, BorgWarner has seen a stable ROA for the majority of the past decade...

Considering these trends have already begun, we'd expect to see BorgWarner's returns already coming under pressure.

Given its reputation as a best-in-class auto supplier, the as-reported ROA may indicate that the company is adapting to changing market dynamics.

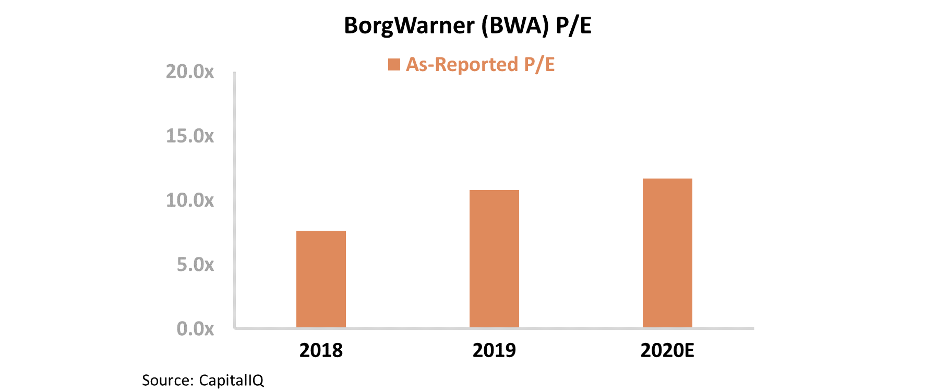

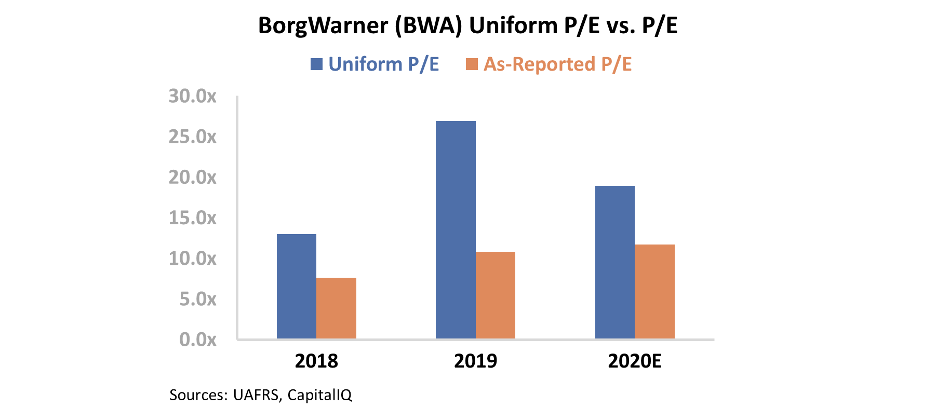

Furthermore, BorgWarner is currently trading at a serious discount to the market. While market average price-to-earnings (P/E) ratios are typically around 20, BorgWarner currently trades around 12 times based on its as-reported P/E.

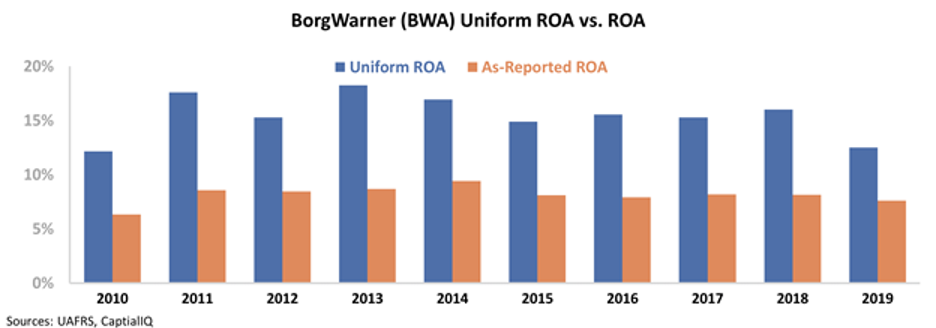

That said, the story becomes less compelling when we look through the "noise" and see the company's Uniform ROA...

Our Uniform Accounting metrics adjust for misleading figures buried in as-reported financial statements that can make financial trends less clear.

After making the correct adjustments, we can see a trend that was invisible before. As electric vehicles and ride sharing have grown in popularity, BorgWarner's returns have already started declining. Take a look...

After peaking at 18% in 2013, Uniform ROA has compressed back to decade-low levels. That's a clear sign of a company that's starting to see operational pressures.

Furthermore, the Uniform numbers reveal that BorgWarner actually trades much closer to market averages with a Uniform P/E ratio of 19.

At these levels, BorgWarner no longer looks like a steal... it looks fairly valued at best.

While as-reported metrics make it seem like investors have the opportunity to buy a best-in-class company at a fair value, the reality is that BorgWarner uniquely faces more industry pressure than many of its peers.

Unless BorgWarner is able to adapt its business to address these secular changes, we can expect returns to continue shrinking... thus making the stock look far less attractive.

Regards,

Joel Litman

April 23, 2020

Even in the midst of the coronavirus pandemic, the valuations for perceived industry 'gatekeepers' keep rising...

Even in the midst of the coronavirus pandemic, the valuations for perceived industry 'gatekeepers' keep rising...