American Express (AXP) is going 'all in' on premium perks...

American Express (AXP) is going 'all in' on premium perks...

The credit-card giant recently unveiled a sweeping update to its Platinum lineup. It's calling this the "largest investment ever" in a card refresh.

The overhaul applies to both the personal and business versions of the Platinum Card... its flagship offering for high-spending customers.

Amex is expanding Centurion Lounge access, with new outposts in Tokyo, Salt Lake City, and Newark, New Jersey. And it's revamping the card's travel benefits, concierge services, and branded offers.

This is a direct challenge to rivals like the Chase Sapphire Reserve card and the Capital One Venture X card. Competitors have been luring away younger, more travel-savvy customers with flexible points and simpler perks.

Put simply, Amex is upping the ante to hold its ground at the top of the premium market.

It's clear the company is confident in its high-end customer base. Amex believes it can keep growing through loyalty and exclusivity.

The problem is, investors also believe in Amex... maybe a little too much. Their sky-high expectations may be setting them up for disappointment.

A decade of card upgrades has already fueled Amex's rally...

A decade of card upgrades has already fueled Amex's rally...

The financial-services giant has been one of the market's quiet winners. Shares have doubled in the past two and a half years, beating the broader S&P 500 by about 40%.

All that outperformance is thanks to consistency, not wild innovation.

Most cards focus on cash back or simple travel points. Amex turned its product into a prestige lifestyle brand. It has raised annual fees, added travel perks, and expanded its exclusive rewards partnerships.

Each wave of upgrades helped it keep customers happy and loyal.

That positioning has helped it dominate the premium market. It also allowed Amex to weather economic slowdowns better than its peers. Its interest income only fell 14% during the Great Recession. And it fell by less than 10% in 2020.

But after years of outperformance, investor expectations have caught up...

But after years of outperformance, investor expectations have caught up...

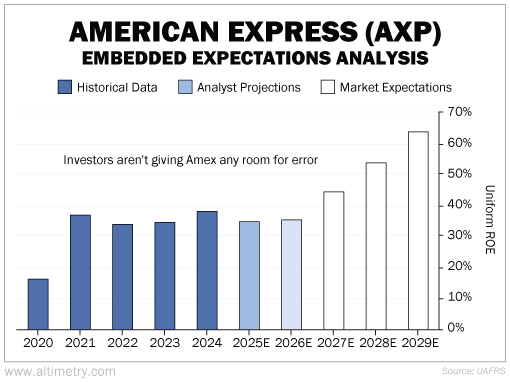

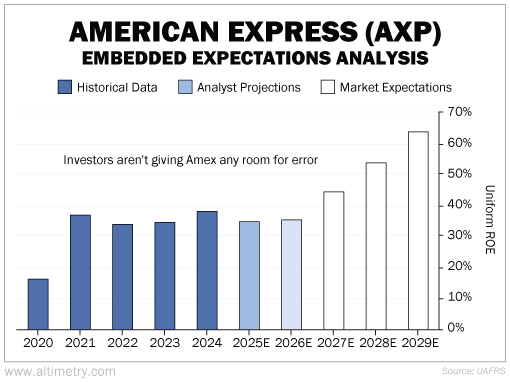

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet... We use American Express' current share price to calculate what investors expect from future performance and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Longtime subscribers know we often look at near-term Wall Street expectations. Analysts tend to have a pretty good grasp on where companies are headed in the next year or two.

Amex's Uniform return on equity ("ROE") has hovered around 35% to 38% in the past five years (excluding a brief period of underperformance during COVID-19). That's about 3 times the 12% corporate average.

Analysts expect that trend to continue over the next two years. But investors are way more bullish. They think Amex's Uniform ROE will reach 64% by 2029.

Take a look...

The market is looking for a significant improvement in profitability. But upgrades alone might not be enough. Amex's competitors have already closed the gap.

Venture X's annual fee undercuts Amex by nearly half... while still offering lounge access, travel credits, and strong cashback features. Sapphire Reserve has a similar advantage.

And both cards are accepted in more places than Amex.

Card updates like this often look great on paper...

Card updates like this often look great on paper...

But the buzzy headlines don't tell the full story. While the resulting fee hikes could boost revenue, they can also scare away customers...

Lounge expansion alone involves major capital expenditures and long-term leases. And elevated customer-acquisition costs are already a drag on margins.

And then there's the ever-present threat of tough competition.

Amex can't afford to slip. Premium customers are loyal... until they're not. That's what makes today's valuation so risky.

The market is acting like Amex will never slip. But even a modest stumble could unravel that confidence.

Regards,

Joel Litman

August 5, 2025

American Express (AXP) is going 'all in' on premium perks...

American Express (AXP) is going 'all in' on premium perks...