DARPA is one of the main groups responsible for Moderna's vaccine...

DARPA is one of the main groups responsible for Moderna's vaccine...

One of the organizations people should be thanking for the Moderna (MRNA) COVID-19 vaccine is the U.S. Defense Advanced Research Projects Agency, commonly referred to as DARPA.

As crazy as it sounds, the vaccine's success isn't due to pharmaceutical groups, health care research facilities, or development labs alone. While these groups are heavily involved in vaccine creation and other drug innovations, U.S. government agency DARPA lent its backing to Moderna.

With its unique funding model, DARPA assisted in the creation and rollout of the Moderna vaccine.

This organization has been funding ground-breaking projects since its initial creation in the 1950s. Some of DARPA's moonshots range from night-vision devices to mobile shooter detection systems to messenger RNA vaccines.

Thanks to DARPA's success, many countries are attempting to do something similar. These countries are trying to create their own vaccines and distribute them at robust speeds.

Many countries outside the U.S. will struggle to make this happen. As a recent article in The Economist highlights: "Replicating DARPA's freewheeling culture is such a challenging task that there have been times when DARPA itself has failed."

It takes a lot of government funding without a lot of oversight.

For many governments, it's too risky to give that much budget to projects with such low success rates.

Unfortunately, many countries have less transparent governments. They have less capital and planning expertise to execute on large projects.

Another reason DARPA is so successful is that it outsources almost everything it does as an organization.

DARPA finds interesting ideas and then goes to the experts. It's run almost like a venture capital firm, with specific outcomes as its goals instead of investment returns.

DARPA's successful outsourcing strategy comes with challenges...

DARPA's successful outsourcing strategy comes with challenges...

To have true success under DARPA's strategies, the organization must find many people outside the agency to conduct key aspects of their processes.

Developing countries would need a robust aerospace and defense industry like the U.S. to be successful.

These countries need to be willing to make pure and expensive research and development ("R&D") investments.

Only a few potential companies could draw in further demand and provide significant value to these processes.

One great company that comes to mind is Lockheed Martin (LMT), the largest defense contractor in the world.

Lockheed has a solid relationship with the U.S. government. DARPA selected Lockheed for its Blackjack project last year, with the total value of the contract coming in at around $40 million. Blackjack is part of the National Security Space assets project, aimed at enhancing military communications with a "high-speed network in low Earth orbit."

The company mainly engages in the design, research, and development of technology systems and products in the aerospace and defense industry. For more than 70 years, Lockheed Martin's designs have defended the U.S.

So, how successful is Lockheed Martin?

So, how successful is Lockheed Martin?

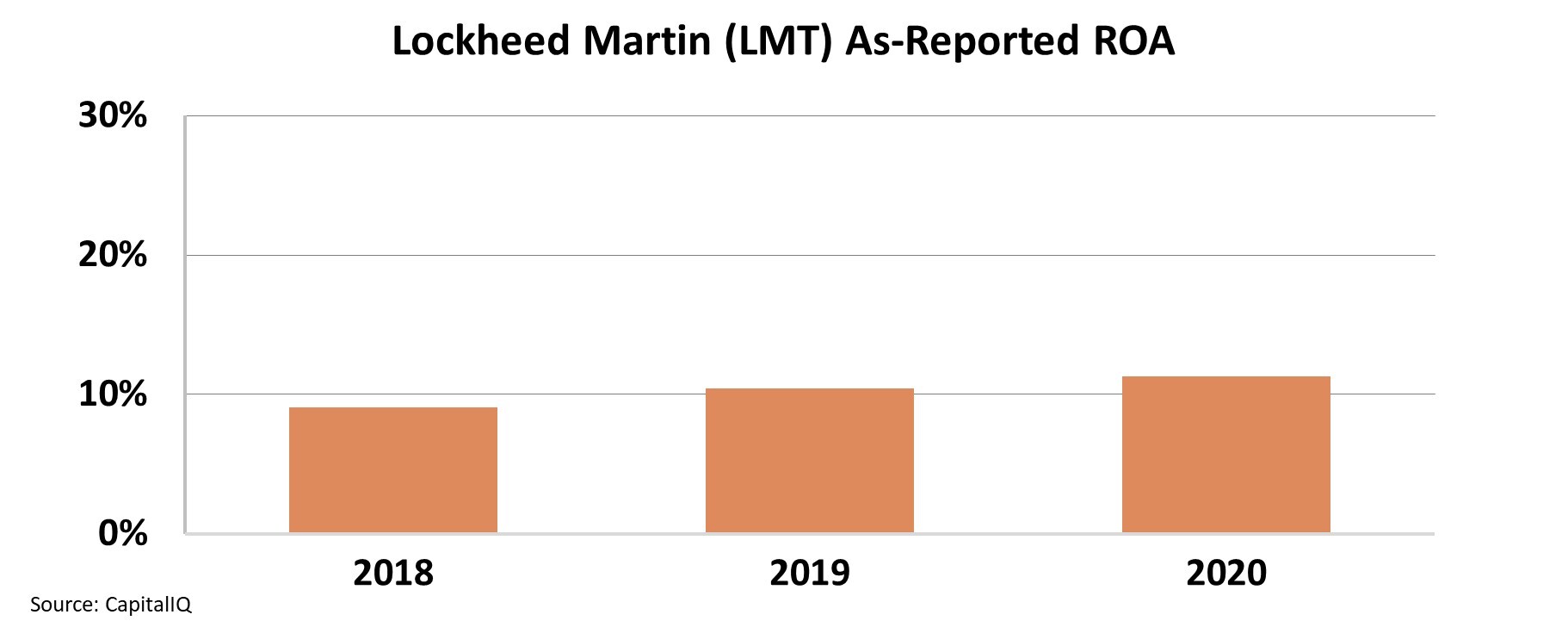

According to the as-reported metrics of Lockheed Martin, the company is just mediocre.

It appears that contracting mostly for the government doesn't leave room for excess returns.

Specifically, the company's return on assets ("ROA") levels have failed to break around 12% since 2018. During this period, its returns have ranged from 9% to 11% levels.

For context, the current U.S. corporate average for returns is around 12%. So, it appears Lockheed Martin is posting returns less than the average.

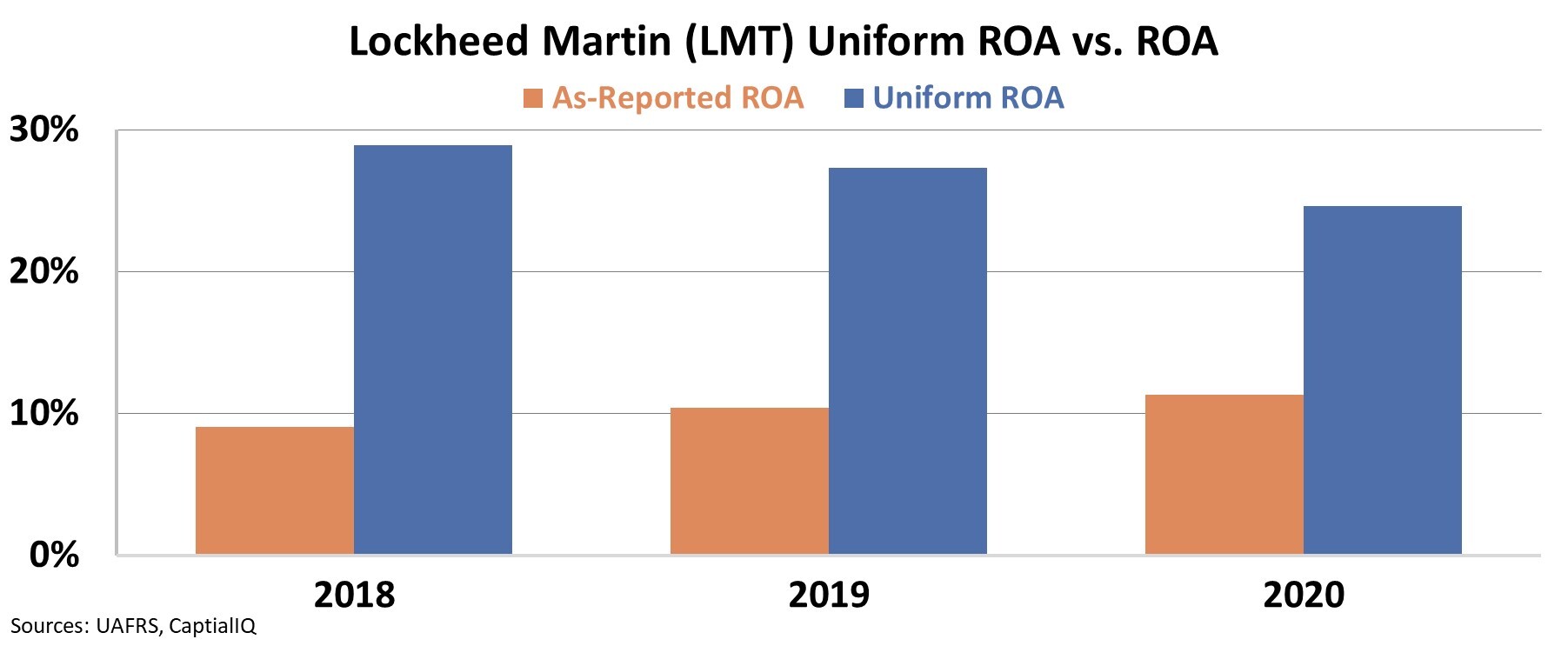

However, this is not an accurate representation of Lockheed Martin's true profitability levels. It's just bad data. In reality, the company is generating returns above the U.S. corporate average.

Since 2018, the company's Uniform ROA levels ranged from 25% to 29%.

Lockheed Martin's consistently high returns allow it to invest aggressively in R&D initiatives. That is misunderstood when looking at the as-reported data.

The company knows it will be compensated adequately for its vital role in the nation's defense. That gives it the confidence to spend at the beginning of an investment cycle.

Without this kind of profitability to power DARPA's investments, the rest of the world will struggle to recreate this type of magic.

Uniform Accounting can put Lockheed Martin in context... and determine whether the stock is a buy...

Uniform Accounting can put Lockheed Martin in context... and determine whether the stock is a buy...

Using the power of Uniform Accounting – which removes the distortions in as-reported financial metrics – The Altimeter breaks down stocks into easily digestible grades based on their real financials.

We need another piece of the puzzle. We also need to look at what the company is priced to do. And The Altimeter has the answers...

Altimeter subscribers can click here to see how Lockheed Martin is valued based on Uniform Accounting.

The Altimeter is a veritable "stock truth detector," which allows you to see the full grading for more than 4,000 other U.S.-listed companies – as well as the real valuations for companies like Lockheed Martin and Moderna.

Get more details about The Altimeter right here.

Regards,

Rob Spivey

July 14, 2021

DARPA is one of the main groups responsible for Moderna's vaccine...

DARPA is one of the main groups responsible for Moderna's vaccine...