Key parts of the supply chain are being disrupted as global lockdowns stretch on...

Key parts of the supply chain are being disrupted as global lockdowns stretch on...

We've already started to hear the discussion – and sometimes, jokes – about the growing scarcity of products as many parts of the globe remain shut down due to the coronavirus pandemic.

You've likely read about the run on toilet paper... or how Clorox wipes, paper towels, and other cleaning supplies are sold out across the country – even on Amazon (AMZN).

One area that has mostly held up well so far is the food supply chain. If you're comfortable waiting in a line to get into your grocery story, you generally haven't had to worry about getting meat or fresh fruits and vegetables.

But parts of the global supply chain are starting to have issues. In addition to dealing with the scarcity of some items, Amazon is also delaying shipping of other non-essentials as it prioritizes the products people need (keep in mind, though, that warehouses of non-essential goods are also starting to shut down).

One of my friends designs board games. His business had been booming throughout February and March. But as April rolled around, his warehouse closed... and sales have basically stopped.

Similarly, as the shutdown has closed roadside restaurants and has increased wait times at border crossings and checkpoints, another key part of the global supply chain – for both perishable and non-perishable goods – has started to see strains.

The trucking industry – the backbone for much of the world's shipping – has started to see strains as well, thanks to the problems mentioned above.

Those issues have also started to cause freight rates to rise, and this is likely to end up in the final prices of those goods. Whether this ends up being a longer-lasting issue will be something to monitor as the shutdown drags on.

Sometimes, CFOs like to play 'legal' accounting games...

Sometimes, CFOs like to play 'legal' accounting games...

Part of a CFO's job is to make his company's financials look as good as possible.

We're not suggesting companies are lying in their financial statements or that CFOs are "cooking the books"... because they don't have to.

Within GAAP and IFRS accounting, corporations have the ability to make certain one-time adjustments in the form of "special item" charges to the income statement.

These include things like inventory write-downs, restructuring charges, and legal settlements. In exchange for a one-time hit to earnings, companies can write down the values of assets on their balance sheets or build reserves for them to take against future expenses.

As the name implies, special items are meant to be used in "special" one-time situations. However, some CFOs have figured out ways to maximize the impact of special items which has come to be known as the "big bath."

Many companies will employ the big bath technique during a recession because management teams know they won't be able to meet earnings expectations anyways. In exchange for the write-off when things are already bad, the company builds a "reserve" that it can use to offset future expenses... which means future results will look better.

We saw this happen during the Great Recession.

However, some companies have figured out how to flip the system on its head by using special items consistently by running "normal" costs through special items – thus allowing them to continually build these reserves.

A great example of this is pharmaceutical giant Pfizer (PFE)...

Over the past decade, Pfizer has taken more than $21 billion in special items. There hasn't been a year during this time frame where the company has taken less than $500 million in special charges, including sizeable restructuring charges in each year.

Because Pfizer takes such large charges each year, we often joke that CFO Frank D'Amelio probably doesn't know the company's true earnings. Pfizer's results could be off any given year by $1 billion in either direction, based on how the company manages its massive reserves.

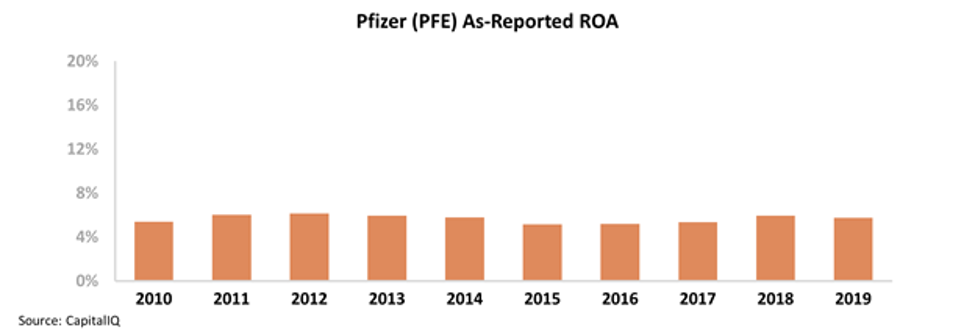

It's no surprise then, that with such confusing financial statements, Pfizer's as-reported metrics are incredibly misleading...

For most of the past decade, Pfizer's return on assets ("ROA") has remained weak and fairly stable. With the long-term corporate average ROA around 6%, the company's big bath strategy doesn't seem to be helping in the long run.

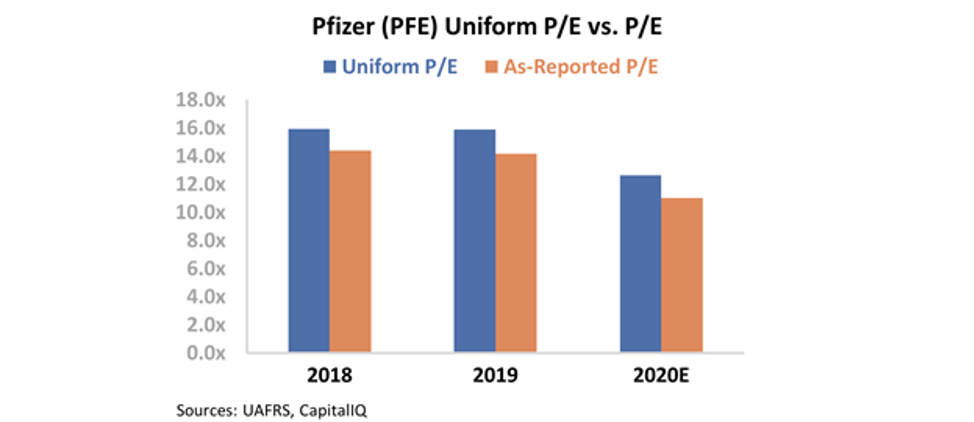

Furthermore, investors don't seem impressed with Pfizer's consistent write-offs. The company trades at a significant discount to market-average price-to-earnings (P/E) ratios... Even though the average is around 20 times, Pfizer only trades at a Uniform P/E ratio of 13. Take a look...

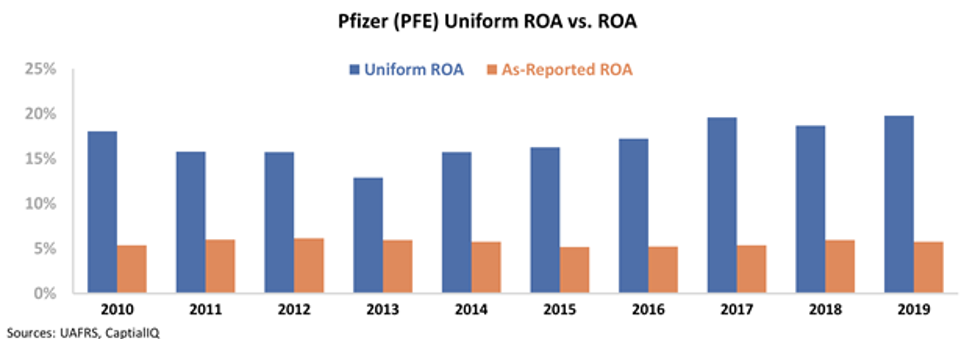

However, using Uniform Accounting metrics to look at Pfizer's profitability, we can see past the impact of the company's confusing accounting strategies to understand its true returns...

We adjusted for the company's consistent "special items" – which in reality are just part of its annual operations – while also adjusting for research and development (R&D) investment and stock options, among other distortions. Now we can see that although Pfizer's Uniform ROA fell to a low of 13% in 2013, it has since recovered significantly – reaching a high of 20% last year...

When looking at Pfizer's performance this way, the market's pessimism and low valuations might be misplaced.

Just because the company's accounting practices are difficult to understand doesn't mean the strategy isn't working on a fundamental level.

And when the market starts to realize Pfizer's momentum, valuations may snap back in line with reality.

Regards,

Joel Litman

April 7, 2020

Key parts of the supply chain are being disrupted as global lockdowns stretch on...

Key parts of the supply chain are being disrupted as global lockdowns stretch on...