Microsoft (MSFT) just fired thousands of employees, and it didn't start with support staff or middle management...

Microsoft (MSFT) just fired thousands of employees, and it didn't start with support staff or middle management...

Instead, it booted the engineers. In Washington state alone, 817 software engineers got pink slips this month.

These specialists build the core products for technology companies. So cutting them may seem like a red flag. But it isn't.

In fact, it's a clear sign that Microsoft is evolving... And AI-powered automation is driving that change.

Microsoft is redirecting capital to develop AI tools for its own operations and for other businesses. In other words, it's doing more with less staff.

And that's already benefiting the company's bottom line.

Today, we'll explore how Microsoft is trading headcount for margin. That could make it, and other tech companies that follow its lead, even more profitable in the years ahead.

Recent cuts signal a deep shift in the tech space...

Recent cuts signal a deep shift in the tech space...

Microsoft has slashed about 6,000 jobs across the company.

Software engineers made up the largest group. Product managers, program managers, and even AI staff were hit. Most customer-facing roles escaped untouched.

That breakdown tells us everything we need to know. It signals the next phase of business development, which is laser-focused on AI...

Microsoft is one of the most aggressive AI adopters in the corporate world. Its internal Copilot tools are reshaping workflows involving code, spreadsheets, e-mails, and presentations.

As of April, CEO Satya Nadella said AI is writing up to 30% of the code on internal projects. This level of automation means smaller teams can handle bigger workloads.

That's why Microsoft can cut tech and management roles without sacrificing productivity.

This shift is also helping it protect margins while investing billions of dollars in new data centers to support the AI push.

And the market is starting to take notice...

And the market is starting to take notice...

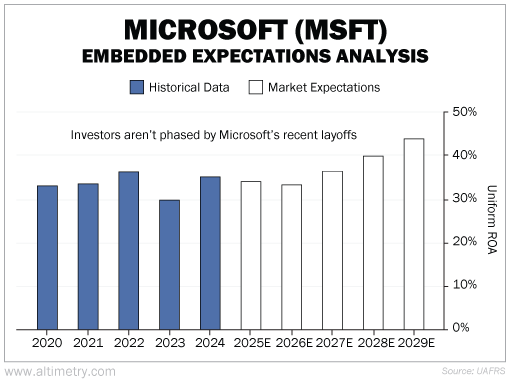

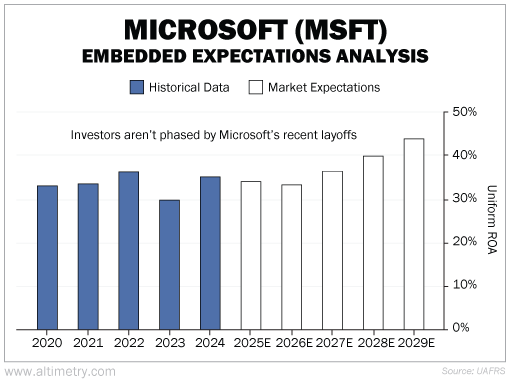

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Microsoft's Uniform return on assets ("ROA") is already incredibly strong at 35%. That's roughly three times the corporate average.

Investors seem to understand that AI developments will only boost Microsoft's profitability... They expect its Uniform ROA to rise to about 44% by 2029. Take a look...

It's no secret that AI is helping Microsoft become more efficient. And that's why investors aren't scared off by the company's firings.

Efficiency will be the new currency among tech leaders...

Efficiency will be the new currency among tech leaders...

Layoffs aren't the red flag they used to be.

As AI takes over tech roles, companies like Microsoft are slashing costs while preserving output... and unlocking better returns.

Their automation focus could generate more profit per employee than ever before. That's why investors should look past the headlines.

As more companies follow Microsoft's lead, leaner teams and stronger margins could become the new norm in the age of AI.

That will open the door to broader gains across the tech sector... and beyond.

Regards,

Joel Litman

May 29, 2025

Microsoft (MSFT) just fired thousands of employees, and it didn't start with support staff or middle management...

Microsoft (MSFT) just fired thousands of employees, and it didn't start with support staff or middle management...