Thanks to his cab-driving dad, Gene Freidman became a king...

Thanks to his cab-driving dad, Gene Freidman became a king...

Freidman's family emigrated from Russia to New York City in 1976. His dad, Naum, took a job as a cab driver to support his wife and 6-year-old son.

Naum eventually began running a fleet of 60 cabs out of a garage in the city. As a result, Gene learned a lot of the ins and outs of the business. So when Naum had a heart attack in 1996, Gene took over.

That's when he became a king.

Specifically, Gene built a kingdom of taxi medallions, earning him the nickname "Taxi King."

You see, in New York City, you need a medallion to operate a cab. It's like any license or permit.

Importantly, city officials restrict the number of taxi medallions, though an owner can transfer one to another person. That means their value can increase with higher demand.

Gene realized that. So he set out to own as many taxi medallions as he could. And as we'll show, he did so at an ideal time.

However, as we'll also explain, ride-hailing has changed a lot in the past 50 years...

There's a new Taxi King... and unlike Gene, its business model is built on more than medallions. That gives it a better chance of surviving for the next 50 years.

When Gene took over his dad's business in the late 1990s, more people wanted to drive cabs...

When Gene took over his dad's business in the late 1990s, more people wanted to drive cabs...

Demand grew so high that medallions sold for more than $100,000 each. By 2011, they started selling for more than $1 million each.

Gene used his fleet of medallions as collateral to buy more than anyone else in the city.

At his peak, he controlled a fleet of around 1,000 medallions. He became one of the most powerful figures in New York City's taxi industry. And his coffers grew as drivers rented medallions for steep fees.

Gene wanted to expand his kingdom beyond New York City. He hoped to control the taxi fleets in other major cities as well. So he moved on to places like Chicago and Boston.

Eventually, Gene's portfolio of medallions was worth more than $1 billion.

Then, Gene's kingdom crumbled...

As Gene's influence expanded, so did his leverage. He took on more debt to fuel the growth of his kingdom. He believed that the value of his taxi medallions would always keep rising.

But by 2014, the cracks had started to show...

But by 2014, the cracks had started to show...

Ride-hailing companies started stealing market share. Folks in big cities like New York had another way to get around. They could ride in someone else's car instead of a dirty cab.

In turn, the value of taxi medallions began to drop. And Gene's lenders started to worry. They wouldn't let him borrow any more money to support his kingdom.

Even worse, Gene ran into legal troubles...

He faced accusations of dodging taxes, shortchanging drivers, and skimming millions off the folks using his medallions. He narrowly avoided prison by turning in his business partners.

Within three years, Gene's kingdom was on its last legs. After the legal troubles, his lenders started coming after the medallions.

And due to the threat of the ride-hailing companies, the medallions' values had plunged...

In July 2019, 16 medallions went up for auction in New York City. Three medallions sold for around $137,000 each. But the other 13 didn't attract any bidders.

That was a far cry from their value just a few years earlier... and they're worth even less today.

It's all because of the ride-hailing industry's growth... and, specifically, the success of companies like Uber Technologies (UBER).

Uber's dominance today rivals that of Gene's at the height of his empire...

Uber's dominance today rivals that of Gene's at the height of his empire...

The company owns about 75% of the ride-hailing market. It has been able to stave off its next largest competitor, Lyft (LYFT), primarily because it also made itself a major player in food delivery.

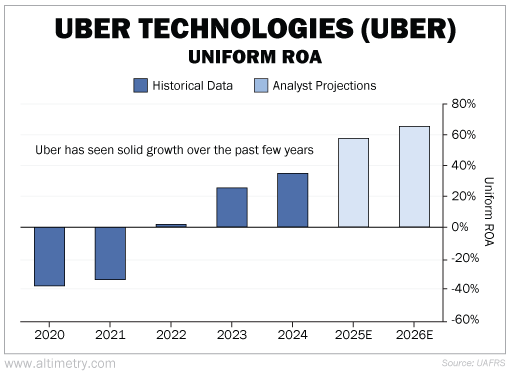

It took until 2023 for Uber to turn a profit. But since then, its Uniform return on assets ("ROA") has risen to 35%... nearly three times the corporate average. And over the next two years, it's expected to keep rising to 65%.

Take a look...

Those are the kinds of returns you get from a business that dominates its industry.

However, despite its success, some investors are looking for what could send it the way of Gene Friedman's empire...

Uber burned billions of dollars in the race to develop autonomous-driving technology. Between 2018 and 2020, it spent nearly $2 billion on its self-driving business, Advanced Technologies, before scrapping it and selling it to a company called Aurora Innovation (AUR).

Put simply, it saw the writing on the wall, as fellow tech giant Alphabet's (GOOGL) self-driving unit Waymo had more developed technology.

But here's the thing... Uber remains the dominant company for ride-hailing. And Waymo knows it.

Earlier this year, the two companies partnered up so users can order a Waymo-powered autonomous vehicle on the Uber app in select markets.

And unlike with Gene Friedman, that's going to help Uber keep its reputation as the Taxi King for years to come.

Regards,

Joel Litman

October 8, 2025

P.S. Last night, my colleague Rob Spivey kicked off our brand-new, two-part Master Class video series.

In Part I, he discusses the future of energy in the AI era. That includes whether U.S. infrastructure can keep up with the AI boom... which power sources are best positioned to fill the coming gap... and how investors can prepare for a once-in-a-lifetime "energy realignment." (If you missed our first lesson, a replay will be available to you later this afternoon.)

Tonight, in Part II, I cover why gold and stocks are rallying today. As I explain, rising geopolitical tensions and ongoing monetary stress worldwide are fueling gold's run... yet U.S. corporate fundamentals still support the bullish case for stocks. Be sure to tune in at 6 p.m. Eastern time to see how you can position your portfolio for rallies in both assets.

As a reminder, our Master Class lessons are free for Altimeter Pro subscribers. You should have received your exclusive invitation last week. And if you're interested in signing up, you can do so at a special discounted rate right here.

Thanks to his cab-driving dad, Gene Freidman became a king...

Thanks to his cab-driving dad, Gene Freidman became a king...